Real Estate Investment Trust in Nigeria (2025 Updated)

by Bright Ugochukwu

Dec 10, 2024

Real Estate Investment Trusts (REITs) have transformed how people invest in property.

Before REITs, investing in real estate meant buying actual buildings, which required a lot of money and effort.

Now, with REITs, anyone can buy shares in a trust that owns real estate, allowing them to earn money from property without managing it.

This article explores topics, including:

- REITs in Nigeria

- Types of REITs

- Major Players

- Regulations

- Benefits

- Challenges

- How REITs Work

- Performance of REITs

- Future Prospects for REITs

Let’s get into it.

Takeaways

- REITs allow individuals to invest in real estate without owning properties directly.

- There are three main types of REITs: Equity, Mortgage, and Hybrid.

- In Nigeria, investors trade REITs on the Nigerian Stock Exchange (NSE).

- The government and stakeholders need to raise awareness about REITs to boost investment.

- Despite challenges, REITs have the potential to contribute significantly to Nigeria’s economy.

Understanding Real Estate Investment Trusts (REITs)

This model makes real estate investment more accessible, even to those with limited capital.

What is Real Estate Investment Trusts?

Real Estate Investment Trusts, or REITs, are companies that own and manage income-producing properties. REITs allow people to invest in real estate without needing to buy or manage properties themselves.

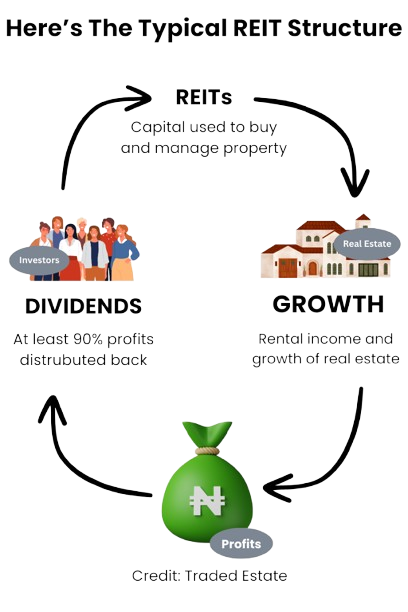

Instead, investors can buy shares in these trusts. They pool money from many individuals to invest in various real estate assets.

This means that even if you have little money, you can still participate in the real estate market.

History and Evolution

The concept of REITs began in the United States in the 1960s. They aimed to make real estate investment accessible to everyone.

Over the years, this model has spread globally, including to Nigeria, where it was introduced about 15 years ago. Despite being one of the oldest in Africa, the Nigerian REIT market is still growing and evolving.

Global Perspective

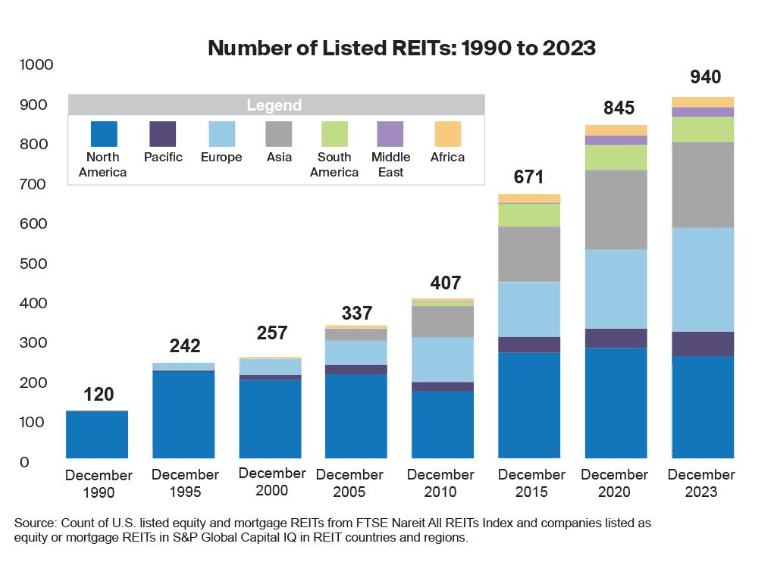

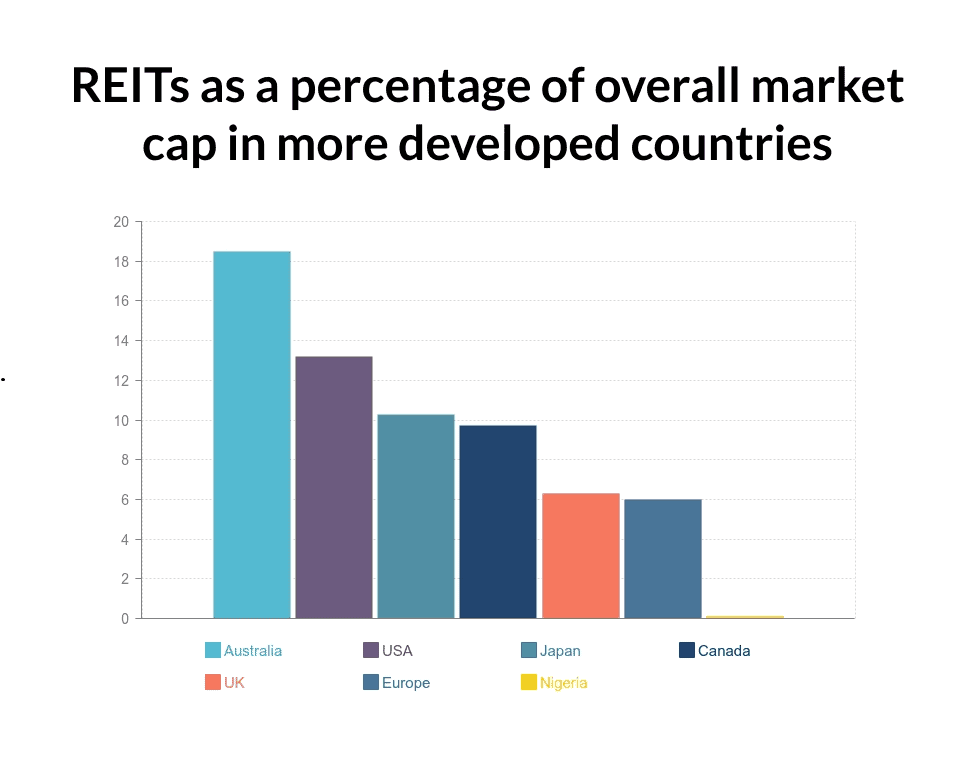

Globally, REITs have become a significant part of the investment landscape.

Investors trade them on stock exchanges, just like regular stocks, providing a way to earn dividends from real estate without the hassle of direct ownership.

In fact, analysts from Nareit estimate that REITs’ global market capitalization is around $2.0 trillion, showcasing their importance in the financial world.

| Year | Global Market Capitalization (in Trillions) |

|---|---|

| 2010 | 0.5 |

| 2015 | 1.0 |

| 2020 | 1.7 |

REITs are a fantastic way for individuals to invest in real estate.

It offers liquidity and a chance to earn from properties. With REITs, there’s no need for large capital or management responsibilities.

They represent a shift in how people can engage with real estate. It makes it easier and less daunting for average investors.

Types of Real Estate Investment Trusts (REITs) in Nigeria

In Nigeria, investors can consider three main types of Real Estate Investment Trusts (REITs). Each type has its own unique characteristics and investment strategies.

Equity REITs

Equity REITs focus on purchasing, holding, and managing commercial and rental properties.

They earn most of their income through rent instead of selling properties.

This type of REIT is ideal for investors looking for stable income from property management.

Mortgage REITs

Mortgage REITs, on the other hand, do not own or manage properties directly.

Instead, they invest in mortgages on real estate properties. These REITs earn income from the interest on the loans they provide.

They have no ownership of the properties. So, this makes it a different kind of investment.

Hybrid REITs

Hybrid REITs combine the strategies of both equity and mortgage REITs.

They invest in both properties and mortgages, allowing for a diversified approach to real estate investment.

This type can appeal to investors who want exposure to rental income and mortgage interest.

| Type of REIT | Focus | Income Source |

|---|---|---|

| Equity REITs | Commercial and rental properties | Rental income |

| Mortgage REITs | Mortgages on real estate properties | Interest from loans |

| Hybrid REITs | Both properties and mortgages | Rental income and interest |

Knowing these types of REITs can help investors decide where to invest in Nigeria’s real estate market. Each type has different benefits and risks, so consider your goals before investing.

Pro Tip: Investing in REITs lets individuals participate in real estate. Investors can do so without buying or managing properties directly.

Major Players in the Nigerian REIT Market

The Nigerian real Estate Investment Trust (REIT) market is still developing, but some notable players are shaping its landscape.

The major REITs in Nigeria include:

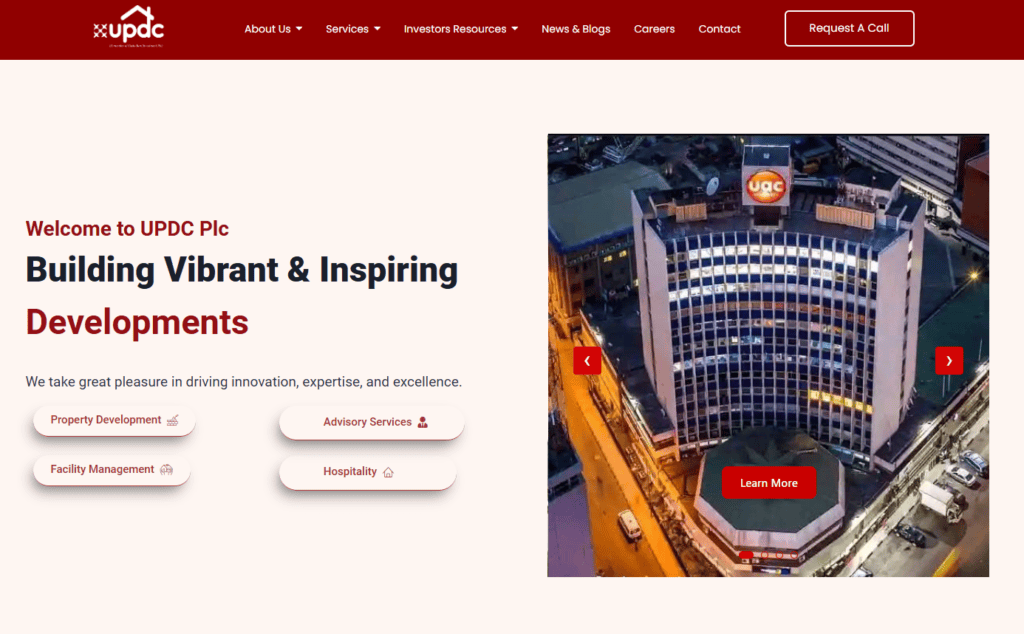

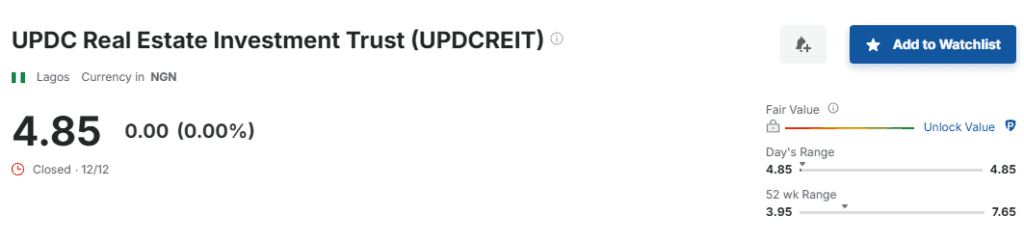

UACN Property Development Corporation (UPDC) REITs

UPDC REIT is one of the pioneering REITs in Nigeria.

The corporation was established to let investors invest in real estate without managing properties directly.

This REIT focuses on acquiring and managing a diverse range of properties, mainly in the commercial sector.

Skye Shelter Fund REITs

Launched in 2008, Skye Shelter Fund is Nigeria’s first REIT.

It aims to provide affordable housing solutions. Also, it offers investors a steady income through dividends.

The fund primarily invests in residential properties, making it a significant player in the housing market.

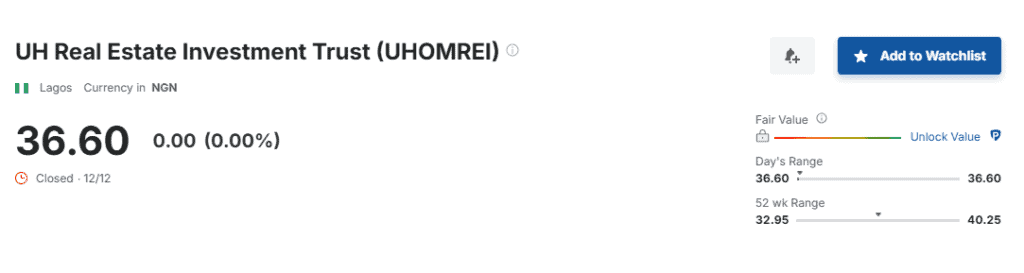

Union Homes REITs

Established in 2008, Union Homes REIT is managed by Union Homes Savings & Loans PLC, a subsidiary of the Union Bank of Nigeria PLC.

This REIT focuses on providing housing solutions and aims to enhance the living standards of Nigerians through its investments in residential properties.

| REIT Name | Year Established | Focus Area |

|---|---|---|

| UACN Property Development Corp. | 2013 | Commercial Properties |

| Skye Shelter Fund | 2008 | Affordable Housing |

| Union Homes | 2008 | Residential Properties |

These REITs are vital to Nigeria’s real estate market. They allow investors and the general public to benefit from real estate investments.

The growth of REITs in Nigeria is vital.

It will boost public awareness and participation in the real estate sector, leading to economic development and improved living conditions for many.

Regulatory Framework Governing REITs in Nigeria

Investment and Securities Act (ISA) 2007

The Investment and Securities Act (ISA) 2007 is a key piece of legislation governing REIT operations in Nigeria.

This act gives the Securities and Exchange Commission (SEC) the power to regulate collective investment schemes, including REITs.

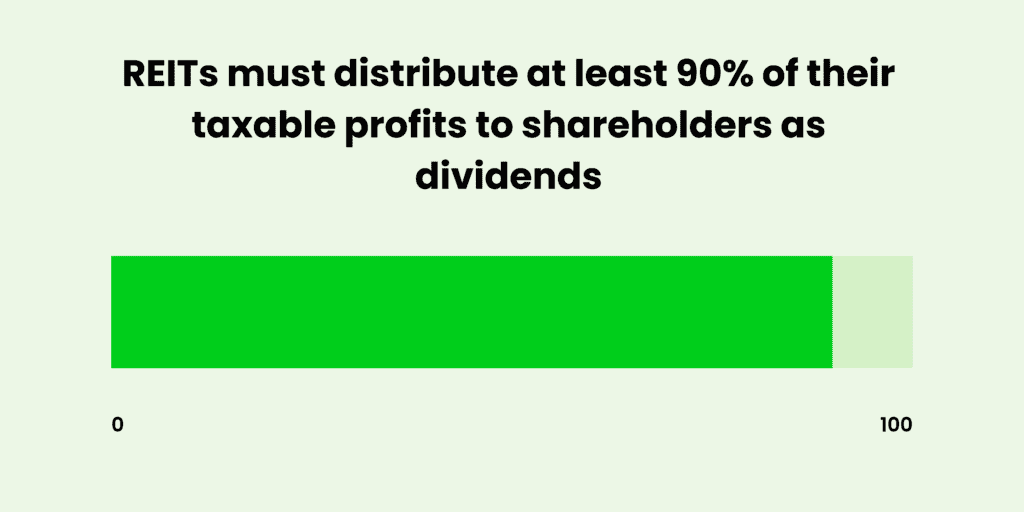

Under this act, REITs must distribute at least 90% of their taxable profits to shareholders as dividends, allowing them to enjoy certain tax exemptions.

Securities and Exchange Commission (SEC) Rules

The Securities and Exchange Commission (SEC) has established specific rules for the registration and operation of REITs.

These rules include:

- Application Form SEC 6A

- Draught Prospectus

- Trust Deeds

- Consent Letters from involved parties

- Certificates of Incorporation for managers and trustees

These requirements ensure that REITs operate with transparency and comply with the law.

Corporate Affairs Commission (CAC) Regulations

The Corporate Affairs Commission (CAC) also plays a significant role in regulating REITs.

It oversees the incorporation and registration of REITs, ensuring they meet all legal requirements. The CAC’s regulations help maintain the integrity of the real estate investment sector in Nigeria.

Pro Tip: Nigeria’s REITs have regulatory frameworks that protect investors and ensure smooth operations.

The regulatory landscape for REITs in Nigeria is shaped by several key laws and regulations, including:

- The ISA

- SEC rules

- CAC regulations

These frameworks are key to creating a stable, appealing environment for real estate investment in the country.

Benefits of Investing in REITs

Investing in Real Estate Investment Trusts (REITs) has many benefits, which make them a popular option for many investors.

Here are three compelling reasons to consider REITs:

Liquidity and Diversification

- Liquidity: Unlike traditional real estate investments, investors can easily buy and sell shares of REITs traded on stock exchanges.

- Diversification: REITs let you invest in many properties, reducing risk.

- Access to Different Property Types: REITs let you invest in various sectors, like residential, commercial, and industrial properties.

Stable Cash Flow

- Regular Dividends: REITs are required to distribute at least 90% of their taxable income as dividends, providing a steady income stream.

- Income from Rent: Rental income from REIT-owned properties provides steady cash flow for investors.

- Higher Returns Possible: The right REIT can yield better returns than traditional investments.

Tax Advantages

- Tax Benefits: REITs often enjoy favourable tax treatment, which can enhance overall returns for investors.

- No Double Taxation: REITs pass income to shareholders, avoiding the double taxation that usually affects corporations.

- Capital Gains: Depending on market conditions, investors may benefit from capital gains when selling their REIT shares.

Pro Tip: Investing in REITs can be a smart way to access real estate. It avoids the hassle of directly managing properties.

REITs provide a unique opportunity to invest in real estate with liquidity, diversification, and stable cash flow.

They are an excellent choice for those wanting to improve their investment portfolio. It avoids the complexities of owning traditional real estate.

Challenges Facing REITs in Nigeria

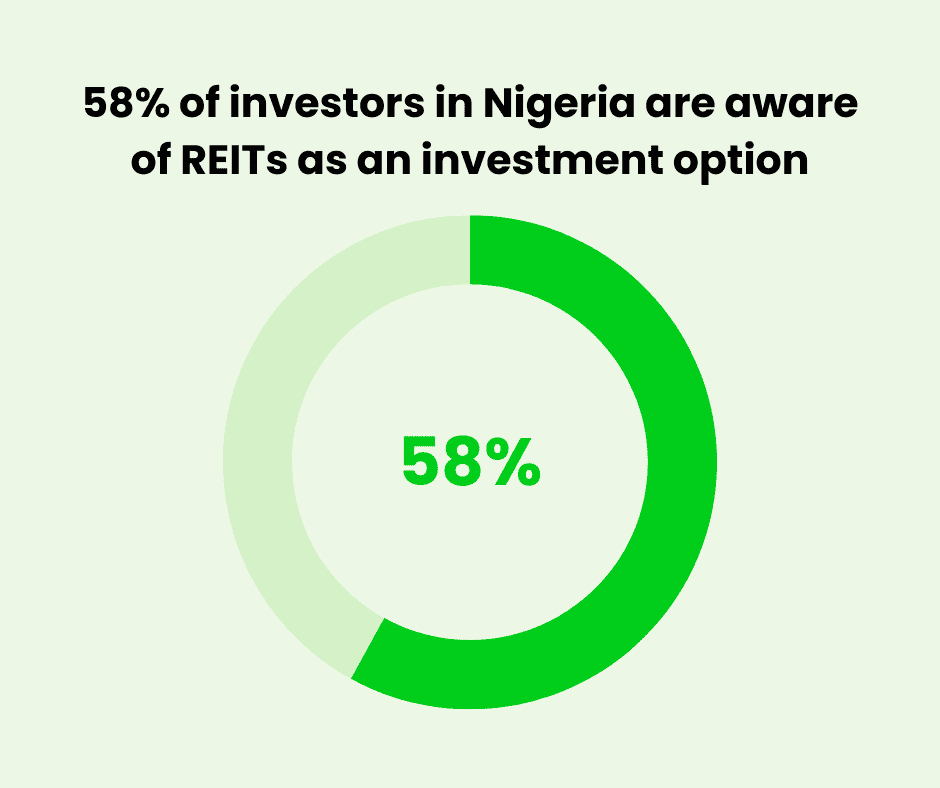

Lack of Public Awareness

One of Nigeria’s biggest hurdles for REITs is more public awareness.

Though Nigeria was the first African country to introduce a REIT in 2008, many still need to understand what REITs are and how they work.

A survey revealed that only 58% of participants were aware of REITs as an investment option.

This lack of knowledge limits the sector’s growth.

Many potential investors need to know the benefits of investing in real estate through REITs.

Bureaucratic Land Title Processes

Another significant challenge is the bureaucratic land title process.

Acquiring land titles can take six months or more. It’s often a lengthy, complicated process. This cumbersome process can deter potential investors and slow down property acquisitions.

Regulatory bodies must streamline these processes. It will help make REITs operate effectively.

Regulatory Framework Issues

The current regulatory framework for REITs in Nigeria is not tailored to the real estate sector’s unique needs.

Existing laws, such as the Investment and Securities Act (ISA) 2007, need to address the specific challenges faced by REITs adequately.

Legislation that focuses exclusively on the real estate sector is urgently needed to ensure better regulation and support for REITs.

Pro Tip: Addressing these challenges is crucial for the growth and success of REITs in Nigeria. Raising public awareness, simplifying land title processes, and improving regulations can boost REITs in Nigeria.

How to Invest in REITs in Nigeria

Investing in Nigeria’s Real Estate Investment Trusts (REITs) is straightforward. It allows people to invest in real estate without owning property.

Here’s how you can get started:

Steps to Purchase REITs

- Research Available REITs: Start by exploring the REITs listed on the Nigerian Stock Exchange (NSE). Some notable ones include UACN Property Development Corporation (UPDC) REITs, Skye Shelter Fund REITs, and Union Homes REITs.

- Open a Brokerage Account: To buy REITs, you will need to open an account with a licensed stockbroker. This is essential as they facilitate the buying and selling of REIT shares on your behalf.

- Fund Your Account: Deposit funds into your brokerage account. Ensure you have enough to cover the cost of the REIT shares you wish to purchase.

- Place Your Order: Once you fund your account, you can place an order to buy shares of your chosen REIT. You can do this online or by contacting your broker in person.

Role of Stockbrokers

- Facilitators: Stockbrokers act as intermediaries between you and the stock market, making buying and selling REIT shares easier.

- Advisors: They can provide valuable insights and advice on which REITs may be suitable for your investment goals.

- Transaction Management: Stockbrokers handle all the paperwork and transactions, ensuring a smooth investment process.

Understanding REIT Dividends

- Regular Income: One of the main attractions of investing in REITs is the potential for regular income through dividends. REITs are required to distribute at least 90% of their taxable income to shareholders.

- Tax Implications: Dividends from REITs are taxed as ordinary income. So, consider this when calculating your potential returns.

Pro Tip: Investing in REITs is a great way to access the real estate market. It avoids the hassles of property management. REITs let you invest in real estate without owning property.

Performance of Nigerian REITs

Market Capitalization

The market capitalization of Nigerian REITs is small when compared to global standards.

Source: Estate Intel

To give you some context, Ikeja City Mall in November 2015, sold for a price higher than the current market cap of Nigerian REITs.

Now, the total market cap of listed REITs in Nigeria is around 50 billion Naira.

That’s only about 0.4% of the Nigerian Stock Exchange (NSE), indicating a significant opportunity for growth in the sector.

Rental Income Statistics

In 2023, Nigerian REITs, including UH REIT, SFS REIT, and UPDC REIT, reported a total rental income of N2.16 billion, marking a 12% increase from the previous year’s rental income of N1.93 billion.

Here’s a quick breakdown of the rental income:

| REIT Name | Rental Income (Naira) |

|---|---|

| UPDC REIT | 1.44 billion |

| UH REIT | 531.3 million |

| SFS REIT | 190 million |

Comparison with Global REITs

When compared to global REIT markets, Nigeria’s share is quite minimal.

For instance, REITs have a global market cap of about $1.7 trillion. Nigeria’s contribution is much lower.

This disparity highlights the potential for expansion and investment in the Nigerian REIT sector.

Pro Tip: REITs in Nigeria show promise. But, public awareness and investment must grow to realize their full potential.

The Nigerian REIT market is still developing.

But, rising rental income and a chance to expand the market present exciting opportunities for investors.

With the right support and awareness, REITs could play a crucial role in the Nigerian economy.

Future Prospects for REITs in Nigeria

Potential for Growth

The future of REITs in Nigeria is promising. There is a growing interest in real estate as an investment option.

Analysts expect the market to grow due to:

- Rising demand for affordable housing.

- Increased awareness and education about REITs.

- Government initiatives aimed at boosting the real estate sector.

Government Initiatives

The Nigerian government is taking steps to enhance the REIT market, including:

- Creating awareness about the benefits of investing in REITs.

- Streamlining land title processes to make property acquisition easier.

- Implementing regulations that support the growth of REITs.

Stakeholder Recommendations

To ensure the success of REITs in Nigeria, stakeholders suggest:

- Improving public education on REITs and their advantages.

- Establishing a dedicated regulatory framework tailored for REITs.

- Encouraging partnerships between the government and private investors.

Pro Tip: REITs hold great promise for real estate investors. Emerging markets and new tech innovations drive this trend.

With the right support and initiatives, REITs in Nigeria can boost the economy and offer investors high ROI.

Case Studies of Successful REITs

UPDC REIT

The UPDC REIT is one of the pioneering real estate investment trusts in Nigeria.

Established in 2007, it focuses on acquiring and managing income-generating properties.

The trust has a diverse portfolio, including residential, commercial, and retail properties.

Key highlights of UPDC REIT include:

- Strong Performance: Consistent returns on investment.

- Diverse Portfolio: Investments in various property types.

- Market Leader: One of the first REITs in Nigeria.

UH REIT

The UH REIT is another significant player in the Nigerian market.

Launched in 2015, it aims to provide investors with a steady income through dividends.

The trust primarily invests in residential properties, making it a popular choice among investors looking for stability.

Notable aspects of UH REIT are:

- Focus on Residential: Primarily invests in housing.

- Stable Dividends: Regular income for investors.

- Growing Portfolio: Expanding its property holdings.

SFS REIT

Investors know the SFS REIT for its innovative approach to real estate investment.

They established it to provide a platform for investors to access the real estate market without requiring large capital.

Some of its key features include:

- Accessibility: Lower entry barriers for investors.

- Innovative Strategies: Unique investment approaches.

- Community Impact: Focus on developing local properties.

| REIT Name | Year Established | Focus Area | Key Feature |

|---|---|---|---|

| UPDC REIT | 2007 | Mixed-use | Market Leader |

| UH REIT | 2015 | Residential | Stable Dividends |

| SFS REIT | 2015 | Community Properties | Accessibility |

These case studies show the success and potential of REITs in Nigeria. They can offer investors ways to grow and earn income.

Pro Tip: Investing in REITs can diversify your portfolio. It gives you real estate exposure without the hassle of managing properties.

Legal Requirements for Establishing REITs in Nigeria

Registration Process

You must follow specific steps to set up a Real Estate Investment Trust (REIT) in Nigeria.

These steps ensure that the REIT operates within the legal framework.

Here’s a simplified list of the key requirements:

- Application Form SEC 6A: This is the initial form that needs to be filled out.

- Draught Prospectus: You must submit two copies of the draught prospectus.

- Trust Deeds: You need to provide two copies of the trust deeds.

- Consent Letters: Letters of consent from all parties involved in the trust.

- Incorporation Certificates: Two copies each of the Certificate of Incorporation and Memorandum/Articles of Association of both the managers and trustees, certified by the Corporate Affairs Commission.

- Directors’ Particulars: Two copies of the particulars of the directors of the manager and trustees, certified by the Corporate Affairs Commission.

- Trust Accounts: A sworn undertaking to maintain separate trust accounts in a reputable bank.

- Minimum Capital Evidence: Proof that the minimum paid-up capital of the manager and trustee meets the Commission’s requirements.

Compliance Obligations

Once registered, REITs must adhere to several compliance obligations to maintain their status.

These include:

- Regular reporting to the Securities and Exchange Commission (SEC).

- Ensuring that at least 90% of taxable profits are distributed to shareholders as dividends.

- You can maintain legal title to properties by holding them through a trust deed.

Key Legal Documents

The following documents are essential for the establishment of a REIT:

- Trust Deeds: Outlining the terms and conditions of the trust.

- Prospectus: Providing detailed information about the REIT to potential investors.

- Incorporation Documents: Certifying the legal existence of the REIT and its managers.

Pro Tip: Starting a REIT in Nigeria has legal requirements. With the right guidance, it can be a rewarding investment.

Conclusion

The demand for affordable housing in Nigeria is on the rise, and the real estate sector is playing a vital role in boosting the country’s economy.

Recent statistics from the National Bureau of Statistics (NBS) revealed that the construction and real estate sectors contributed a remarkable N20 trillion to the GDP in the first three quarters of 2022.

Out of this, real estate alone accounted for N7 trillion.

Real Estate Investment Trusts (REITs) present a fantastic opportunity for investors to engage in the real estate market and earn profits without the hassle of managing properties directly.

With the right support, REITs can boost investment in Nigeria’s real estate.

Frequently Asked Questions

How do REITs work?

REITs gather money from many investors to buy properties or mortgages. Investors earn money through dividends, which are a share of the profits.

What types of REITs are there in Nigeria?

In Nigeria, there are three main types of REITs: Equity REITs, which own and manage properties; Mortgage REITs, which invest in real estate loans; and Hybrid REITs, which combine both strategies.

What are the benefits of investing in REITs?

Investing in REITs can provide liquidity, diversification, stable cash flow through dividends, and potential tax benefits.

What challenges do REITs face in Nigeria?

REITs in Nigeria face challenges such as a lack of public awareness, complicated land title processes, and issues with the regulatory framework.

How can I invest in REITs in Nigeria?

You can invest in REITs in Nigeria by purchasing shares through licensed stockbrokers on the Nigerian Stock Exchange.

What are the legal requirements for setting up a REIT in Nigeria?

To set up a REIT in Nigeria, you need to register with the relevant authorities, comply with regulations, and provide the necessary documentation.

What is the future outlook for REITs in Nigeria?

The future of REITs in Nigeria looks promising, with potential for growth, government support, and increasing public interest in real estate investments.