Top 7 Habits of Successful Real Estate Investors

by Bright Ugochukwu

Feb 22, 2025

Getting into real estate investing can be a wild ride. But those who succeed often have key habits they rely on.

These tips aren’t learned overnight.

Successful investors follow these practices every day. And knowing these habits can help you stand out and succeed in real estate.

What Are the Habits of Successful Real Estate Investors?

Here are the top habits of successful real estate investors:

- Stay Educated

- Make a Plan

- Build a Network

- Know the Risks

- Invest Long-Term

- Diversification

- Continuous Evaluation

Great, let’s jump right to it.

Continuous Learning and Market Awareness

Embracing Technological Advancements

In the fast-paced world of real estate, technology is a game-changer.

Successful investors know the latest tools and platforms. They actively use them in their strategies.

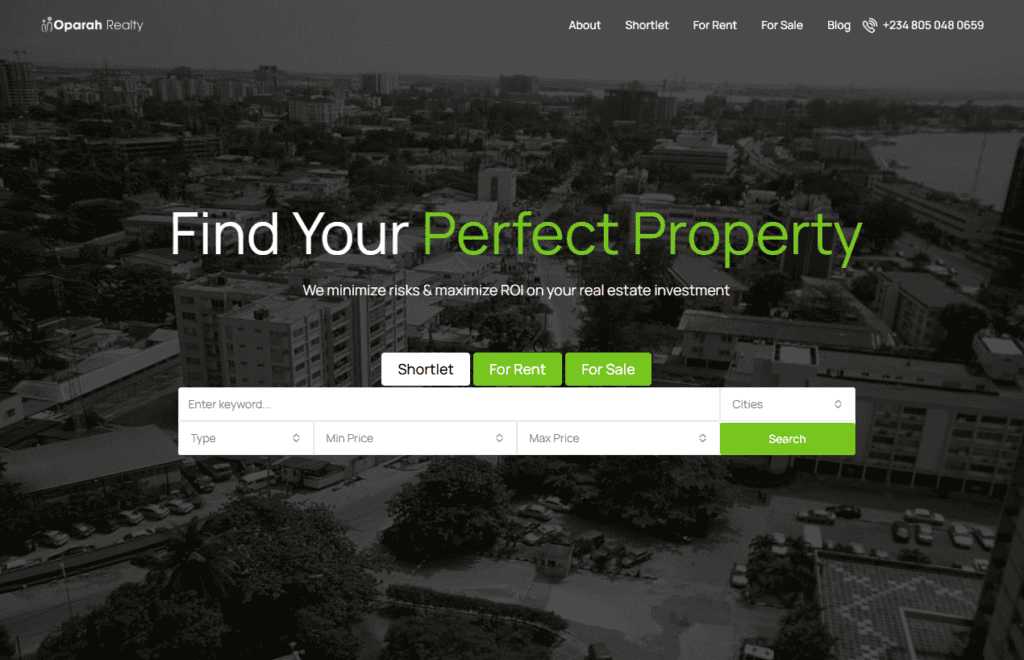

High-achieving investors in Lagos leverage Oparah Realty‘s platform for strategic property investments.

Staying tech-savvy can give you a competitive edge, as can using AI for property valuation and blockchain for secure transactions.

Adopting these innovations helps streamline processes, making operations more efficient and less error-prone.

Staying Informed on Market Trends

The real estate market is like a living organism, constantly changing and evolving.

To thrive, investors need to be in tune with these shifts. This involves regularly reviewing market reports, attending industry seminars, and networking with other professionals.

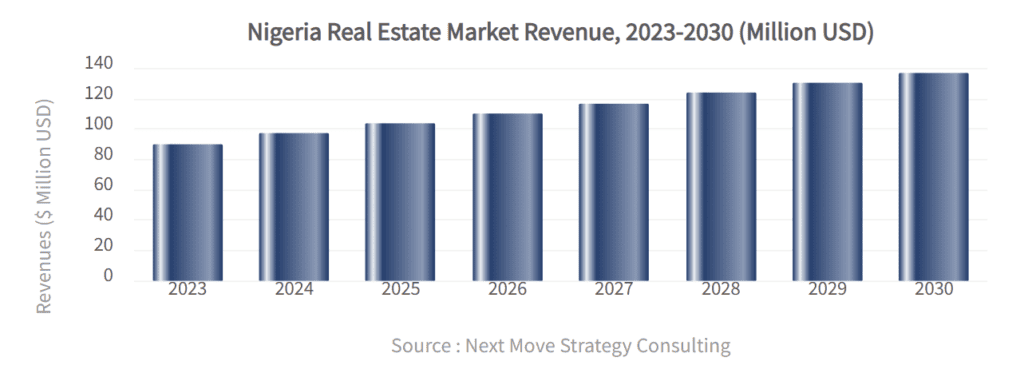

According to NextMSC, the Nigeria Real Estate Market size was valued at USD 91.1 million in 2023, and is predicted to reach USD 137.8 million by 2030, at a CAGR of 6.1% from 2024 to 2030.

When investors understand current trends, they can make better decisions. Their choices will align with the market’s needs. This proactive approach mitigates risks and uncovers new opportunities.

Understanding Regulatory Changes

Regulations in real estate can be a minefield, but they’re also crucial for maintaining a fair and transparent market.

Investors must keep abreast of changes in laws and policies that affect property ownership, zoning, and taxation.

This knowledge ensures compliance and helps identify potential challenges or advantages in their investment strategies. Proactively understanding regulatory shifts can prevent legal issues and foster smoother transactions.

Pro Tip: In the ever-evolving real estate landscape, knowledge isn’t just power—it’s a necessity. Keeping up with technological, market, and regulatory changes is not optional; it’s vital for success. Those who commit to continuous learning will better navigate the industry’s complexities.

Financial Discipline and Strategic Planning

Budgeting and Cash Flow Management

Successful real estate investors know the importance of sticking to a budget. They meticulously plan their expenses for each property, ensuring they don’t overspend.

This financial discipline helps them manage their funds wisely and avoid unnecessary financial stress.

Cash flow management is crucial. Monitoring income and expenses closely ensures that the business remains profitable.

Here’s a simple table to illustrate how a real estate investor might track this:

| Income Source | Annual Income | Annual Expenses | Net Cash Flow |

|---|---|---|---|

| Rental Property A | ₦1,800,000.00 | ₦400,000.00 | ₦1,400,000.00 |

| Rental Property B | ₦800,000.00 | ₦240,000.00 | ₦560,000.00 |

| Total | ₦2,600,000.00 | ₦640,000.00 | ₦1,960,000.00 |

Leveraging Financial Tools Wisely

Investors often use other people’s money (OPM) to grow their portfolios, but they are careful.

They ensure they understand the terms of any loans or investments they take on.

This cautious approach helps them avoid overleveraging, which can lead to financial trouble. They also keep some funds in reserve to cover unexpected costs, such as repairs or vacancies.

Preparing for Unexpected Expenses

Investors set aside some of their profits as a buffer for unforeseen costs. A financial cushion gives you peace of mind when facing a sudden repair or a market downturn.

A few strategies include:

- Maintaining an emergency fund

- Regularly reviewing and adjusting budgets

- Investing in insurance policies to cover major risks

Pro Tip: In real estate, it’s not just about making money, but also about having the foresight to protect what you have.

Strategic planning in finance involves a business determining its approach to achieving its short-term and long-term financial goals. It focuses on aligning resources and efforts to meet these objectives effectively.

Building and Maintaining Strong Networks

Creating a solid network is among the most essential habits for successful real estate investors. It’s not just about who you know, but how you cultivate these relationships to get the most out of them.

Connecting with Industry Professionals

To thrive in real estate, connecting with industry professionals is a must.

This means actively participating in networking strategies that can help you meet new clients and peers. Think of attending local meet-ups, joining online forums, or even organising small gatherings.

These connections can lead to new chances and insights you may not find anywhere else.

Plus, they can support you when you need advice or a second opinion.

Learning from Experienced Mentors

Having a mentor can be like having a cheat sheet for real estate success.

Mentors with experience know the ropes and provide insights not found in textbooks.

They can guide you through complicated situations and help you avoid common pitfalls. It’s like having a GPS that knows all the shortcuts and detours.

So, if you can, find someone whose journey you admire and ask if they’d be willing to mentor you.

Participating in Real Estate Events

Real estate events are like the industry’s watering holes. You never know who you’ll meet; these encounters can lead to great partnerships.

Whether it’s a big conference or a small seminar, these events are gold mines for networking.

They provide a platform to learn about the latest market trends, meet potential partners, and even find investors. Being present at these gatherings can significantly boost your network and your knowledge.

Pro Tip: Building a network is not just about collecting business cards; it’s about creating meaningful relationships that can support your growth and success in real estate.

Thorough Research and Due Diligence

Analysing Market Conditions

Real estate investors don’t just enter a market without knowing its conditions. They take the time to study them thoroughly.

This involves examining current trends, property values, and economic indicators such as employment rates and consumer spending habits.

Understanding these elements helps investors predict potential shifts and make informed decisions.

- Property Values: Track how property values fluctuate in your area of interest.

- Trends: Are people moving into urban centres or out to the suburbs? Knowing this can guide your investment choices.

- Economic Indicators: Employment rates and consumer spending can give clues about market health and potential growth.

Understanding Legal and Regulatory Frameworks

Before you invest in any property, know the laws and regulations that control real estate deals. This means knowing zoning laws, property codes, and tax obligations.

- Zoning Laws: Ensure you can use the property for your intended purpose.

- Property Codes: Ensure the property complies with local building regulations.

- Tax Policies: Be aware of any tax obligations or incentives that could affect your investment.

Pro Tip: Real estate investing involves more than buying and selling properties but also navigating a complex web of legal requirements. Ignorance isn’t bliss here; it carries a financial risk.

Evaluating Investment Risks

Every investment carries some level of risk, and real estate is no different.

Successful investors take time to evaluate these risks and plan for them.

This involves examining potential market downturns, property-specific issues, and even broader economic changes that could impact their investments.

- Market Downturns: What happens if the market takes a dip? Have a plan in place.

- Property Issues: Consider the age and condition of the property and potential repair costs.

- Economic Changes: Be aware of how economic shifts could affect your investment’s value.

Doing your homework protects your investment and helps you grab chances others might miss. It’s about being prepared, not just hopeful.

Long-Term Vision and Investment Strategies

Focusing on Sustainable Growth

Real estate isn’t about quick flips or fast profits. Successful investors know that the real money is in the long game.

Patience is a virtue.

Holding onto properties for a while can lead to significant gains in appreciation and rental income. It’s like planting a tree; you water it, give it sunlight, and it grows into something substantial over time.

Investors often aim for sustainable growth, building a firm portfolio even when the market wobbles.

Adapting to Market Cycles

Markets are like the weather; sometimes it is sunny, and sometimes it is stormy.

It’s important to understand these cycles and adjust your strategies accordingly.

It might be the perfect time to buy when the market is down. On the flip side, it may be time to hold back a bit when everything’s booming.

Successful investors keep an eye on these cycles, adapting their plans to ride the waves rather than getting swept away.

Balancing Short-Term and Long-Term Goals

Balancing short-term wins with long-term objectives can be tricky.

You might want to cash in on a property now, but will it be worth more in five years?

It’s a constant juggle.

Some investors set clear goals, like acquiring several properties within a decade or achieving a specific return on investment. They regularly review these goals, making tweaks to stay on course.

Pro Tip: In real estate, having a long-term vision isn’t just about making money; it’s about building something that lasts. It’s about creating a legacy that can weather the storms and shine in the sunshine.

Diversification and Risk Management

Investing Across Different Property Types

Successful real estate investors don’t stick to one type of property.

They spread their investments across different property types like residential, commercial, and even short-term rentals.

This strategy helps reduce risk because if one market suffers, the others may still be doing well.

Imagine having a portfolio that includes a mix of apartments, office spaces, and vacation homes. When the housing market slows down, perhaps the demand for office spaces may remain strong, or vice versa.

Exploring Non-Real Estate Investments

Sticking solely to real estate can be risky. That’s why savvy investors often look beyond properties.

They might invest money in stocks, bonds, or other investment vehicles.

It’s like not putting all your eggs in one basket. This way, if one sector is struggling, others may be thriving, helping to balance the overall investment.

Balancing Portfolio Exposure

Investors also pay attention to how much exposure they have in each area.

They don’t want to rely too heavily on one market or property type. Balancing exposure allows them to better handle market fluctuations.

For instance, if they notice their portfolio is too heavy on residential properties, they might start looking into commercial opportunities to even things out.

Pro Tip: Diversification isn’t a buzzword; it’s a practical approach to managing risk. Investors can cushion themselves against market volatility and ensure more stable returns over time by spreading investments across various sectors.

Incorporating real estate portfolio diversification mitigates risks and opens up opportunities for growth across different sectors. It’s about being prepared for whatever the market throws your way.

Adaptability and Innovation in Real Estate

Embracing New Technologies

To stay ahead in real estate, you must embrace new technologies.

From virtual reality tours to blockchain for secure transactions, tech is reshaping investors’ operations.

Staying tech-savvy isn’t a choice; it’s a necessity.

Investors who integrate these tools can streamline operations, improve client experiences, and easily make data-driven decisions.

- Virtual reality offers immersive property tours, saving time and travel costs.

- Blockchain ensures secure and transparent transactions.

- AI-driven analytics provide insights into market trends and potential investments.

Learning from Past Mistakes

Every investor has faced setbacks, but the key is to learn and adapt.

The best investors reflect on past errors, understanding what went wrong and why. This reflection isn’t about focusing on failure but learning from it to improve strategies.

Pro Tip: Mistakes are the stepping stones to growth. They teach us resilience and innovation.

Adjusting Strategies to Market Changes

The real estate market changes all the time. It’s affected by economic shifts, new policies, and what consumers want.

Investors must be agile and ready to pivot their strategies to align with current conditions.

- Monitor economic indicators and adjust investment plans accordingly.

- Stay informed about regulatory changes that might impact property values.

- Be open to diversifying into new markets or property types.

In today’s dynamic real estate landscape, adaptability is no longer an option – it’s a necessity. Embracing innovation and adjusting to the ever-evolving market are crucial for success.

Conclusion

So, there you have it. The habits of successful real estate investors aren’t about making a quick buck.

It’s about playing the long game, keeping your eyes peeled for opportunities, and adapting when things don’t go as planned.

These investors never stop learning; they manage their money smartly and build networks that open doors.

They do their homework, think long-term, and keep their ethics in check.

It’s not rocket science, but it does take effort and grit. These habits might be your ticket to success if you’re interested in real estate. It’s a journey, not a sprint. Keep at it, and who knows, you might find yourself thriving in the real estate industry.

Frequently Asked Questions

Who is considered the top real estate investor?

Warren Buffett is often seen as a top real estate investor, thanks to his smart investments through Berkshire Hathaway, which holds a lot of real estate.

What are the common habits of successful real estate investors?

Successful real estate investors keep learning, manage their money well, build strong networks, do thorough research, think long-term, diversify their investments, and adapt to changes.

Why is networking important for real estate investors?

Networking helps real estate investors find more opportunities, gain insights, and learn from others. It connects them with other investors, agents, and experts.

How do real estate investors manage risks?

Investors manage risks by diversifying their investments, understanding market trends, and preparing for unexpected expenses. They also learn from past mistakes.

What role does technology play in real estate investing?

Technology helps investors analyse market data, track property performance, and communicate with buyers and sellers. It makes investing more efficient and informed.

Why is long-term thinking important in real estate investing?

Long-term thinking helps investors focus on sustainable growth, building equity over time rather than seeking quick profits. It allows them to benefit from market recoveries and appreciation.