A Beginner's Guide to Real Estate Investing in Lagos (2025)

by Bright Ugochukwu

Jan 16, 2025

Investing in Lagos real estate can seem intimidating at first. But, with the proper guidance, you can navigate this exciting market.

This beginner’s guide will help you start your journey.

It is for you if you want to earn rental income or grow your wealth through property appreciation.

I will break down the essentials, from:

- What’s Investing

- Fundamentals

- Setting Goals

- Budgeting

- Research

- Selection

- Managing Risks

- Management

- Staying Updated

Let’s uncover the details.

Takeaways

- Learn the basic terms and types of properties in Lagos.

- Define your investment goals based on your financial situation.

- Create a budget and explore financing options.

- Research the market to find the best locations.

- Understand the importance of property management and compliance.

What is Real Estate Investing?

Real estate investing involves buying properties to earn money, either from renting them out or selling them for a higher price later.

Here’s a simple breakdown:

- Buying: Acquiring property, such as houses, apartments, commercial buildings, or land.

- Owning: Holding onto the property, potentially generating income through rental.

- Managing: Handling maintenance, tenant relations, and property upkeep.

- Selling: Eventually selling the property at a profit.

Real estate investing can take many forms, from buying and flipping single-family homes to investing in large-scale commercial properties or real estate investment trusts (REITs).

Basics of Real Estate Investing in Lagos

You must grasp the basics when starting in real estate investing.

This section will guide you through key terms, types of properties, and market analysis techniques that are vital for success in Lagos.

Key Terminologies in Real Estate

Understanding the language of real estate is crucial.

Here are some key terms:

- Appreciation: The increase in property value over time.

- Equity: The difference between the property’s market value and the amount owed on it.

- Cash Flow: The net income generated from a property after expenses.

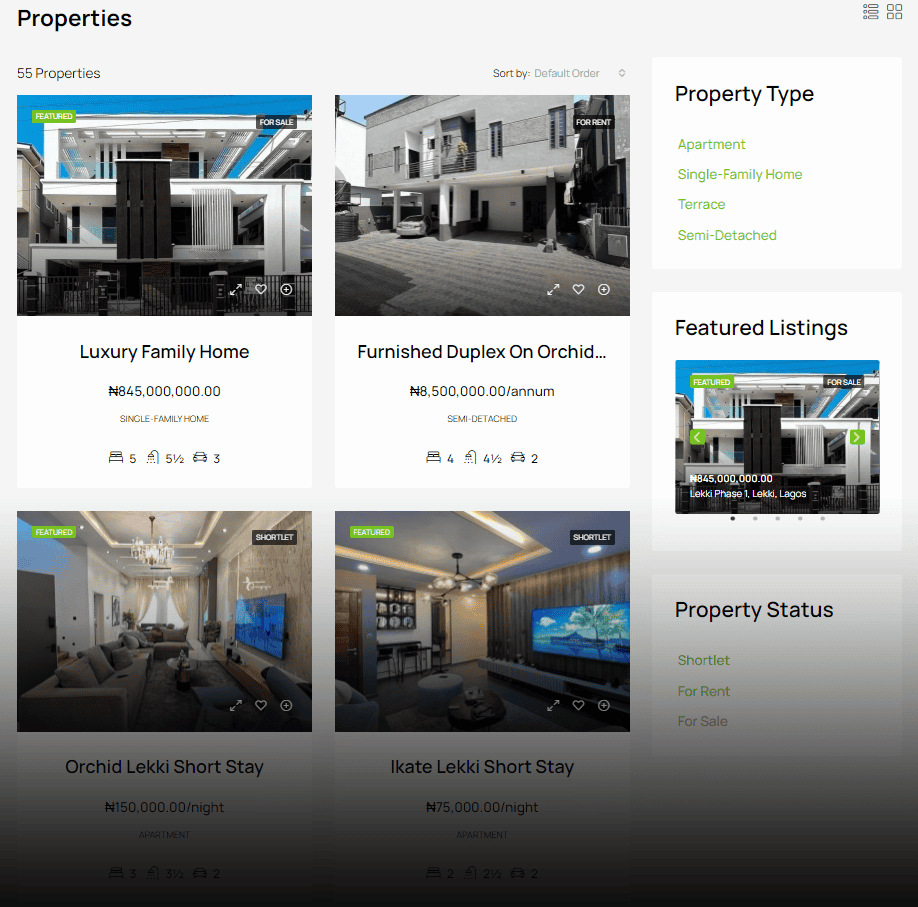

Types of Properties Available

In Lagos, you can invest in various types of properties:

- Residential: Houses, apartments, and condos.

- Commercial: Office buildings, retail spaces, and warehouses.

- Land: Undeveloped plots for future construction or resale.

Market Analysis Techniques

To make informed decisions, you need to conduct a thorough analysis of the market.

Here are some techniques:

- Comparative Market Analysis (CMA): Evaluating similar properties to determine a fair market value.

- Trend Analysis: Observing historical data to predict future market movements.

- Location Analysis: Understanding the dynamics of the Lagos real estate market, considering factors such as location, demographics, and market trends.

Pro Tip: These basics will help you navigate the complexities of real estate investing in Lagos. With the right knowledge, you can unlock the potential of this vibrant market and start building your wealth.

Setting Your Investment Goals

When starting your journey in real estate investing, it is essential to set clear goals that will guide your decisions and help you stay focused.

Here are some key areas to consider:

Defining Your Financial Objectives

- Identify your main goal: Are you looking for rental income, capital appreciation, or a mix of both?

- Set specific targets: Aim to earn a set amount each month or reach a specific property value.

- Consider your timeline: How long do you plan to invest before seeing returns?

Assessing Risk Tolerance

- Know your comfort level: Are you okay with high-risk investments or prefer safer options?

- Check your financial situation: This will help determine how much risk you can take.

- Think about market fluctuations: Be prepared for ups and downs in the market.

Balancing Rental Income and Capital Appreciation

- Decide on your focus: Will you prioritize steady rental income or long-term property value growth?

- Consider a balanced approach: A mix of both can provide stability and growth.

- Review your goals regularly: As your situation changes, adjust your strategy accordingly.

Pro Tip: Setting clear investment goals is like having a map for your journey. It helps you navigate the market’s complexities and stay on track to your financial goals.

Define your goals, assess your risk, and balance your income strategies.

This will create a solid foundation for your real estate investments in Lagos. Clear goals lead to better decisions and success in your investments!

Financial Readiness and Budgeting

Evaluating Your Financial Situation

Before investing in real estate, it’s crucial to evaluate your financial situation. This means examining your savings, income, and any debts you may have.

Here are some steps to help you assess:

- List all your income sources.

- Calculate your monthly expenses.

- Determine how much you can comfortably invest.

Exploring Financing Options

In Lagos, there are various financing options available for real estate investments.

Some standard methods include:

- Mortgages: Traditional loans from banks.

- Partnerships: Teaming up with others to share costs.

- Personal Loans: Borrowing from friends or family.

Creating a Realistic Budget

Once you understand your finances and financing options, it’s time to create a budget.

A reasonable budget should include:

- Purchase price of the property.

- Renovation costs if needed.

- Ongoing expenses like maintenance and taxes.

Pro Tip: A clear budget helps you avoid overspending. It keeps your investment on track.

In 2025, real estate investment presents strong potential, with multiple benefits such as:

- appreciation

- rental income

- inflation protection

- tax advantages

Being financially ready sets the stage for successful investing in Lagos.

Conducting Market Research

When it comes to real estate investing, thorough market research is essential for spotting profitable opportunities.

Here’s how to get started:

Identifying Lucrative Locations

- Look for areas with growing populations.

- Check for upcoming infrastructure projects.

- Research local amenities like schools and hospitals.

Analysing Economic Trends

- Keep an eye on employment rates in the area.

- Monitor property value changes over time.

- Understand the local economy’s health and growth potential.

Understanding Demographic Dynamics

- Study the age distribution of residents.

- Identify income levels and employment sectors.

- Look for trends in housing preferences, such as rentals versus ownership.

Pro Tip: Market research is not just about numbers. It’s about understanding the community and its needs. This insight will serve as a reliable guide for your investment decisions.

These steps will help you make choices that align with your investment goals.

Remember, the more you know about the market, the better your chances of success!

Selecting the Right Properties

In real estate investing, choosing the right properties is key to success.

Here are some key factors to consider:

Factors to Consider in Property Selection

- Location: Look for areas with good infrastructure and amenities.

- Market Demand: Research the demand for rental properties in the area.

- Property Condition: Assess whether the property needs repairs or renovations.

Evaluating Infrastructure and Market Demand

Understanding the local infrastructure can greatly impact your investment.

Consider the following:

| Infrastructure Type | Importance Level |

|---|---|

| Roads and Transport | High |

| Schools and Hospitals | Medium |

| Shopping Centres | High |

Potential for Growth and Appreciation

Investing in areas with potential for growth can lead to better returns.

Look for:

- Upcoming developments (like new roads or schools).

- Areas with increasing property values.

- Locations with a growing population.

Pro Tip: Remember, the right property can make all the difference in your investment journey. Take your time to research and choose wisely!

Managing Risks in Real Estate Investments

Investing in real estate can be rewarding but comes with its share of risks. Understanding how to manage these risks is crucial for any investor.

Here are some effective strategies for managing risk in real estate:

Diversification Strategies

- Spread your investments across different types of properties (residential, commercial, etc.).

- Invest in various locations to reduce the impact of local market downturns.

- Consider different investment vehicles, such as real estate investment trusts (REITs) or partnerships.

Insurance and Legal Considerations

- Obtain comprehensive insurance to protect against property damage and liability claims.

- Consult with a real estate attorney to ensure all contracts and agreements are legally sound.

- Stay updated on local laws and regulations to avoid legal pitfalls.

Due Diligence Processes

- Conduct thorough research on any property before investing or developing it, including checking the property’s history, market trends, and potential issues.

- Evaluate the financials of the property, including expected rental income and expenses.

- Inspect the property to identify any necessary repairs or improvements.

Pro Tip: Managing risks well can lead to more successful investments and peace of mind.

These strategies will help you navigate real estate investing. And, protect your investments from potential setbacks.

Effective risk management is vital to achieving your investment goals and ensuring long-term success in the Lagos real estate market.

Effective Property Management

Managing properties effectively is important for ensuring that your investments yield the best returns.

A well-managed property can significantly enhance your investment’s value.

Here are some key areas to focus on:

Maintenance and Upkeep

- Regular inspections to identify issues early.

- Timely repairs to prevent further damage.

- Keeping the property clean and well-maintained to attract tenants.

Tenant Relations

- Establish clear communication channels with tenants.

- Address tenant concerns promptly to maintain a positive relationship.

- Implement a fair and transparent rental agreement.

Compliance with Local Regulations

- Stay updated on local property laws and regulations.

- Obtain all necessary permits and licenses.

- Regularly review compliance to avoid legal issues.

| Aspect | Importance |

|---|---|

| Maintenance | Prevents costly repairs later |

| Tenant Relations | Reduces turnover and vacancies |

| Compliance | Avoids legal penalties |

Pro Tip: Good property management protects your investment and boosts tenant satisfaction, leading to longer leases and better returns.

Focus on these areas; you can have a successful property management strategy that maximizes your investment potential.

A Lagos-based property firm, Messrs Silverstone, has noted progress at Eastland Golf Estate, which shows the benefits of good management.

Continuous Learning and Staying Updated

In the ever-changing world of real estate, staying informed is crucial.

Here are some practical ways to keep your knowledge fresh:

Engaging with Real Estate Communities

- Join local real estate groups to connect with other investors.

- Take part in online forums to share experiences and insights.

- Attend meetups to network and learn from seasoned professionals.

Attending Seminars and Workshops

- Look for workshops that focus on specific investment strategies.

- Attend seminars to hear from industry experts about market trends.

- Participate in training sessions to enhance your skills.

Leveraging Online Resources

- Follow reputable real estate blogs for the latest news and tips.

- Listen to podcasts that cover various aspects of real estate investing.

- Read books to deepen your understanding of investment strategies.

Pro Tip: Continuous learning is the key to success in real estate. Staying updated helps you make informed decisions and seize market opportunities.

These activities will help you navigate Lagos’s changing real estate market and reach your financial goals.

Wrapping Up Your Real Estate Journey in Lagos

In conclusion, starting to invest in real estate in Lagos can be exciting and rewarding.

You can build a successful investment portfolio by taking small steps, learning continuously, and staying informed about the market.

It’s vital to set clear goals and know your finances before diving in. Don’t hesitate to seek advice and connect with other investors. With patience and dedication, you can unlock the many opportunities that Lagos has to offer.

FAQs

How do I start investing in real estate?

First, you should learn the basics, set your goals, and save money for your first property.

What types of properties can I invest in?

You can invest in different types of properties like houses, apartments, or land.

What should I consider when choosing a property?

Look at the location, the price, and whether the property is likely to increase in value over time.

How can I manage risks in real estate investing?

You can manage risks by diversifying your investments, getting insurance, and doing thorough research before buying.

Is it necessary to have a lot of money to invest in real estate?

No, you can start with a small amount. Many people begin by buying smaller properties or using loans.