Ultimate Checklist for First-Time Real Estate Investors in Lagos

by Bright Ugochukwu

Feb 19, 2025

Thinking about investing in the Lagos property market for the first time?

You’re NOT alone.

With skyrocketing demand, hidden risks, and endless ‘get-rich-quick’ advice, first-time real estate investors often lose money before they even begin.

But what if you had a proven, step-by-step checklist to avoid costly mistakes and secure profitable deals from day one?

We’ll break down the exact steps from:

- Market Overview

- Property Finance

- Property Choice

- Legal Navigation

- Building Team

- Due Diligence

- Rental Income

- Tech in Investing

- Tax Implications

- Investment Strategy

- Green Investments

If you’re ready to invest wisely—not just hope for luck—keep reading.

Let’s break it down and make it simple.

Key Takeaways

- Research neighbourhoods like Victoria Island and Ikeja for potential investment opportunities.

- Before purchasing, understand the legal requirements, including land titles and local regulations.

- Consider both residential and commercial properties to diversify your investment.

- Work with a reliable team, including real estate agents and legal experts, to guide your investment journey.

- Stay informed about market trends and predictions to make well-timed investment decisions.

Navigating the Lagos Real Estate Market

Key Neighbourhoods to Consider

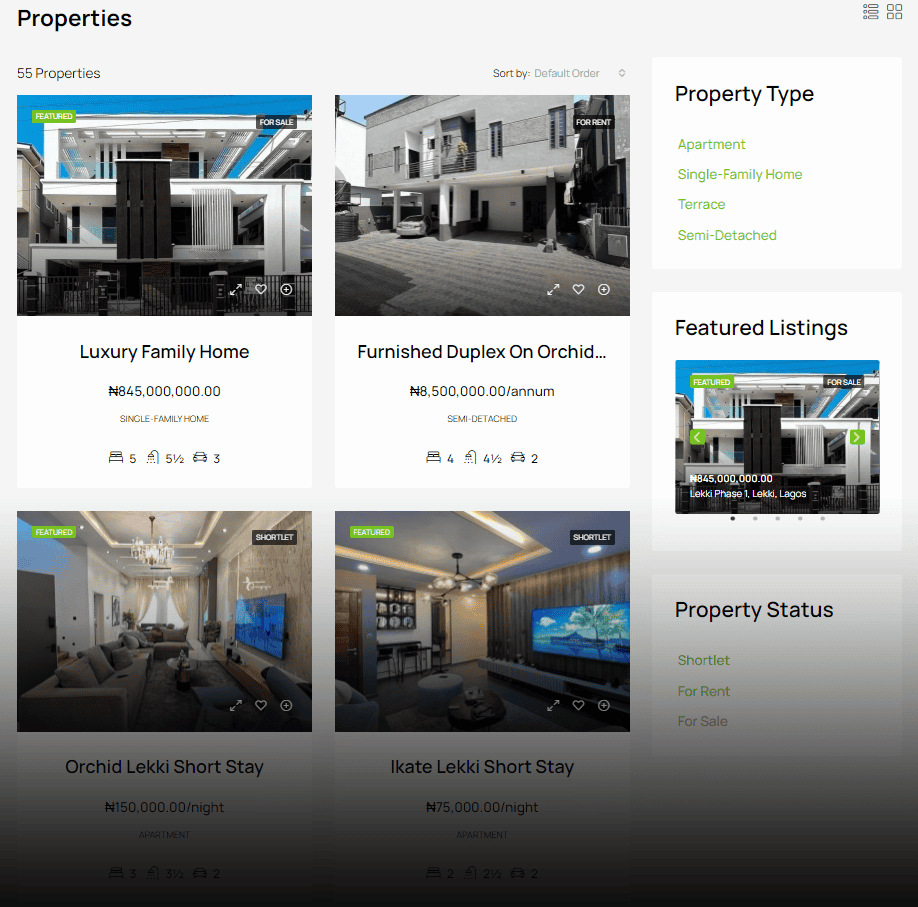

When you’re entering the Lagos real estate market, picking the right neighbourhood is everything. Lagos is vast, and each area has its own vibe and perks.

Here are some of the key spots to think about:

- Ikoyi: Known for its luxury apartments and serene environment, Ikoyi is a top choice for affluent buyers. It’s perfect if you’re looking for exclusivity and a touch of class.

- Lekki: This area is buzzing with development and offers a mix of residential and commercial properties. It’s popular among young professionals and families.

- Victoria Island: The business hub of Lagos, Victoria Island is ideal for those looking to invest in commercial real estate. It’s lively, with plenty of amenities and a vibrant nightlife.

- Yaba: Often dubbed as the “Silicon Valley of Nigeria,” Yaba is great for tech enthusiasts and startups. It’s an up-and-coming area that’s attracting a lot of attention.

Market Trends and Predictions

The Lagos real estate market is ever-changing, and keeping up with market trends is vital.

Luxury apartments are in high demand, but there’s also a growing interest in affordable housing. Developers are catching up and adapting their projects to meet these diverse needs.

Looking ahead, experts predict a steady growth in the market, driven by urbanisation and a rising middle class.

Legal Considerations

Before you jump into buying property in Lagos, you need to get familiar with the legal landscape.

Here are some points to consider:

- Land Titles: Make sure the property has a valid title. This can be a Certificate of Occupancy or a Governor’s Consent. Without this, your ownership might be questioned.

- Regulatory Compliance: Check that the property complies with local building regulations, including zoning laws and environmental assessments.

- Legal Assistance: It’s wise to hire a lawyer who specialises in real estate to guide you through the process. They can help with due diligence and ensure all documents are in order.

Pro Tip: Investing in Lagos real estate can pay off, but it requires planning and a good grasp of market trends. Knowing the market can guide your choices, whether you’re looking for a luxury apartment or a budget option.

Financing Your First Property Investment

Exploring Mortgage Options

So, you’re thinking about diving into the real estate market in Lagos?

One of the first things you’ll need to figure out is how you’ll pay for it. Mortgages are a popular option, but they can be a bit tricky.

There are different types of mortgages, each with its terms and conditions.

Fixed-rate mortgages provide stable payments. In contrast, adjustable-rate mortgages may begin with low rates but can rise later.

It’s crucial to understand which one fits your financial situation.

When looking for mortgage brokers, they can be your best friend. These professionals help you find financing options that align with what you can afford, making the whole process a lot less stressful.

Government Incentives and Schemes

The Nigerian government has several incentives to make property investment more accessible.

This includes programs like the National Housing Fund, which offers affordable loans to Nigerians.

Understanding these options can significantly reduce the financial burden and make your investment more feasible.

Here’s a quick rundown:

- National Housing Fund: Offers low-interest loans to contributors.

- Family Homes Fund: Targets low-income earners with affordable housing.

- Mortgage Refinance Company: Provides liquidity to mortgage lenders, making it easier for them to offer loans.

Budgeting for Additional Costs

Buying a property isn’t just about the purchase price. Additional costs can catch you off guard if you’re not prepared.

These include legal fees, agency fees, and property taxes.

Setting aside a budget for these expenses is wise to avoid any unpleasant surprises.

Pro Tip: Unexpected costs can derail your investment plans. Always budget for more than the property price to ensure a smooth purchasing process.

Considering these factors, you’ll be better prepared to finance your first property investment in Lagos. Remember, thorough research and planning are your best allies in this journey.

Choosing the Right Property Type

Residential vs. Commercial Properties

When you’re starting out in real estate, one of the first decisions you’ll face is choosing between residential and commercial properties.

Residential properties, such as homes and apartments, are typically easier to manage and require less initial capital. They also offer a steady rental income, especially in bustling areas.

Conversely, commercial properties, such as office spaces or retail outlets, might promise higher returns but often involve more risk and complexity.

Here’s a quick comparison to help you decide

| Property Type | Pros | Cons |

|---|---|---|

| Residential | Easier to manage, consistent demand | Lower returns, tenant turnover |

| Commercial | Higher potential returns, long-term leases | Complex management, economic sensitivity |

Pros and Cons of Off-Plan Investments

Off-plan investments can be enticing, especially with the promise of lower prices and the opportunity to customise your property.

However, they come with their own set of challenges.

The biggest advantage is the potential for capital growth before completion. But beware of construction delays and market fluctuations, which can impact your investment.

Consider these points when thinking about off-plan investments:

- Price Advantage: Often cheaper than completed properties.

- Customization: Ability to influence design and layout.

- Risks: Potential for delays and changes in market conditions.

Evaluating Property Conditions

Before you dive into a purchase, evaluating the property’s condition is crucial.

Before purchasing evaluate the property’s condition.

This isn’t just about aesthetics; it’s about understanding structural integrity and potential repair costs.

Hiring a professional property inspector can save you from future headaches and unexpected expenses.

Pro Tip: A thorough inspection today can prevent costly surprises tomorrow, providing you with invaluable peace of mind.

Choosing the right property type involves weighing the pros and cons of residential versus commercial options, considering the potential and risks of off-plan investments, and ensuring the property condition is up to scratch.

It’s all about aligning your choice with your investment goals and risk tolerance. For more insights on selecting investment properties, consider focusing on neighbourhoods that boost property value and rental potential.

Navigating Legal and Regulatory Requirements

Understanding Land Titles and Ownership

Investing in Lagos real estate means getting familiar with the different types of land titles.

Titles like Certificate of Occupancy (C of O), Governor’s Consent, and Deed of Assignment are essential.

Make sure the property you’re eyeing has a valid title.

Without it, you might face legal troubles down the road. It’s a good idea to work with a real estate lawyer who can verify these documents. They’ll ensure everything’s legit, and you won’t run into any nasty surprises.

Compliance with Local Regulations

Lagos has specific building codes and zoning laws. If you’re planning to build or renovate, check these rules first. Ignoring them can result in fines or even the demolition of your property.

Here are some steps to stay compliant:

- Research: Understand the local building codes and zoning regulations.

- Permits: Obtain necessary permits before starting any construction.

- Inspections: Schedule regular inspections to ensure ongoing compliance.

Working with Legal Experts

Having a legal expert on your team is more than a smart move—it’s essential. They can guide you through the Lagos State Real Estate Regulatory Authority Law, 2022.

Legal experts help with:

- Reviewing contracts and agreements.

- Ensuring compliance with all legal requirements.

- Offering advice on potential legal issues.

Pro Tip: Getting the legal stuff right immediately saves you from headaches and unexpected costs later. A good lawyer is your best ally in navigating the Lagos real estate landscape.

Building a Reliable Investment Team

Finding a Trustworthy Real Estate Agent

When entering the Lagos real estate market, finding the right real estate agent is like finding a good mechanic for your car—essential yet challenging.

You want someone who knows the ins and outs of Lagos, from the bustling streets of Victoria Island to the serene corners of Ikoyi.

Start by asking for recommendations from friends or colleagues who’ve been through the process.

You can also check online reviews, but take them with a pinch of salt.

Agents should be able to provide a list of past clients you can contact. Once you’ve shortlisted potential agents, meet them in person. This shows you how professional they are and if they’re someone you can work with for a long time.

Engaging Property Inspectors

Property inspectors are your eyes and ears when it comes to evaluating the condition of a property. They help you avoid nasty surprises like faulty plumbing or electrical issues.

A thorough inspection is crucial in Lagos, where building codes can sometimes be overlooked.

Ensure your inspector is certified and experienced with the type of property you’re interested in. Don’t pick the first inspector you find; compare several to see who offers the best service.

Consulting Financial Advisors

A financial advisor can help you navigate the economic waters of property investment.

They’ll help you grasp your budget, look into financing options, and suggest ways to boost your returns. Look for advisors with experience in real estate investments, particularly in Lagos. They should be able to guide you on leveraging opportunities like shortlets in Lagos.

Always check their credentials and try to understand their reputation in the industry. A good advisor will help you make informed decisions and keep you from making costly mistakes.

Pro Tip: Building a reliable investment team goes beyond hiring experts—it’s about forming a network of trusted partners who understand your goals and collaborate with you to reach them. This team supports you as you explore the unpredictable world of real estate investment.

Conducting Thorough Due Diligence

Researching Property History

Before investing in any property, make sure you learn its full background.

First, research the property’s history. Look for past ownership disputes, liens, or any unresolved legal issues.

It’s not just about who owned it before. It’s also about spotting any red flags that might affect your investment.

- Ownership Records: Verify past and current ownership details.

- Legal Disputes: Look for any ongoing or past legal issues related to the property.

- Liens and Encumbrances: Ensure there are no financial claims against the property.

Assessing Market Value

Determining the market value of a property is a crucial step in due diligence.

Engage with local real estate experts and compare similar properties in the area to ensure you’re getting a fair deal. This involves looking at recent sales data and current market trends.

- Comparative Market Analysis (CMA): Compare the property with others in the same area.

- Current Market Trends: Understand the local real estate market dynamics.

- Professional Appraisal: Consider hiring a certified appraiser for an unbiased property valuation.

Identifying Potential Risks

Every investment has risks, but spotting them early can save you a lot of trouble later.

Look into environmental risks, zoning laws, and any future developments that might impact the property’s value.

- Environmental Concerns: Check for any environmental hazards or restrictions.

- Zoning Laws: Understand the zoning regulations that apply to the property.

- Future Developments: Be aware of any planned developments in the area that could affect property value.

Pro Tip: Doing your homework now can prevent surprises later. Thorough due diligence is more than a step; it protects you from potential pitfalls. Knowing what you’re getting into is half the battle won.

For a structured approach, consider following a simple four-step process to ensure you’re covering all bases efficiently.

Maximising Rental Income Potential

Setting Competitive Rental Prices

Setting the right rental price is a balancing act. You want to attract tenants but also maximise your income.

Start by researching similar properties in the area. Look at what they charge and what they offer.

It’s crucial to be competitive but not underpriced.

Consider the amenities your property offers. You might justify a higher price if it’s in a prime location or has unique features.

Check market trends and adjust your prices based on those observations. Frequent reviews of your rental prices ensure you remain relevant and appealing to potential tenants.

Attracting and Retaining Tenants

Finding tenants is one thing; keeping them is another. To attract quality tenants, make sure your property is well-maintained and presentable.

First impressions matter.

Once you’ve got tenants, retaining them involves good communication and prompt responses to their needs.

A happy tenant is less likely to leave, saving you the hassle of re-advertising and dealing with vacant periods. Offering incentives such as minor upgrades or flexible lease options can help encourage longer stays.

Managing Property Maintenance

Regular maintenance is key to maintaining your property and ensuring tenant satisfaction.

Create a maintenance schedule for routine checks and repairs. This proactive approach prevents minor issues from becoming costly problems.

Encourage tenants to report issues early and ensure you have a reliable team or contacts for repairs. Managing maintenance well keeps your property in good shape and makes it more appealing to current and future tenants.

Pro Tip: Staying on top of maintenance preserves the property’s value and builds trust with your tenants. They appreciate a landlord who is attentive and responsive to their living conditions.

Utilising Technology in Real Estate Investment

Online Platforms for Property Search

The real estate scene in Lagos is bustling, and finding the right property can feel like looking for a needle in a haystack.

Online platforms have simplified this process. These platforms allow you to philtre properties by location, price, and property type.

Think of them as your digital real estate agent.

They provide a wealth of information, including property photos, descriptions, and sometimes even floor plans. Some even allow buyers to schedule viewings or contact sellers directly.

For those interested in innovative approaches, PropPal is leveraging blockchain technology to simplify property investments, making it accessible to more individuals.

Virtual Tours and Inspections

Virtual tours have become a game-changer in property viewing.

You don’t have to spend weekends visiting different properties. You can check out many homes right from your couch.

These tours offer a 360-degree view of properties, allowing you to inspect every nook and cranny.

This technology is beneficial for overseas investors with tight schedules. It saves time and helps in making informed decisions without the hassle of physical visits.

Leveraging Data Analytics

Data analytics is transforming how investors approach real estate.

You can make better investment choices by looking at market trends, investor behaviour, and property values.

Predictive analytics tools can forecast market changes, helping you stay ahead of the curve. These insights enable investors to identify lucrative opportunities and mitigate risks.

Data-driven strategies can boost your investment success and help you make smart, informed choices.

Understanding Tax Implications

Understanding the tax implications is crucial when investing in real estate in Lagos. Taxes can significantly affect your returns, so knowing what to expect is essential.

Property Tax Obligations

Property taxes are a reality for any real estate investor.

In Lagos, these taxes can vary depending on the location and type of property. So, it’s important to factor these costs into your budget from the start.

Remember that property taxes are typically assessed annually, and failing to pay them can result in penalties or even legal action.

Tax Benefits for Investors

Investing in real estate isn’t just about costs; there are also tax benefits to consider.

For instance, you might be eligible for deductions on mortgage interest, property management fees, and even certain repairs.

These deductions can reduce your taxable income, ultimately saving you money. Understanding these benefits can lead to a substantial improvement in your investment strategy.

Working with Tax Professionals

Navigating the tax landscape can be complicated, especially for first-time investors.

This is where tax professionals come in.

They can help you understand your obligations and identify potential savings. A good tax advisor will ensure you comply with local laws while maximising your investment’s profitability.

Pro Tip: Taxes can seem scary, but they can help boost your real estate ROI. With the proper knowledge, you can use them to your advantage. Consider them not as an obligation but as a part of your overall investment strategy.

Additionally, when selling property, be aware of the 10% capital gains tax on profits in Lagos. This is a crucial aspect to consider when planning your investment exit strategy.

Developing a Long-Term Investment Strategy

Setting Clear Investment Goals

Setting clear investment goals is essential before diving into the real estate market.

Are you looking for regular rental income? Or is your aim to flip properties for a profit?

Knowing your endgame helps you decide on the type of property and location to invest in. Establishing clear goals will guide your investment decisions and help you stay focused.

Diversifying Your Property Portfolio

Relying on a single type of property can be risky. Diversification is key to managing risk.

Consider a mix of residential, commercial, and perhaps even industrial properties. This not only spreads risk but also opens up multiple streams of income.

Here’s a simple breakdown:

- Residential Properties: Steady rental income, but might require more management.

- Commercial Properties: Higher rental yields but often longer vacancy periods.

- Industrial Properties: Less management but may have higher entry costs.

Monitoring and Adjusting Your Strategy

The real estate market is dynamic, and what works today might not work tomorrow.

Review your strategy at regular intervals and prepare to make adjustments. This might mean selling a property that isn’t doing well. Or, it could mean reinvesting in a booming area.

Consider these steps:

- Regular Market Analysis: Monitor market trends and adjust your portfolio accordingly.

- Performance Review: Evaluate the performance of your properties at least annually.

- Flexibility: Be open to changing your strategy based on new information.

Pro Tip: Creating a long-term strategy goes beyond buying properties—it’s about planning for the future and adjusting to market changes.

Sustainability and Green Investments

Benefits of Eco-Friendly Properties

Investing in eco-friendly properties helps the planet and offers good returns.

Eco-friendly buildings often have lower operating costs thanks to energy-efficient designs and sustainable materials.

Tenants want spaces that match their values, making green properties highly desirable.

Plus, these properties can command higher rents and attract long-term tenants who appreciate the benefits of living in a sustainable environment.

Incorporating Sustainable Practises

To truly embrace sustainability, integrate green practices into all parts of your property investment.

This might include installing solar panels, using rainwater harvesting systems, or choosing durable, environmentally friendly materials.

Here’s a quick checklist to get you started:

- Opt for energy-efficient appliances and lighting.

- Use sustainable building materials.

- Implement water-saving fixtures and systems.

- Design with natural ventilation and lighting in mind.

- Incorporate green spaces and landscaping that conserves water.

Future Trends in Green Real Estate

The real estate market in Victoria Island is already seeing a shift towards sustainable and green buildings, and this trend is expected to grow.

Developers are increasingly adopting eco-friendly designs as demand for sustainable living spaces rises.

We can expect more innovations in the future, such as smart home technologies that enhance energy efficiency and reduce carbon footprints.

Observing these trends will help you stay ahead in real estate and ensure your investments are profitable and sustainable.

Pro Tip: Investing in green real estate is not a trend; it’s a commitment to a more sustainable future. As more people want eco-friendly properties, the opportunity for profit grows. Accept the change and be part of the solution.

Wrapping It Up

So, there you have it, the ultimate checklist for first-time real estate investors in Lagos.

Getting into the property market can feel overwhelming. But with proper preparation, you’re ready to make a splash.

Remember, it’s all about doing your homework, understanding the local market, and having a solid plan.

Whether you’re buying a flat in Lekki or a plot in Ikeja, patience and persistence are your best options. Don’t rush it; take your time to find the right deal.

And hey, don’t be shy about asking for help when needed. There is a whole community of investors and experts who can offer guidance. So, go out there and start your property journey with confidence.

Frequently Asked Questions

What are the best neighbourhoods in Lagos for real estate investment?

Some popular areas include Lekki, Ikeja, and Victoria Island, known for their growth potential and amenities.

How can I finance my first property purchase in Lagos?

You can explore mortgage options from banks, look into government schemes, or consider investor partnerships.

What legal documents do I need to buy property in Lagos?

Ensure you have the Certificate of Occupancy, Deed of Assignment, and Land Survey Plan, among others.

Is it better to invest in residential or commercial properties in Lagos?

It depends on your goals. Residential properties often provide steady rental income, while commercial properties might offer higher returns.

How do I find a trustworthy real estate agent in Lagos?

Research online reviews, ask for recommendations, and check their credentials and experience in the local market.

What should I look for when inspecting a property?

Check the condition of the structure, plumbing, and electrical systems and ensure no legal disputes on the property.

Are there tax benefits for real estate investors in Lagos?

Yes, investors can benefit from incentives like capital allowances and deductions on mortgage interest.

How can I maximise rental income from my property?

Set competitive rental prices, maintain the property well, and offer attractive amenities to tenants.