- Home

- Property Buying Process

- Lagos Home Affordability Calculator

Lagos Home Affordability Calculator: Find Your Budget in Minutes—and Avoid Costly Mistakes

by Bright Ugochukwu

Last Updated: Aug 24, 2025

Looking to buy a home in Lagos? Don’t let the market’s high prices and hidden costs catch you off guard.

This guide gets you started quickly by showing you what you can afford in minutes—so you avoid financial stress and buyer’s remorse.

Quick Summary: The Lagos Home Affordability Calculator helps you set a safe budget, avoid hidden costs, and choose the right neighbourhood. Stick to a 30–35% debt-to-income ratio and always plan for extra fees.

You’ll get crystal-clear, proven steps. Let’s jump in.

Why You Need a Home Affordability Calculator

Even as a seasoned Lagos broker, I see buyers underestimate what they can actually handle. You want to be confident before making offers.

A home affordability calculator does that:

- It gives you real-time clarity.

- It protects you from overstretching.

- It helps you plan your next moves.

This tool stops you from buying more than your budget allows. It saves you sleepless nights.

Avoid Financial Stress

Many buyers strain their monthly cash flow by over-committing to a mortgage.

I’ve seen clients regret it fast—it often sets off a chain reaction of missed bills, stress, and even foreclosure threats. A calculator helps you keep your debt at a safe level. Use it, and you’ll sleep better at night.

Pro Tip: Never let your mortgage or rent take more than 30–35% of your income. This helps keep you safe from financial stress in Lagos.

Lagos-Specific Factors

In Lagos, the home-buying picture is unique. Prices high. Inflation biting. Hidden fees lurking.

Examples:

- Agent commissions run around 2–5% of the price.

- Legal fees + stamp duties can spike total outlay.

- Utility reconnections and maintenance catch you off guard.

An affordability calculator specifically designed for Lagos includes all of this.

Pro Tip: Always budget an extra 5–10% of the property price for hidden costs like agent fees, legal fees, and stamp duty.

How Our Calculator Works

Here’s how it works under the hood.

Inputs We Consider

To calculate properly, we gather data that reflects your true financial picture:

Your Income & Savings

I ask for your net monthly income and how much you’ve saved for a down payment. In Lagos, the ability to put down 20–30% down can improve mortgage terms—or even avoid them.

Existing Debts/Liabilities

Include here—car loans, education loans, credit card balances. They reduce what you can safely borrow.

Current Lagos Market Rates

Interest rates vary.

We pull current mortgage rates, from maybe 18% to 25% annually. We also include agent fees, legal charges, stamp duties, and other site-specific costs.

The Formula Behind It

At its heart, the calculator uses the debt-to-income (DTI) ratio.

That’s your total monthly debt (new mortgage + existing debts) divided by your gross monthly income.

A safe range in Nigeria is typically around 30–40%. That gives you enough breathing room. I’ve guided clients with this ratio many times—so I know it works.

Step-By-Step Guide to Using the Calculator

Let’s break it down.

You use the calculator in three straightforward steps:

1. Enter Your Financial Details

- Input your net salary.

- Enter your savings for a down payment.

- Add your current monthly payments on other debts.

2. Adjust for Lagos Realities

This is crucial. Don’t rely on bare property prices. After you enter the number:

- Add agent fees (say 3%).

- Add legal costs (roughly ₦100,000–₦300,000).

- Factor in maintenance costs—such as repairs, upkeep, and bills.

Our calculator adjusts the maximum price accordingly.

3. Get Your Personalised Budget Range

Within seconds, you get a smart budget range—e.g., “You can target ₦30M–₦40M in property value.” Then you can choose down payment options or stretch your term. Easy.

Pro Tip: Enter your net income (after tax), not gross income. This gives a realistic affordability figure to work with.

Understanding Your Results

What’s a “Safe” Budget?

We aim for a DTI ratio of 30–35% net income.

That means your total outgoing—mortgage, debts—shouldn’t exceed a third of your salary.

It’s a buffer.

It avoids cash crunches.

Lagos Neighbourhoods in Your Range

Once you have your budget, match it to areas:

| Budget Range (₦) | Possible Neighbourhoods |

|---|---|

| ₦120M–₦350M | Mainland areas like Surulere, Yaba, Ikeja |

| ₦350M–₦600M | Lekki Phase 1, Ajah, Ikoyi (some pockets) |

| ₦600M+ | Victoria Island, Banana Island, upmarket zones |

Sources: PropertyPro, Nigeria Property Centre

You can link each neighbourhood to detailed area guides—covering amenities, commute, and schools.

When to Stretch (or Reduce) Your Budget

- Stretch only if: You can afford a larger down payment, expect income growth soon, or plan to sell/upgrade fast.

- Reduce if: Your job is unstable, savings are lean, or you’re uncomfortable with tight monthly margins.

I use real cases here: one client stretched a bit, rented part of the space for income, and made it work smartly.

Pro Tip: If your calculated budget points to Mainland but you want Island, consider buying a smaller property in Lagos Island—or a larger one on the Mainland. Balance location and lifestyle.

Common Lagos Affordability Mistakes

Underestimating Fees

Buyers often skip estimates for:

- Agent fees (2–5%).

- Legal fees (₦150K–₦300K).

- Stamp duty and documentation.

- Utility reconnection, maintenance, and renovation.

These can add 5–10% more to the cost. My calculator flags those.

Ignoring Future Expenses

Don’t forget:

- School fees (these can double quickly).

- Commuting or bad traffic costs.

- Unexpected household repairs—generators, plumbing, etc.

I once helped a family that had maxed out their budget, then had to pull their kids from school due to tuition shock. Avoid that.

Overlooking Financing Options

- Mortgage pros: Spread payments and maintain liquidity.

- Mortgage cons: High interest; long payback.

- Cash purchase pros: No interest or approvals.

- Cash cons: Drains liquidity.

In some cases, splitting the difference—15–25% down plus mortgage—works best. I tailor this often.

Pro Tip: Test-drive your budget. For 3 months, set aside the amount you’d pay on a mortgage. If you struggle, reduce your target property budget.

Next Steps After Calculating Your Budget

How to Improve Your Affordability

- Save more for a down payment—it lowers the amount you need to borrow.

- Pay off high-interest debts first, like credit cards or payday loans.

- Add a co-borrower: Spouse or partner income can stretch eligibility.

- Negotiate terms with developers—sometimes you get better down payment plans.

I regularly coach clients through negotiation and structuring payment plans. It helps.

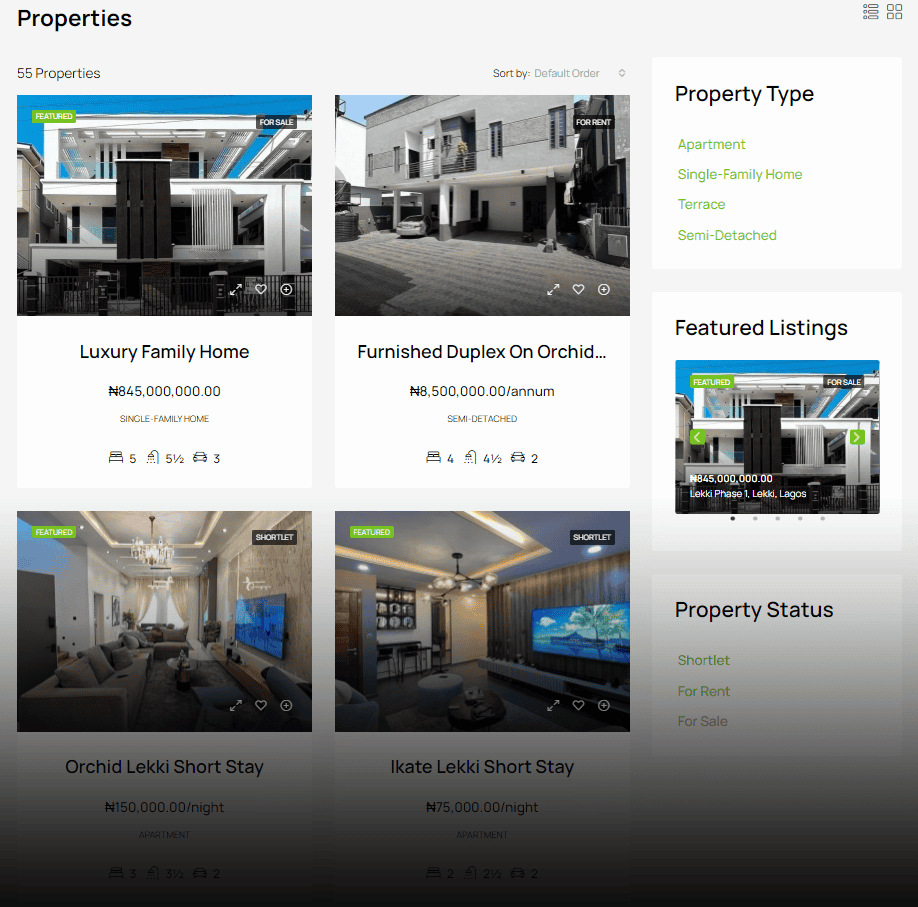

Where to Find Homes in Your Range

Once the budget is clear, move to listings:

- Online portals: Oparah Realty, PrivateProperty, NPC.

- Agent listings: I can share exclusive (often unadvertised) deals.

- Developer presales: These sometimes lock-in prices before inflation hits.

Smart buyers check both listings and insiders.

Pro Tip: Developers in Lagos often offer flexible payment plans. Always ask before walking away—it can save you millions.

Talk to a Lagos Real Estate Expert

This is your call to action. After calculating, book a chat.

I offer free, NO-pressure consults.

We review your budget, shortlist, and next move together. You get personal guidance, neighbourhood intel, and deal savvy.

Final Thoughts

A Lagos-specific home affordability calculator helps you:

- Understand what you truly can afford—down to the exact number.

- Avoid hidden costs that derail budgets.

- Make smart, stress-free property decisions.

I say this from experience—and from helping dozens of clients buy without panic or regret.

Want a safe path to homeownership in Lagos? Use this guide.

Enter your numbers. Talk with me when you’re ready. You’ll see how simple and empowering it can feel.

FAQs

What Salary Do I Need for a ₦100M Home?

To comfortably afford a ₦100M home in Lagos, you should aim for a net monthly income that keeps your debt-to-income (DTI) ratio at or below 35%.

If you make a 30% down payment (₦30M), your loan will be ₦70M.

At current Lagos mortgage rates (about 18–25% per year), you may need a monthly income of ₦2.5M–₦3.5M to stay in the safe range.

Tip: Your exact figure will depend on interest rates, the loan term, and other debts you may have.

Can I Afford a Home on a Single Income?

Yes—if your income and savings are strong enough to cover both the down payment and safe monthly repayments.

Many of my clients in Lagos buy on a single income, but they:

- Keep their DTI under 35%.

- Have at least 20–30% down payment saved.

- Choose neighbourhoods within your budget (the Mainland is often more forgiving than the Island for single-income buyers).

How Much Should I Save for a Down Payment?

In Lagos, the recommended down payment is 20–30% of the property price.

- A minimum of 20% is what most lenders prefer.

- A 30% or higher down payment can help you secure better loan terms or assist in negotiating a developer payment plan.

Example: For a ₦50M home, aim for ₦10M–₦15M upfront.

What is a Good Debt-to-Income Ratio?

A good debt-to-income ratio in Lagos is 30–35%.

This means all your monthly debts (including your new mortgage) should not exceed one-third of your monthly income.

Staying within this range gives you breathing room for future expenses, such as maintenance, school fees, or emergencies.

How Can You Determine if You Can Afford a Loan?

You can determine if you can afford a loan by:

- Calculating your DTI – Ensure that your total debt payments do not exceed 35% of your monthly income.

- Factoring in Lagos-specific costs – Include agent fees, legal charges, stamp duty, and maintenance.

- Testing the monthly payment – If you can “practice pay” your expected mortgage amount for 3–6 months (set it aside in savings without touching it), you’re likely in a safe zone.

DISCLOSURE: Oparah Realty provides this information for educational purposes only and is not intended as legal or financial advice. Property affordability varies by individual circumstances, and we recommend consulting a licensed financial advisor or real estate expert before making any purchase decisions.