How to Buy a House in Lagos: A Step-by-Step Guide (Without Getting SCAMMED!)

by Bright Ugochukwu

Jan 31, 2025

So, you’re thinking about buying a house in Lagos. It’s a big move, and let’s face it, not the easiest thing to do.

Lagos is a busy city with a property market that’s as lively as its streets.

But don’t worry; this guide is here to break it down for you step-by-step.

Here, we’ll cover the following:

- Market Knowledge

- Setting Budget

- Choosing Location

- Engaging Agent

- Property Search

- Inspecting Property

- Legal Requirements

- Negotiating Price

- Finalising Purchase

- Other Considerations

Rest assured, we’ve got you covered.

Key Takeaways

- Understand the Lagos property market by researching key areas and current trends.

- Set a realistic budget considering all potential costs, including hidden ones.

- Choose the right location based on factors like safety, amenities, and future growth.

- Engage a competent real estate agent to help navigate the buying process.

- Conduct thorough inspections and legal checks to avoid future headaches.

Understanding the Lagos Property Market

Key Areas to Consider

When you’re thinking about buying a house in Lagos, the first thing you need to do is figure out where you want to live.

Lagos is a sprawling city with a mix of buzzy urban areas and quieter residential spots.

Key areas to consider include Ikoyi, Victoria Island, and Lekki for luxury living, while places like Yaba, Surulere, and Ikeja offer more affordable options.

Each area has its own vibe, so it’s a good idea to visit a few neighbourhoods to find the one that feels right for you.

Current Market Trends

The Lagos property market is constantly changing, with demand for luxury apartments rising alongside interest in more affordable housing options.

Developers are responding to these trends, creating a variety of properties to meet the needs of different buyers.

It’s a good idea to keep an eye on market reports and talk to local real estate agents to understand what’s happening right now.

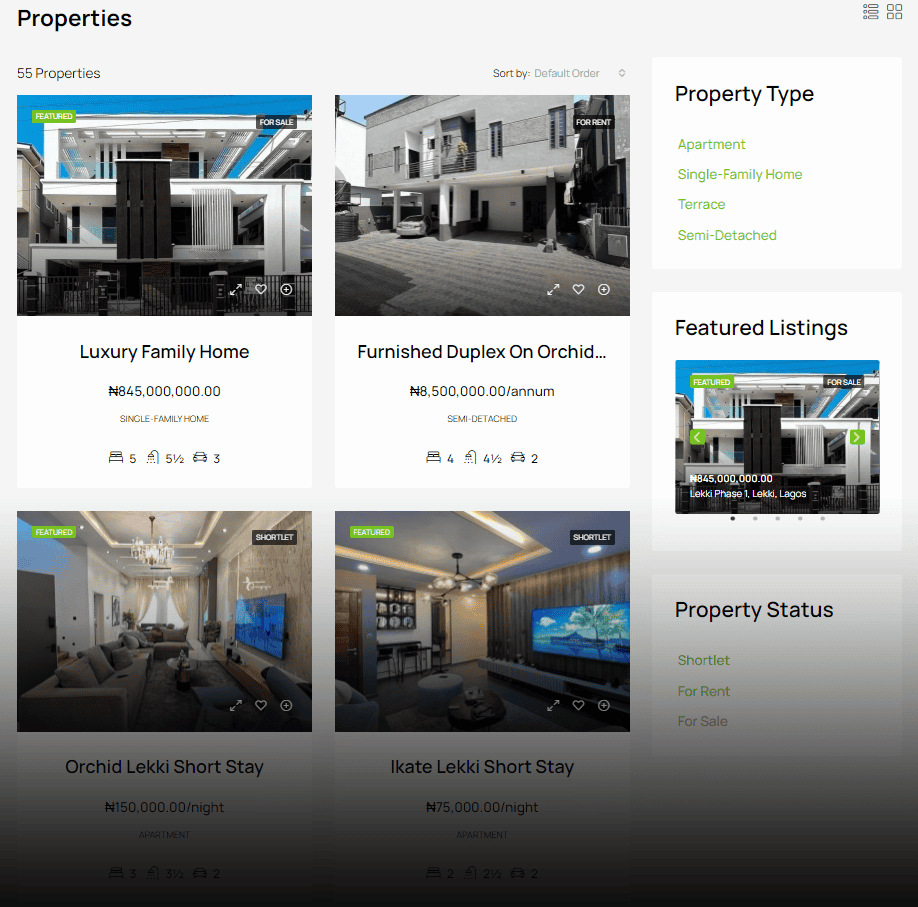

Property Types Available

Lagos offers a wide range of property types.

You can find high-rise apartments, detached houses with gardens, semi-detached homes, and terraced houses.

There are also commercial properties like offices and shops for those interested in business.

Each property type has its own benefits and potential downsides, so consider what best suits your lifestyle.

Lagos has it all!

You can find a modern apartment or a traditional home.

Pro Tip: Understanding the property market in Lagos is crucial before making a purchase. Take your time to research and explore your options to find the perfect home that fits your needs and budget.

Setting a Realistic Budget for Your House Purchase

Assessing Your Financial Situation

Before jumping into the home-buying process, taking a good look at your financial health is crucial.

Start by analysing your current income, savings, and any outstanding debts.

Understanding your financial limitations will help you avoid biting off more than you can chew. Consider future expenses that might pop up, like kids’ education or a new car.

Considering Additional Costs

Buying a house isn’t just about the sticker price. There are plenty of extra costs that can sneak up on you.

Think about taxes, insurance, and maintenance fees. Don’t forget to budget for closing costs, which can include legal fees and agent commissions.

Here’s a quick breakdown of typical additional costs:

| Cost Type | Estimated Amount |

|---|---|

| Legal Fees | NGN 150,000.00 |

| Agent Commissions | 5% of Purchase |

| Property Taxes | 1-2% annually |

Exploring Financing Options

Now, onto the money part. You’ll likely need a loan, so check out different financing options.

Banks, mortgage companies, and even some government programmes might offer what you need. Compare interest rates and terms to find the best fit for your situation.

Pro Tip: Buying a new home is exciting. But, stay grounded in your finances. It will save you stress later.

Once you’ve evaluated your finances thoroughly, you’ll be better prepared to make smart choices about your home purchase.

A budget isn’t just about numbers. It’s about knowing the costs of your choices. And, it’s about preparing for the duties of owning a home.

Choosing the Right Location in Lagos

Factors to Consider

Selecting the ideal spot for your new home in Lagos isn’t only about finding a place you like. It’s about striking a balance between convenience, lifestyle, and future growth.

Think about the daily commute—how long are you willing to spend in traffic?

Schools, hospitals, and shopping centres should also play a part in your decision. The proximity to key infrastructure projects can boost your property’s value and quality of life.

Popular Neighbourhoods

Lagos is a sprawling city with diverse neighbourhoods, each with its own vibe and perks.

Here’s a quick rundown:

- Victoria Island: Known for its hectic business district, it’s perfect if you want to be at the heart of the action.

- Lekki: Lekki has a mix of homes and businesses. It’s ideal for families and young professionals.

- Ikeja: As the state capital, has government offices, malls, and residential areas.

Future Development Plans

When buying a property, consider areas planners have earmarked for future development.

These places often see a rise in property values as new amenities and infrastructure projects are completed. Investigate government plans for road expansions, new schools, or commercial centres.

These developments can transform a quiet suburb into a bustling hub, adding long-term value to your investment.

Pro Tip: Picking the right location in Lagos is not just about where you live today but where you want to be tomorrow. Look for future growth and development to make a smart investment.

Engaging a Competent Real Estate Agent

Benefits of Using an Agent

Buying a house in Lagos can be stressful, but having a real estate agent by your side can make the process smoother.

Agents have local knowledge and expertise that can save you time and money.

They can provide you with a curated list of properties that meet your criteria, negotiate on your behalf, and help you navigate the legal paperwork.

In short, an agent can be your guide through the complex Lagos property market.

How to Choose the Right Agent

Selecting the right agent in Lagos is very important.

Here’s a simple checklist to help you make the right choice:

- Experience: Look for agents with a proven track record in the Lagos property market.

- Reputation: Ask around or check online reviews to ensure the agent is well-regarded.

- Communication: Ensure they are responsive and communicate clearly.

- Local Knowledge: They should have in-depth knowledge of the neighbourhoods you are interested in.

- Professionalism: They should be licenced and adhere to ethical standards.

Questions to Ask Your Agent

When you’ve narrowed down your list of potential agents, it’s time to ask some key questions:

- How long have you been working in real estate in Lagos?

- Can you provide references from past clients?

- What is your strategy for finding properties that match my needs?

- How do you handle negotiations, and what is your success rate?

Pro Tip: A competent real estate agent is like a trusted adviser. They help you make informed decisions and avoid pitfalls.

Finding a suitable real estate agent in Lagos can be effectively achieved through referrals from family, friends, or colleagues who have experience with reputable companies. This approach helps ensure that you connect with trustworthy professionals.

Conducting a Thorough Property Search

Online Property Listings

When you’re starting your property search in Lagos, online listings can be a great place to begin.

Websites dedicated to real estate often have extensive databases where you can search properties based on location, price, and type.

These platforms offer a convenient way to browse properties from the comfort of your home.

However, always verify the listings’ authenticity. Not all online properties may be up-to-date.

Visiting Properties

Once you’ve shortlisted some properties online, it’s time to hit the ground running.

Arrange visits to these properties to get a feel for the neighbourhood and the house itself.

Take note of the property’s condition, the amenities available, and the general vibe of the area. It’s a good idea to visit at different times of the day to better understand the locality.

Meeting a few locals can also provide insights into the community and any potential issues.

Evaluating Property Features

During your visits, pay close attention to the features of each property.

Are the rooms spacious enough for your needs? What about the condition of the plumbing and electrical systems?

Make a checklist of your must-haves and nice-to-haves.

Don’t hesitate to ask the seller or agent detailed questions about the history and maintenance of the property.

Pro Tip: A thorough property search ensures that you make the right investment. Take your time, do your homework, and avoid rushing—better to be careful than regret a hasty decision.

For a deeper understanding of the legal aspects involved, you might want to perform a legal search in Nigeria to ensure everything is in order before making a commitment.

Inspecting the Property

What to Look for During Inspection

When you’re checking out a house, keep an eye out for the big stuff.

Structural issues are a top concern. Look for cracks in the walls or ceilings, sagging floors, or any signs of foundation problems.

These can be expensive to fix and might indicate more profound issues.

Next up, water damage.

Check for stains on the ceiling or walls, which might indicate leaks. Also, remember to peek under sinks and around the bathroom for any signs of mould or mildew.

Common Red Flags

Certain things should make you think twice. If you notice a strong smell of dampness, it could mean there’s a moisture problem.

Flickering lights or outdated electrical panels might point to electrical issues.

Also, be wary of fresh paint in just one area – it could be hiding something.

And if the neighbourhood seems a bit too noisy or unsafe during your visit, you might want to reconsider.

Hiring a Professional Inspector

It’s smart to bring in a pro.

A qualified inspector will know exactly what to look for and can spot issues you might miss.

They’ll check everything from the roof to the basement and provide a detailed report, saving you a lot of hassle and money later on.

Plus, having an inspector gives you a better idea of what you’re getting into before you commit.

Pro Tip: An inspection is your chance to get up close and personal with a property, revealing its true colours before making one of your life’s most significant purchases. Take it seriously, and don’t rush the process.

Legal Requirements and Documentation

Getting the legal stuff right when buying a house in Lagos is super important. You don’t want any surprises later on, trust me.

Let’s break it down.

Essential Legal Documents

You need some essential papers before you get the keys to your new place.

These include:

- Deed of Assignment: This shows that the property is being transferred from the seller to you.

- Certificate of Occupancy (C of O): This is proof that you have the right to occupy the land.

- Registered Survey Plan: This outlines the exact boundaries of your property.

These documents are essential for property transactions and legal processes.

Role of a Property Lawyer

Having a property lawyer can make your life a whole lot easier.

They help with:

- Verifying Documents: Ensuring everything is legit and in order.

- Drafting Contracts: Making sure the terms are clear and fair.

- Legal Advice: Guiding you through any legal hiccups.

Avoiding Legal Pitfalls

To avoid getting into a legal mess, keep these in mind:

- Verify the Title: Always make sure the seller is the actual owner.

- Check for Encumbrances: Ensure the property isn’t tied up in legal disputes.

- Get All Agreements in Writing: Verbal promises mean nothing in real estate.

Pro Tip: Buying a house without sorting the legal stuff is like walking a tightrope without a safety net. It’s risky and can lead to problems. Always double-check and consult professionals to keep your investment safe.

Negotiating the Purchase Price

Strategies for Effective Negotiation

Negotiating the price of a house in Lagos can be a bit tricky, but it’s a crucial step in the buying process.

Start by doing your homework.

Research comparable properties in the area to get a sense of the market value. This will give you a baseline for your negotiations.

Don’t be afraid to make an initial offer that’s lower than the asking price—sellers often expect some back-and-forth.

Consider these strategies:

- Understand the Seller’s Motivation: Knowing why the seller is selling can give you leverage. Are they in a hurry to move, or are they testing the market?

- Highlight Property Flaws: If the property has issues, use them as a bargaining chip to lower the price.

- Be Prepared to Walk Away: Sometimes, the best negotiating tactic is to be willing to step back if the deal isn’t right.

Understanding Market Value

Before making an offer, you need to understand what the property is worth.

This means looking at recent sales of similar properties in the neighbourhood.

Consider hiring a property valuer for an independent assessment. This can help you avoid overpaying, especially if you’re buying in a hot market.

Here’s a simple table to help you compare:

| Property Feature | Your Property | Comparable Property |

|---|---|---|

| Price | NGN 220M | NGN 195M |

| Size | 400 sqm | 410 sqm |

| Year Built | 2022 | 2025 |

When to Walk Away

It’s important to know when to walk away from a deal.

If the seller isn’t budging on the price and it’s clear that the property isn’t worth the asking amount, it might be time to move on.

There are plenty of other properties out there.

Also, if you find out during the negotiation that the property has legal or structural issues that the seller will not address, don’t hesitate to walk away.

Pro Tip: Buying a house is a big decision. It’s easy to get attached to a property. But, stay clear-headed during negotiations. The right property at the right price will come along, be patient.

Finalising the Purchase

Once you’ve reached this stage, you’re almost at the finish line of owning your own home in Lagos.

However, there are still a few crucial steps to ensure everything goes smoothly.

Preparing the Contract of Sale

The contract of sale is a vital document that outlines the terms and conditions of your purchase.

It’s essential to review this document carefully with your lawyer to ensure all details are accurate and fair.

Make sure the contract includes:

- The agreed purchase price

- Payment terms and schedule

- Details of any fixtures and fittings included

Don’t hesitate to ask questions if anything seems unclear. Your lawyer is there to guide you through this process.

Securing Financing

If you’re not buying the property outright, securing financing is your next big step.

Here are some options to consider:

- Mortgage Loans: Banks and financial institutions offer these loans. They usually require a down payment.

- Renewed Hope Cities and Estates Programme: This initiative offers a straightforward path to home ownership for Nigerians without lobbying.

- Family Loans or Personal Savings: Sometimes, family help or personal savings can bridge the gap.

Completing the Transaction

Once you secure financing and sign the contract, it’s time to complete the transaction.

This involves:

- Paying any outstanding fees or taxes.

- Ensuring all legal documents are correctly signed and exchanged.

- Receiving all necessary title deeds and property documents.

Pro Tip: Buying is not just about signing papers. It’s about ensuring every detail is in order to avoid future headaches.

After these steps, the property is officially yours. Congratulations on your new home! The journey doesn’t end here. Now comes the joy of moving in and making the space truly yours.

Post-Purchase Considerations

Transferring Ownership

Once you’ve signed the dotted line and the keys are in your hand, the next big step is transferring ownership.

This isn’t just a formality; it’s a must-do to make sure the property is legally yours. Make sure all the necessary documents are filed with the local government authorities.

In Lagos, this usually involves obtaining the Governor’s consent and a Certificate of Occupancy.

Don’t skip this step; it’s crucial for securing your ownership rights.

Managing Ongoing Costs

Owning a home isn’t just about the purchase price. There are ongoing costs that you need to budget for. Think about property taxes, utility bills, and maintenance fees.

Here’s a quick list to keep in mind:

- Property Taxes: These are annual fees based on the value of your home.

- Utilities: Regular bills for water, electricity, and waste disposal.

- Maintenance: Costs for repairs and general upkeep.

Property Maintenance Tips

Keeping your new home in tip-top shape is all about regular maintenance.

Not only does it keep your place looking good, but it can also save you money in the long run by avoiding costly repairs.

Here are a few tips:

- Routine Inspections: Check for leaks and cracks. Fix minor issues before they become big problems.

- Seasonal Upkeep: Clean gutters, service your AC, and prepare your home for the rainy season.

- Professional Help: It’s best to call the pros for plumbing or electrical work.

Pro Tip: Owning a home is a journey, not a destination. Each step you take after buying your house is part of building a space that is truly yours. Embrace the process and enjoy the comfort of your new home.

Conclusion

Buying a house in Lagos isn’t just about finding a home. It’s also about making a smart investment for your future. It’s a journey that can be both thrilling and nerve-wracking.

From setting your budget to finally getting the keys, each step is crucial. It’s not just about the house. It’s also the neighbourhood, the paperwork, and the people you work with.

Take your time, do your research, and don’t rush into anything. With the right approach, you’ll not only find a house but a home that suits your lifestyle and needs.

Frequently Asked Questions

How much does it usually cost to buy a house in Lagos?

The cost of a house in Lagos can vary greatly. In fancy areas like Ikoyi or Victoria Island, it might be super expensive, but in other places, it could be more affordable.

What steps should I follow to purchase a house in Lagos?

To buy a house, you should decide on a budget and find a good real estate agent. After that, look at houses, make an offer, and do all the legal checks before buying.

Can foreigners buy property in Lagos?

Yes, foreigners can buy property in Lagos. But they must follow local laws, and it’s brilliant for them to get help from a lawyer to ensure they do everything right.

What types of houses can I find in Lagos?

You can find apartments, standalone houses, semi-detached homes, and even row houses in Lagos. There are also places for businesses, like offices and shops.

How can I pay for my house in Lagos?

You can use your savings, get a bank mortgage, or sometimes the property developer might offer a payment plan to help you buy the house.

What should I watch out for when buying a house in Lagos?

Be careful to check the house’s legal papers, be aware of any extra costs, take your time making decisions, and seek advice from experts like agents or lawyers.

Are there any extra costs after buying a house in Lagos?

Yes, keeping your house in good shape might involve ongoing costs, such as maintenance, taxes, and other fees.

Why is it important to have a lawyer when buying a house in Lagos?

A lawyer helps ensure that all the legal documents are correct and that you don’t fall into traps or scams during the buying process.