Equity REIT vs. Mortgage REIT: Which Real Estate Investment Is Right for You?

by Bright Ugochukwu

Last Updated: Aug 19, 2025

Looking to grow your wealth with real estate—but not sure whether to invest in Equity REITs or Mortgage REITs?

You’re in good company.

As a broker here in Lagos, I’ve walked many clients through this decision.

Today, I’ll guide you in selecting the right REIT type for your goals in clear and confident terms.

Quick Answer: Choose Equity REITs if you want long-term growth, steady rental income, and exposure to physical properties. Pick Mortgage REITs if you want higher short-term dividend yields and are comfortable with more risk from interest rate changes.

Here, we’ll cover topics, including:

Let’s dive in and make this choice easy.

Key Differences at a Glance: Equity REITs vs. Mortgage REITs

Here’s a comprehensive table summarising the key differences between Equity REIT and Mortgage REIT:

| Aspect | Equity REITs | Mortgage REITs (mREITs) |

|---|---|---|

| Core Investment Focus | Own, operate, and manage income-producing physical properties. | Invest in mortgages or mortgage-backed securities (MBS); act as lenders rather than landlords. |

| Income Source | Earn rental income from tenants plus potential capital gains from property appreciation. | Earn interest income from mortgage loans and MBS holdings. |

| Underlying Assets | Tangible real estate—offices, malls, apartments, hotels, hospitals, data centers, etc. | Financial instruments—home loans, commercial mortgages, and packaged mortgage securities. |

| Primary Growth Driver | Increase in property values and consistent rental cash flow. | Changes in interest rates and spreads between borrowing and lending rates. |

| Dividend Yield Potential | Moderate (often 3–5% annually) but more consistent over time. | High (often 7–12% annually) but can be volatile. |

| Risk Profile | Tied to real estate market cycles—occupancy rates, rental demand, and property valuations. | Tied to interest rate movements and borrower credit risk (defaults). |

| Volatility Level | Generally lower volatility, but exposed to property downturns and high operating expenses. | Higher volatility due to sensitivity to rate changes, leverage, and credit market conditions. |

| Inflation Protection | Stronger—rents can be adjusted upward to match inflation trends. | Weaker—interest income doesn’t always keep up with inflation unless rates adjust favorably. |

| Leverage Use | Moderate—properties often financed with mortgages, but less reliant on heavy leverage. | High—mREITs often use significant borrowing to amplify returns, increasing risk. |

| Capital Appreciation Potential | High—asset values can grow over the long term. | Low—focus is on income generation, not capital gains. |

| Sensitivity to Interest Rates | Indirect—higher rates can raise borrowing costs, affecting profits. | Direct—rate changes impact spreads, borrowing costs, and asset values significantly. |

| Liquidity | High—traded on stock exchanges like regular shares. | High—also traded on stock exchanges, but share prices may swing more sharply. |

| Best For | Long-term investors seeking steady growth, inflation protection, and tangible asset exposure. | Income-focused investors willing to accept higher risk for higher short-term yields. |

This table provides a concise comparison to help investors understand when to choose between Equity REITs vs. Mortgage REITs.

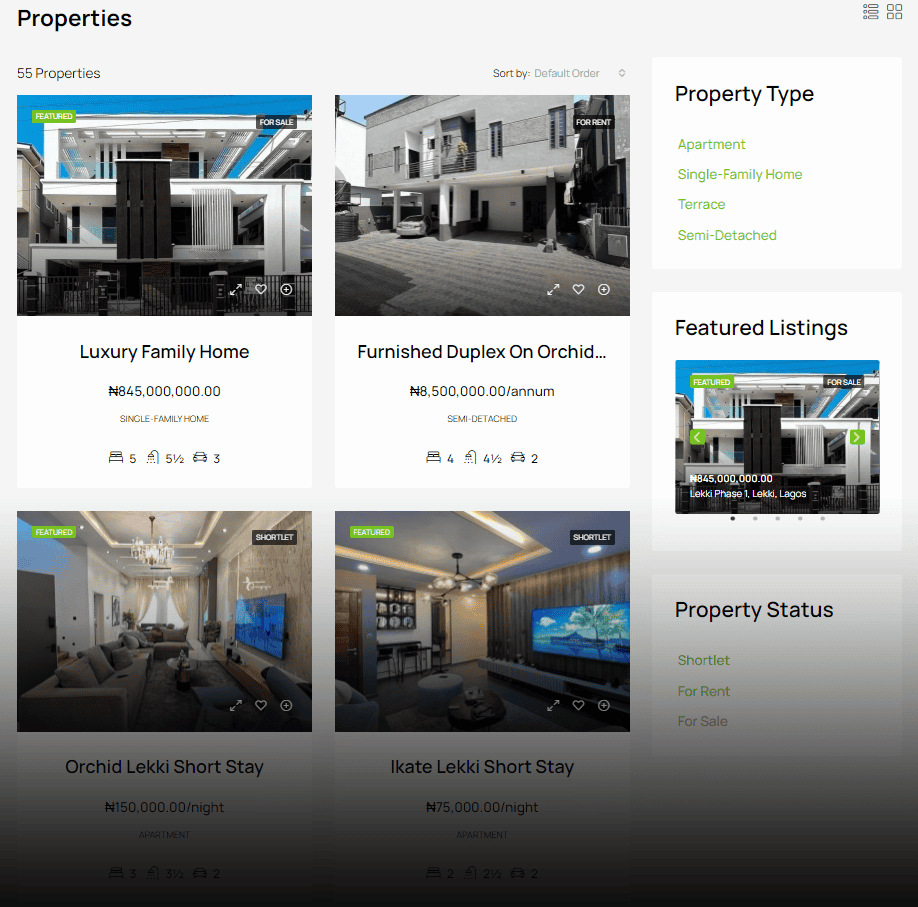

What Are REITs? (Quick Primer)

Definition of REITs (Real Estate Investment Trusts explained)

A REIT is a company that owns or finances income-generating real estate.

It lets you invest in property without owning physical buildings or writing mortgage loans yourself.

Why Investors Choose REITs (Liquidity, dividends, diversification)

- Liquidity: Unlike physical real estate, you can buy and sell REIT shares easily.

- Steady Dividends: REITs are required by law to distribute at least 90% of their profits as dividends, providing a steady income stream.

- Diversification: These options allow you to invest across various sectors—such as commercial, residential, and healthcare—without requiring a large capital investment.

Pro Tip: If you’re new to REITs, start with a REIT ETF. It spreads your risk across many properties or loans without you picking individual REITs.

Equity REITs: Owning Physical Real Estate

How Equity REITs Work (Buy/operate income-generating properties)

Equity REITs acquire, manage, and operate real property—like malls or office buildings—to earn rental income.

As a broker, I’ve seen these REITs deliver reliable income for clients over time.

Types of Properties They Hold

Commercial (Office buildings, malls)

Equity REITs often own office towers or shopping centres—a great play on business activity and retail strength.

Residential (Apartments, student housing)

They also offer exposure to housing markets: apartments, condos, and student residences.

Speciality (Hotels, hospitals, data centres)

Some focus on niche assets like hotels, hospitals, or data centres. These can offer unique upside (or risk) depending on economic trends.

Pros of Equity REITs

1. Steady rental income

You receive regular cash flow as tenants pay rent—quite predictable if occupancy remains strong.

This makes equity REITs appealing to investors seeking stability and consistent returns, especially when properties are located in high-demand areas such as commercial hubs or residential hotspots.

2. Appreciation potential

When property values rise, so does the NAV (net asset value) of the REIT.

Over time, well-located properties in growing cities can experience huge appreciation, which boosts shareholder value and provides both income and long-term growth.

3. Inflation hedge

Rent often increases with inflation, which can help shield your returns.

This means your income has the potential to keep pace with rising costs, protecting your purchasing power in ways that many fixed-income investments cannot.

Pro Tip: Look for Equity REITs with long-term leases that have rent escalation clauses. They can help protect your income against inflation.

Cons of Equity REITs

1. Sensitive to property market cycles

If the real estate market dips, values and rental income can suffer.

For example, during economic slowdowns, vacancies may rise, reducing rental cash flow and lowering the value of the REIT’s holdings.

2. High operational costs

Managing properties costs money—maintenance, staffing, and financing reduce returns.

Large capital expenses like repairs, renovations, or regulatory compliance can also cut into profits, leaving less to distribute as dividends.

Mortgage REITs: Financing Real Estate

How Mortgage REITs Work (Invest in mortgages/MBS, not properties)

Mortgage REITs (mREITs) don’t own physical property.

Instead, they lend money via mortgages or mortgage securities. They earn by collecting interest.

Types of Mortgage REITs

Residential mREITs (Home loans)

These focus on personal home loans or RMBS (residential mortgage-backed securities).

Commercial mREITs (Business property loans)

These invest in mortgages for commercial buildings and business properties.

Pros of Mortgage REITs

1. High dividend yields

Because they earn spread income on interest, mREITs often yield higher dividends than equity REITs.

This makes them attractive to income-focused investors who prioritise cash payouts, even if that comes with higher risk.

2. Interest rate play

They can benefit if interest rates fall—borrowing costs drop while assets hold value.

In the right environment, this allows mREITs to widen their profit margins and deliver stronger returns than traditional property-based REITs.

Cons of Mortgage REITs

1. Interest rate sensitivity

Rising rates can narrow spreads and reduce income, making them volatile when rates fluctuate.

Even small changes in central bank policy or global credit markets can quickly impact performance, creating uncertainty for investors.

2. Higher risk of defaults

If borrowers can’t pay up, mREIT income suffers. The 2008 financial crisis shows how risky they can be.

Mortgage defaults, foreclosures, and credit losses can significantly impact dividend payouts, making mREITs less reliable during times of financial stress.

Pro Tip: Mortgage REITs tend to perform best in stable or falling interest rate environments. Keep a close eye on central bank policy before making a significant investment.

Which REIT Type Fits Your Goals?

A few years ago, one of my clients here in Lagos, Mr. Ade, was looking for a steady income stream for his retirement.

Initially, he was drawn to Mortgage REITs because of their high dividend yields—he loved the idea of earning double-digit returns.

However, after a period of rising interest rates, his mREIT investments dropped sharply in value, and his dividend payments were cut. We restructured his portfolio to include more Equity REITs, focusing on stable commercial and residential properties.

Over the next three years, these Equity REITs generated consistent rental income and moderate capital growth, providing him with peace of mind and financial stability.

He now uses mREITs only for a small, high-yield portion of his portfolio.

Choose Equity REITs if You Want:

- Long-term appreciation + stability: If you prefer steady growth over time and less volatility.

- Exposure to physical real estate: You like knowing you’re backing office blocks, apartments, or malls.

Choose Mortgage REITs if You Want:

- Short-term high yields: Dividend income is your priority—even if it comes with risk.

- Interest rate speculation: If you anticipate falling rates, you can ride the income boost.

Pro Tip: You don’t have to choose only one. A balanced REIT portfolio—mixing Equity and Mortgage REITs—can give you both stability and high yields.

How to Invest in REITs (Practical CTA)

REIT ETFs vs. Individual Picks

- REIT ETFs like Vanguard’s VNQ or iShares’ ICF let you diversify with one trade.

- Individual REIT shares allow you to handpick sectors—like hospitals or data centres—for targeted exposure.

In Lagos, we can help you access international REIT ETFs, or locally listed REITs (where available) via your brokerage account.

Tax Considerations (Pass-through income rules)

REIT dividends are taxed as ordinary income.

That means higher tax rates than dividends from other stocks. In Nigeria, specific tax guidance may apply—so check with your tax advisor or let us guide you based on local rules.

Final Thoughts

Both Equity and Mortgage REITs offer distinct paths to real estate exposure.

Equity REITs give you tangible assets, predictable income, and inflation protection. Mortgage REITs offer higher yields and rate-driven returns—but with added volatility.

As your broker in Lagos, I guide clients using a mix of REITs tailored to their risk comfort and income needs. Want moderate stability with growth? Lean toward Equity REITs. Want a regular high income and can tolerate ups and downs? Mortgage REITs might suit you.

Ready to explore specific REITs or ETFs—or see tailored recommendations based on your goals? Let’s talk.

FAQs on Equity REITs vs. Mortgage REITs

Which of these is an advantage of Equity REITs over Mortgage REITs?

Equity REITs offer tangible property ownership and the potential for long-term value appreciation, in addition to steady rental income.

This gives investors more stability and an inflation hedge compared to the rate-sensitive, income-only nature of Mortgage REITs.

Why are Mortgage REITs risky?

Mortgage REITs are highly sensitive to interest rate changes and rely heavily on leverage to boost returns. When rates rise or borrowers default, their income and share prices can drop sharply—making them more volatile than Equity REITs.

Are Equity REITs risky?

Yes, but their risks are tied mainly to property market cycles.

Factors such as falling occupancy rates, declining rental demand, or declining property values can negatively impact returns. However, they are generally less volatile than Mortgage REITs.

What is the dark side of REITs?

The “dark side“ is that while REITs provide passive income, they can be highly sensitive to market conditions and often use significant debt.

Also, REIT dividends are taxed as ordinary income, which can reduce your net returns compared to other investments.

Can a REIT lose money?

Yes. A REIT can lose value if property markets decline, interest rates move unfavorably, or operating costs rise. Share prices can also fall due to poor management decisions or adverse economic conditions.

Should I invest in real estate or REITs?

It depends on your goals. If you want hands-on control and are ready for the work of owning property, physical real estate may be for you.

If you want liquid, diversified, and hassle-free exposure to real estate, REITs are a better fit—allowing you to buy or sell easily without managing tenants or properties.