Ultimate Guide to Due Diligence in Real Estate (2025 Updated)

by Bright Ugochukwu

Feb 23, 2025

Are you into real estate? You’ll hear “due diligence” a lot. It’s basically about doing your homework before buying a piece of real estate.

Knowing the ins and outs can save you from headaches and money pits, whether you’re eyeing a fixer-upper or a shiny new apartment.

Our guide will walk you through:

Let’s explore the nitty-gritty of due diligence in real estate investing and make sure you’re set for a smart purchase.

Key Takeaways

- Due diligence is essential for identifying potential issues before purchasing a property.

- It involves checking legal documents, financial records, and the physical condition of the property.

- Skipping due diligence can lead to costly surprises later on.

- Professional help from inspectors and lawyers can be invaluable in this process.

- Starting early and keeping detailed records can make the process smoother.

What is Due Diligence in Real Estate?

Due diligence in real estate means carefully checking a property before buying it. It involves reviewing documents, assessing finances, and evaluating risks.

This helps ensure everything is in order with the law, money, and the building itself. The goal is to ensure the transaction is legal, and that the property is suitable for investment.

Importance of Due Diligence in Real Estate Investing

Clarifying the Concept of Due Diligence

In real estate investing, due diligence is your safety net.

It’s the process of digging into all the nitty-gritty details about a property before purchasing.

Think of it as doing your homework.

You want to know everything about the property—its legal standing, financial health, and physical condition. This way, you’re not walking into any nasty surprises.

Clarifying these aspects helps make sure the investment fits your financial goals and expectations.

The Role of Due Diligence in Risk Mitigation

Buying real estate is a big deal; the last thing you want is to discover hidden problems after signing on the dotted line.

Due diligence helps you spot these issues early.

It’s like having a checklist for spotting potential red flags. You can mark issues like legal disputes, debts, or structural problems.

Identifying these risks early lets you negotiate better terms with the seller or choose to walk away. This process significantly reduces the chances of future disputes or financial losses.

How Due Diligence Enhances Investment Confidence

When you go through the due diligence process, it boosts your confidence as an investor. You’ve got the facts and figures and know exactly what you’re getting into.

This knowledge empowers you to make informed decisions, whether negotiating the price or planning future investments.

Investing becomes less of a gamble and more of a calculated move. With due diligence, you’re not just buying a property but securing a solid foundation for your investment portfolio.

Pro Tip: Due diligence is a vital step in buying, and a thorough way to understand and protect your investment. It helps you move ahead with confidence, knowing you’ve thoroughly checked the property’s strengths and weaknesses.

Key Components of Due Diligence in Real Estate

Legal Due Diligence: Ensuring Compliance and Clear Titles

Legal due diligence ensures that no nasty surprises are lurking in the paperwork.

Checking the title deed is a must.

This ensures the seller owns the property and has no hidden liens or debts. Also, you need to look at zoning and land-use regulations to confirm the property’s legal standing.

This step is crucial if you plan to develop or change the property in any way. Don’t forget to review any contracts or agreements tied to the property to ensure everything’s above board.

Financial Due Diligence: Assessing Economic Viability

Financial due diligence is about crunching the numbers to see if the property is a good investment.

This involves reviewing the property’s income and expenses, tax records, and any existing loans.

You want to ensure the property aligns with your financial goals and doesn’t come with hidden costs. It’s like giving the property a financial health check.

Physical Inspection: Evaluating Property Condition

This is where you roll up your sleeves and get a good look at the property itself.

A thorough inspection checks the structural integrity, plumbing, electrical systems, and even potential pest problems.

It’s a top-to-bottom health check for the property. This step helps you spot any issues that might require costly repairs down the line.

Community and Neighbourhood Analysis

Understanding the community and neighbourhood is as important as the property itself.

You want to know about local amenities, schools, crime rates, and future development plans.

This helps you assess the potential value growth of the property and whether it meets your needs. It’s about seeing the bigger picture beyond the property’s four walls.

Pro Tip: In real estate, due diligence is your best friend. It’s about knowing exactly what you’re getting into before you sign on the dotted line.

Consider examining physical conditions, zoning restrictions, and legal standings. Doing so ensures informed decision-making in real estate transactions.

Conducting Effective Due Diligence: A Step-by-Step Approach

Initial Research and Information Gathering

First, gather all the information you can about the property. This includes checking property records, past ownership, and any legal issues.

Digging into these details early can prevent nasty surprises later.

You might want to make a checklist to ensure you don’t miss anything crucial. This is your foundation, so be thorough.

Engaging Professional Services for Expert Insights

Once you’ve done your homework, it’s time to bring in the pros.

Hiring professionals like real estate inspectors, lawyers, and appraisers is key. They’ll spot things you might miss, like structural problems or legal hiccups.

Hiring experts can seem like a big expense, but it’s an investment in peace of mind and security.

Reviewing Findings and Making Informed Decisions

After gathering all the reports and insights, sit down and review everything carefully.

Look at inspection results, legal documents, and financial assessments. This is where you’ll put together the puzzle pieces.

If something doesn’t add up, don’t ignore it.

Take your time to understand what each finding means for your investment. This step is all about making sure your decision is informed and aligned with your goals.

Pro Tip: Take a methodical approach to due diligence to protect your investment and ensure you make a choice that aligns with your financial and personal goals. A well-researched decision is a confident decision.

Common Challenges and Pitfalls in Real Estate Due Diligence

Overlooking Critical Inspections

Skipping inspections can be a costly mistake. Imagine buying a property only to find out later that it has severe structural issues or a pest infestation.

Thorough inspections are vital to uncover hidden problems that could lead to expensive repairs down the line.

Hiring a qualified inspector to check everything from the foundation to the roof is essential. Specialised inspections, such as for pests or environmental hazards, are also necessary.

Neglecting Legal and Regulatory Aspects

Legal issues can be a nightmare if not appropriately addressed. Failing to verify a property’s legal status might lead to disputes or even loss of ownership.

Engage a real estate lawyer to conduct a title search and review zoning laws. They will ensure there are no legal hiccups, like unclear titles or zoning violations, which could jeopardise your investment.

Misjudging Financial Implications

Financial oversight can lead to overpaying or unexpected expenses. It is crucial to review the property’s economic history, assess market value, and check property tax records.

This ensures the property aligns with your budget and investment goals. A detailed financial review helps avoid the trap of hidden costs that might not be obvious at first glance.

Pro Tip: Real estate due diligence goes beyond ticking boxes—it’s about making informed decisions to protect your investment. Missing any step can lead to costly consequences.

These common pitfalls can help you better navigate due diligence and protect your real estate investment.

For more insights into avoiding mistakes in real estate investing, consider reviewing common house-hunting mistakes to ensure a successful journey.

Tools and Resources to Aid Due Diligence in Real Estate

Real estate due diligence can seem overwhelming, but using the right tools and resources can make the process much smoother.

Here’s a breakdown of some essential aids to ensure you make a well-informed investment.

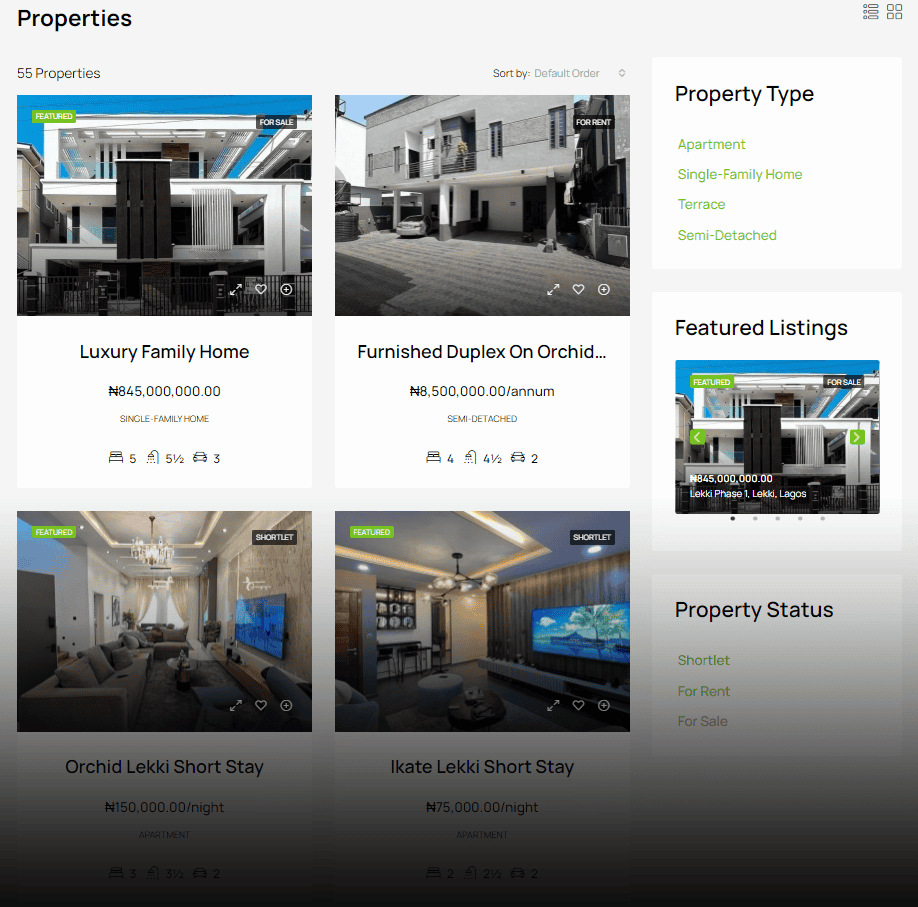

Utilising Online Platforms and Databases

In today’s digital age, online platforms and databases are invaluable for conducting thorough due diligence.

They provide access to property records, market trends, and zoning laws. Websites offering detailed property insights can save you a lot of time and effort.

Some popular platforms include Oparah Realty, 99acres, Housing, and MagicBricks. These resources offer a solid foundation for assessing a property’s potential.

Leveraging Professional Expertise

Hiring professionals like real estate attorneys, inspectors, and appraisers is crucial.

These experts bring a wealth of experience and can spot issues you might miss. Their input can be invaluable, whether a legal hiccup or a structural problem.

Engaging the right professionals ensures every aspect of the property is thoroughly evaluated.

Creating and Using Comprehensive Checklists

Checklists are simple yet effective tools for ensuring that no detail is overlooked. They help organise the process, from initial research to final decision-making.

A well-structured checklist covers everything from verifying titles to assessing neighbourhood conditions. It helps you mark off each step, ensuring a complete due diligence process.

Pro Tip: In real estate, the devil is in the details. Documenting everything helps keep those details in check, ensuring a smooth transaction and a sound investment.

Tips for Successful Due Diligence in Real Estate Investing

Starting the Process Early

Kicking off the due diligence process as soon as you spot a potential property is a wise move. Starting early gives you the luxury of time to uncover any hidden issues that might not be obvious at first glance.

A rushed process can lead to overlooked details, which might cause headaches later on. Rather than scrambling at the last minute, it’s like setting off on a road trip with a full tank and map in hand.

Allocating Adequate Budget for Due Diligence

Cutting expenses is tempting, but it’s important to budget for inspections, legal reviews, and professional services.

Think of it as an investment in peace of mind.

Skimping now might save a few bucks, but it could lead to costly mistakes down the road.

Proper budgeting ensures that each aspect of the property is thoroughly checked, from the legal documents to the comprehensive inspection of structural and system evaluations.

Documenting Every Step for Future Reference

Keeping detailed records of every inspection, report, and conversation is not just good practise; it’s essential.

These documents serve as a reference point for future decisions and can be invaluable if disputes arise.

It’s like having a diary of your journey through the buying process, ensuring nothing gets forgotten.

Pro Tip: Real estate due diligence goes beyond ticking boxes—it’s about making informed decisions to protect your investment. Missing any step can lead to costly consequences.

Successful due diligence in real estate investing involves being proactive, prepared, and meticulous. Starting early, budgeting wisely, and documenting everything are the keys to a smooth and successful property purchase.

Conclusion

So, there you have it, a whirlwind tour through the ins and outs of due diligence in real estate. It’s not just a box-ticking exercise; it’s your safety net against nasty surprises down the line.

Whether you’re looking for a cosy flat or a sprawling commercial space, taking the time to research the details can save you a lot of trouble.

It’s important to be THROUGH.

Check the legal documents, inspect every corner, and ask the tough questions. And hey, if it all feels a bit much, there’s no shame in calling in the pros. After all, a little help can go a long way in making sure your investment is as solid as a rock.

FAQs

Why do people do due diligence when buying a house?

People do due diligence to find any hidden problems with a house. This helps them make smart choices and avoid surprises later.

What are the main parts of doing due diligence for a house?

The main parts are checking the house itself, making sure the legal stuff is in order, looking at the money side, and seeing if the neighbourhood is nice.

What do you check during a house inspection?

During a house inspection, you check if the house is strong, if the plumbing and electricity work, and if there are any pests or other problems.

How can I make sure a house is legal to buy?

To ensure a house is legal, check the title deed, make sure the seller owns it, and see if it follows all the local rules and laws.

What should I do if I find problems during due diligence?

If you find problems, you can ask the seller to fix them, try to change the deal, or decide not to buy the house.