First-Time Homebuyer's Guide in Lagos: What You Need to Know

by Bright Ugochukwu

Mar 11, 2025

If you’re a first-time homebuyer in Lagos, that dream is totally achievable. It may seem overwhelming, but you can do it.

Lagos is a bustling city with a growing real estate market.

For first-timers, navigating this landscape might seem tough, but it becomes much easier with the proper guidance. That’s why we created this First-Time Homebuyer’s Guide.

Here, we’ll cover topics, including:

- Lagos Homebuyers Basics

- Setting Your Budget

- Choosing a Neighbourhood

- Property Inspections

- Legal Considerations

- Working with Agents

- Homeownership Extra Costs

We’ll cut through the noise and provide the clarity you need to find that perfect home.

Takeaways

- Understand the local real estate market, including popular neighbourhoods and future developments.

- Set a realistic budget considering all potential costs like taxes, insurance, and maintenance.

- Choose a neighbourhood that fits your lifestyle by considering factors like amenities and commuting distance.

- Get a thorough property inspection to avoid unexpected issues after purchase.

- Familiarise yourself with the legal aspects of buying property to ensure a smooth transaction.

Understanding First-Time Homebuyers in Lagos

Key Market Trends

The Lagos real estate market is buzzing with activity. It’s a city where the demand for property never seems to slow down.

Residential properties here have been appreciating annually by 4-6%, largely due to ongoing infrastructure projects like new roads and public amenities.

Such developments boost property values and enhance the city’s appeal to new investors.

Understanding these trends is essential for those eyeing a slice of Lagos. The city’s growth is more than numbers; it is about a constantly evolving landscape.

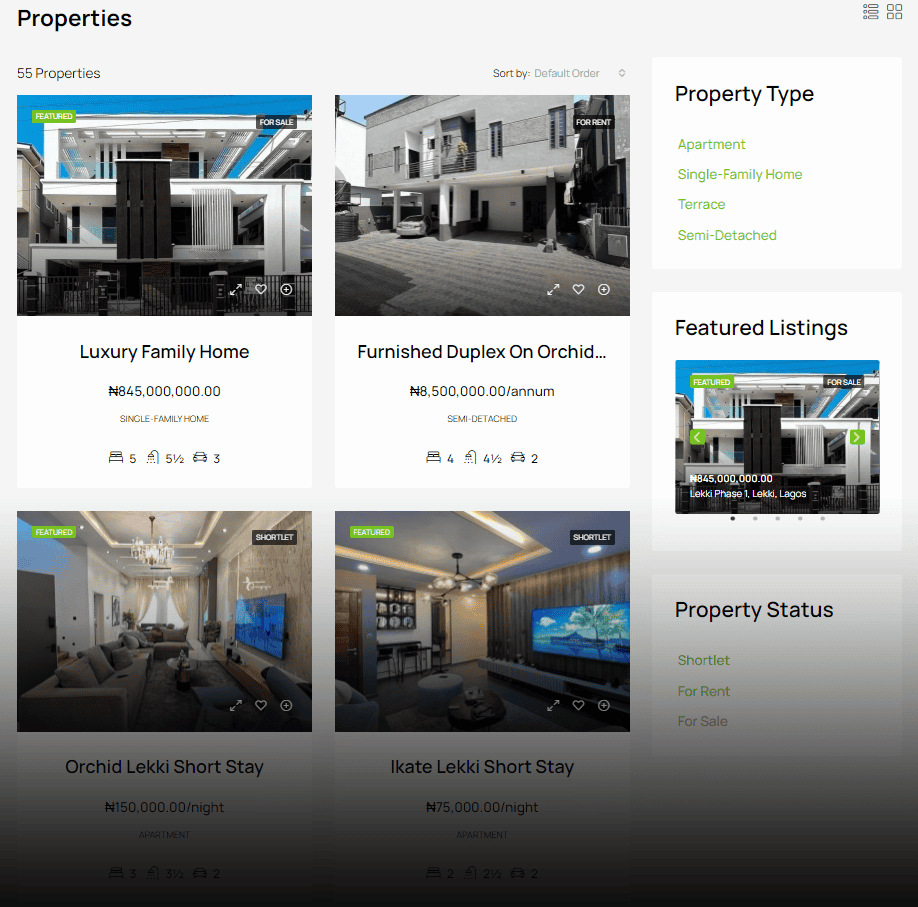

Popular Neighbourhoods

Lagos is a city of contrasts, with each neighbourhood offering something unique.

From the busy streets of Victoria Island to the serene environment of Ikoyi, there’s a place for everyone.

- Ikoyi: Known for its upscale vibe and luxury homes, it’s the go-to for those seeking a high-end lifestyle.

- Lekki: Offers a mix of residential and commercial properties, making it a versatile choice for many.

- Yaba: A favourite among the younger crowd, thanks to its vibrant culture and proximity to educational institutions.

Future Developments

The future of Lagos’s real estate market looks promising. There are discussions about several new developments aimed at transforming the cityscape.

Upcoming projects are set to introduce more residential and commercial spaces, catering to the growing population.

- The expansion of Eko Atlantic City, a new city built on reclaimed land, promises to be a game-changer.

- New transport hubs and road networks are in the pipeline to ease the notorious traffic in Lagos.

- Plans for more green spaces and recreational areas are in the works, enhancing the city’s liveability.

Pro Tip: With these developments, Lagos continues to cement itself as a key player in the real estate sector. It is about the present and preparing for a vibrant future.

Setting a Realistic Budget for Your First Home

Buying a home for the first time in Lagos can feel like a rollercoaster.

One minute, you’re excited; the next, you’re overwhelmed. But, setting a realistic budget can help keep things on track.

Calculating Total Costs

First things first, it’s not just about the price tag on the house. You have to think about all the extra costs that sneak up on you.

We’re talking about property taxes, insurance, and maintenance. Plus, there’s the closing costs when you finally sign on the dotted line. Make sure you factor in all these bits and pieces so you’re not caught off guard.

Here’s a quick rundown of what you might need to budget for:

- Down payment: Usually a chunk of the purchase price.

- Closing costs: Fees for the paperwork and legal matters.

- Property taxes: These can vary, so check local rates.

- Homeowner’s insurance: Protects your new place.

- Maintenance and repairs: Things break; it happens.

Budgeting Tools and Resources

Now, let’s talk tools. There are loads of budgeting apps out there that can help you keep track of your spending.

Some people swear by spreadsheets, while others prefer apps like Mint or YNAB (You Need A Budget).

Find what works for you and stick to it. These tools can help you see where your money’s going and where you might be able to save a bit.

Financial Advisors and Their Role

Sometimes, it’s worth getting a bit of professional advice.

Financial advisors can offer insights that you might not have considered.

They can help you figure out how much you can realistically afford and suggest ways to manage your finances better.

Plus, they can give you tips on saving for that all-important down payment.

Pro Tip: Setting a budget is about numbers and making sure your dream home doesn’t become a financial nightmare. Planning carefully and using the right resources can make your first home purchase a success.

Choosing the Right Neighbourhood in Lagos

Factors to Consider

Picking the right neighbourhood in Lagos is a big deal, especially if it’s your first home. You want to think about a few things.

First, how close is it to your work?

Nobody wants to be stuck in traffic for hours. Schools are another biggie if you have kids.

And what about local amenities? Are there shops, parks, or hospitals nearby?

Safety is key too. You want to feel safe walking around, day or night.

Visiting Neighbourhoods

Once you’ve got a shortlist, it’s time to hit the road.

Visit these areas at different times—morning, afternoon, and night.

You’ll get a feel for the vibe, noise levels, and traffic. Weekends might be different from weekdays, so check it out then too.

Talk to locals; they’ll give you the lowdown on what it’s really like living there.

Evaluating Local Amenities

Local amenities can make or break a neighbourhood. Think about what you need day-to-day.

Are there supermarkets, gyms, or restaurants nearby?

Public transport is a biggie if you don’t drive.

Check if there are bus stops or train stations close by. And don’t forget about green spaces. Parks and gardens can be a great escape from the city hustle.

Having everything you need close by can make life so much easier.

Pro Tip: Choosing where to live in Lagos is about the house and the whole lifestyle. From commute times to weekend hangouts, make sure your new neighbourhood ticks all your boxes.

The Importance of Property Inspections

What to Look for During Inspections

Buying a house is a big deal, and you really want to know what you’re getting into.

Property inspections are like a magnifying glass for your future home.

When you’re checking out a house, keep an eye out for these things:

- Structural integrity: Look for cracks in walls or ceilings. These might be signs of bigger issues.

- Roof condition: No one wants a leaky roof. Check for missing tiles or signs of water damage.

- Plumbing and electrical systems: Make sure everything’s in working order. Turn on taps and light switches to see if they function properly.

Hiring a Professional Inspector

While you might feel confident spotting some issues, hiring a professional property inspector can be a game-changer.

These experts know exactly what to look for and can spot problems you might miss. They provide a detailed report, which can be crucial for negotiating repairs or price adjustments.

Plus, they help you avoid nasty surprises after moving in.

Common Issues to Watch Out For

Even in a seemingly perfect home, there can be hidden problems.

Here are some common issues that tend to crop up:

- Damp and mould: Often found in bathrooms, these can lead to health issues and costly repairs.

- Pest infestations: Termites or rodents can cause significant damage if not dealt with promptly.

- Foundation problems: These can be expensive to fix and might affect the safety of the home.

Pro Tip: An inspection is a formality and safety net against future headaches and problems.

In the end, a comprehensive inspection helps you make an informed decision, ensuring your new home is a safe and sound investment.

Navigating the Legal Aspects of Home Buying

Buying a home in Lagos is a journey, and understanding the legal aspects can make or break the experience.

Here’s what you need to know.

Understanding Property Deeds

Property deeds are like the birth certificates of homes. They prove ownership and outline the rights of the property holder.

In Lagos, it’s crucial to verify the authenticity of these deeds.

Always check if the deed is registered with the appropriate government authority. This step ensures you’re not buying a property with legal issues.

A genuine deed means peace of mind.

The Role of a Real Estate Lawyer

A real estate lawyer is your legal backbone during this process.

They help review contracts, ensure that all legal documents are in order, and protect your interests.

It’s wise to engage a lawyer familiar with Lagos’ property laws. They can spot red flags and advise on the best course of action.

Think of them as your safety net in this complex transaction.

Contract Terms and Conditions

Contracts are filled with terms and conditions that can be mind-boggling.

Pay attention to clauses about payment schedules, penalties for late payments, and any contingencies.

It’s more than signing a contract. You need to know what you’re agreeing to.

Here’s a quick checklist:

- Payment Terms: Know the amount, due dates, and penalties.

- Contingencies: Conditions that must be met for the sale to proceed.

- Special Clauses: Any unique terms tailored to your agreement.

Pro Tip: Before you sign anything, remember: a contract is not just paperwork. It’s a binding agreement that can impact your financial future.

Navigating these legalities might seem overwhelming, but with the right guidance, you can handle it smoothly. Always stay informed and never hesitate to ask questions if something seems unclear.

Working with a Real Estate Agent

Benefits of Professional Guidance

Buying a home, especially for the first time, can be overwhelming.

A real estate agent acts as a knowledgeable ally, guiding you through the complexities of the market.

They have access to listings you might not find on your own and can provide insights into property values and local trends.

Their expertise can save you time and money, ensuring you make informed decisions. Moreover, they can help you avoid common pitfalls many first-time buyers face.

Finding a Trustworthy Agent

Choosing the right agent in Lagos is crucial.

You can start by asking friends or family who have recently purchased homes for referrals. Online reviews can also provide valuable insights into an agent’s reputation.

When interviewing potential agents, consider their experience, communication style, and familiarity with the neighbourhoods you’re interested in.

A trustworthy agent should be transparent about their fees. And willing to discuss your budget and expectations openly.

Questions to Ask Potential Agents

When meeting with potential agents, it’s important to ask the right questions to gauge their suitability:

- How long have you been working in the real estate industry?

- What is your experience with first-time homebuyers?

- Can you provide references from past clients?

- How familiar are you with the neighbourhoods I’m interested in?

- What is your approach to negotiating offers?

Pro Tip: A good real estate agent doesn’t only find you a house; they find you a home that fits your needs and lifestyle.

Working with a seasoned agent can make home-buying smoother and more enjoyable. Your agent is there to represent your interests and help you find the best possible deal on your new home.

Preparing for Additional Homeownership Costs

When buying a home, the expenses don’t stop at the purchase price.

It’s essential to consider the additional costs that come with homeownership.

Let’s break down some of these costs so you can plan your budget wisely.

Understanding Closing Costs

Closing costs can catch many first-time buyers off guard.

These are fees paid at the closing of a real estate transaction and can include:

- Legal fees: For handling the paperwork and ensuring everything is in order.

- Title insurance: Protects against disputes over property ownership.

- Appraisal fees: To determine the home’s value.

- Inspection fees: Covering the cost of a professional home inspection.

These costs can add up to 2-5% of the home’s purchase price, so it is crucial to factor them into your budget.

Property Taxes and Insurance

Property taxes vary depending on the location and are a recurring cost you need to budget for annually.

Check with local authorities to get an estimate of what you’ll be paying.

Additionally, homeowner’s insurance is a must to protect your investment against unforeseen events like natural disasters or theft. Don’t forget to shop around for the best rates.

Maintenance and Utility Expenses

Owning a home means taking on maintenance tasks that your landlord likely covered if you rented before.

Regular maintenance like gutter cleaning, lawn care, and HVAC servicing is necessary to keep your home in good shape. It’s wise to set aside a maintenance fund for unexpected repairs, like a leaky roof or faulty plumbing.

Utility costs are another aspect to consider. These include water, electricity, gas, and internet services. The size of your home and the number of occupants can significantly impact these expenses.

Pro Tip: Homeownership is rewarding, but it comes with responsibilities. Planning for these additional costs ensures you’re financially prepared and can enjoy your new home without stress.

Consider exploring rent-to-own schemes in Lagos as an alternative option, where timely payments contribute towards purchasing the property. This could be a strategic approach to manage costs effectively.

Conclusion

Buying your first home in Lagos is a big step, and it can feel like a rollercoaster ride. But with the right info and a bit of patience, you can make it through.

Set a budget that works for you, check out different neighbourhoods, and get a good real estate agent on your side.

Don’t skip the property inspection, and make sure you understand all the legal stuff. It’s a lot to take in, but once you get the keys to your new place, it will all be worth it.

Frequently Asked Questions

What should I know about the Lagos real estate market?

The Lagos real estate market is vibrant and ever-changing. Key trends include rising property values and a focus on urban development. Popular areas include Victoria Island and Lekki, while future projects are expected to enhance infrastructure.

How can I set a realistic budget for buying my first home?

Start by calculating all costs, including the home price, taxes, and maintenance. Use budgeting tools and consult financial advisors to ensure you stay within your limits.

What factors should I consider when choosing a neighbourhood?

Consider proximity to work, schools, and amenities like shops and parks. Visiting neighbourhoods at different times can give you a better feel for the area.

Why are property inspections important?

Inspections help identify any hidden problems in a home, such as structural issues or faulty wiring. Hiring a professional ensures a thorough check.

What legal aspects should I be aware of when buying a home?

Understand property deeds and contract terms. A real estate lawyer can guide you through the legal process and ensure everything is in order.

What extra costs should I expect as a homeowner?

In addition to the purchase price, anticipate closing costs, property taxes, insurance, and regular maintenance. These can add up, so plan accordingly.