Lagos Real Estate Market 2025: Key Trends and Insights

by Bright Ugochukwu

Oct 25, 2024

The Lagos real estate market is vibrant and fast-changing. It offers both challenges and opportunities for investors and homebuyers.

As we enter 2025, it’s essential to know the trends, neighbourhoods, economic indicators, and challenges in this busy market.

This article sheds light on:

Key Takeaways

- Lagos is experiencing rapid population growth, which is driving demand for both luxury and affordable housing.

- Ikoyi and Victoria Island are still popular. But, Ajah and Ibeju-Lekki are gaining attention as new hotspots.

- GDP growth and foreign investment are essential for market dynamics.

- Challenges like housing shortages and bureaucratic issues impact the real estate landscape.

- Investors should focus on understanding market trends and government incentives for better decision-making.

Current Trends in the Lagos Real Estate Market

Understanding the latest trends in the Lagos real estate market is crucial for making informed decisions.

Let’s delve into the key factors shaping this dynamic industry.

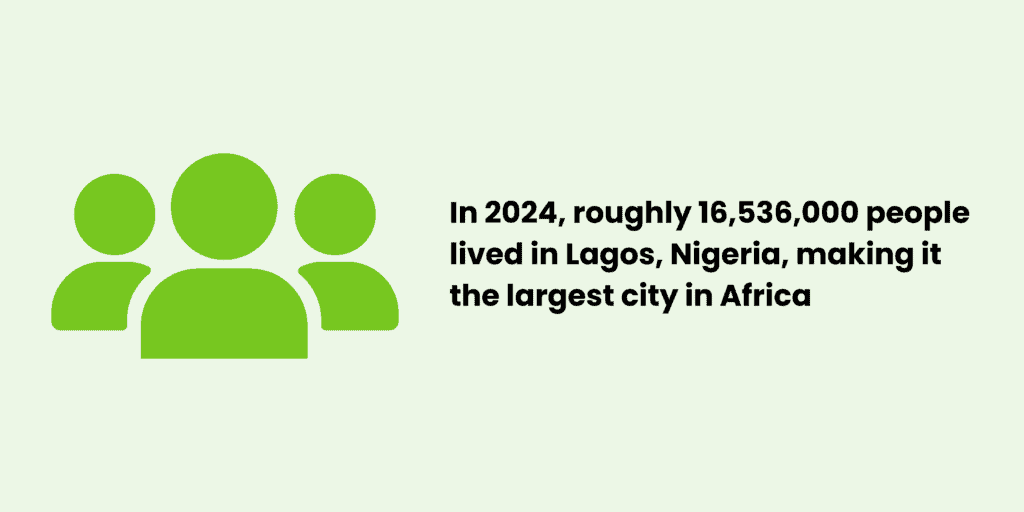

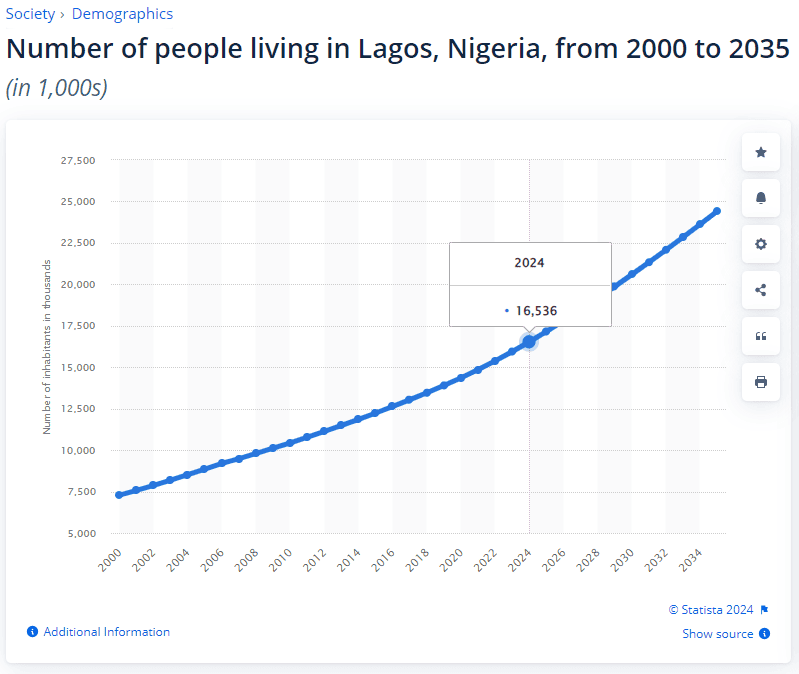

Population Growth and Urbanization

Lagos is experiencing rapid population growth, driving the demand for housing.

As more people move to the city, the need for both luxury and affordable homes increases. This urbanisation trend is reshaping the landscape of the real estate market.

Data Source: Statista

In 2024, roughly 16.536 million people lived in Lagos, Nigeria, making it the largest city in Africa.

Lagos’s population has been gradually increasing, with thousands of people flocking every year to the city, searching for job opportunities and a better life. By 2035, 24.4 million might be dwelling in the city.

Demand for Luxury vs. Affordable Housing

In Lagos, there is a noticeable divide in the housing market.

Luxury properties in Ikoyi and Victoria Island are in high demand. They often fetch premium prices.

On the other hand, buyers are flocking to newer areas, like Ajah and Ibeju-Lekki, for cheaper options. This creates a unique dynamic in pricing and availability across different areas.

The Growth Index of Lagos Real Estate Market

Using 2018 as the base year, the Price Growth Index shows varied, large increases in property prices across Lagos from 2019 to 2023.

Victoria Island, Ikoyi, and Banana Island show strong growth.

In 2023, Ogudu and Abraham Adesanya experienced significant growth, by 275.00% and 254.17%, respectively

| Area | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Victoria Island | 17.30% | 50.00% | 66.67% | 100.00% | 200.00% |

| Ikoyi | 23.97% | 34.99% | 79.06% | 134.16% | 203.03% |

| Banana Island | 12.50% | 25.00% | 175.00% | 200.00% | 225.00% |

| Lekki Phase 1 | 0.00% | 40.00% | 75.00% | 100.00% | 210.00% |

| Lekki Phase 2 | -5.94% | 1.02% | 64.29% | 103.06% | 129.59% |

| Opebi Allen | 4.17% | 8.33% | 16.67% | 33.33% | 108.33% |

| Adeniyi Jones | 25.00% | 25.00% | 29.17% | 108.33% | 150.00% |

| Ogba | 21.43% | 28.57% | 28.57% | 42.86% | 85.71% |

| Ikeja GRA | 3.64% | 7.57% | 30.91% | 41.09% | 100.00% |

| Maryland | 4.17% | 4.17% | 8.33% | 25.00% | 108.33% |

| Gbagada | 4.17% | 4.17% | 8.33% | 25.00% | 108.33% |

| Anthony | 4.17% | 4.17% | 8.33% | 25.00% | 108.33% |

| Yaba | 0.00% | 9.09% | 13.64% | 36.36% | 54.55% |

| Festac Town | 8.33% | 8.33% | 16.67% | 33.33% | 100.00% |

| Ogudu | 4.17% | 8.33% | 91.67% | 108.33% | 275.00% |

| Magodo GRA | 6.13% | -11.72% | 30.91% | 151.69% | 200.00% |

| Ikorodu | 8.00% | 20.00% | 40.00% | 52.00% | 180.00% |

| Apapa GRA | 8.33% | 8.33% | 12.50% | 16.67% | 108.33% |

| Sangotedo | 9.27% | 16.96% | 25.00% | 37.50% | 96.43% |

| Agungi | 10.95% | 14.48% | 78.95% | 86.47% | 184.21% |

| Abraham Adesanya | 31.12% | 61.21% | 108.33% | 182.14% | 254.17% |

Source: NIESV | Lagos State Branch

Impact of Government Policies

Government policies play a crucial role in shaping the real estate market.

Recent initiatives to improve infrastructure and ease land acquisition processes are expected to influence the market positively.

Pro Tip: Understanding the Lagos real estate market dynamics is essential for making informed investment decisions.

However, bureaucratic hurdles still pose challenges for many investors.

| Area | Average Price (Luxury) | Average Price (Affordable) |

|---|---|---|

| Ikoyi | ₦500M | N/A |

| Victoria Island | ₦450M | N/A |

| Ajah | N/A | ₦30M |

| Ibeju-Lekki | N/A | ₦25M |

In summary, the Lagos real estate market combines luxury and affordability.

It is shaped by population growth, government policies, and the city’s urbanisation. Investors should monitor these trends to navigate the market effectively.

Key Neighbourhoods to Watch Out For

As Lagos grows, some neighbourhoods are gaining popularity with investors and homebuyers.

Here are some key areas to keep an eye on:

Ikoyi and Victoria Island

Ikoyi is one of the most prestigious neighbourhoods in Lagos. It is known for its luxury homes and high-end apartments, which attract affluent residents and offer a vibrant lifestyle.

Victoria Island, adjacent to Ikoyi, is also a hub for business and entertainment, making it a prime location for living and investment.

Emerging Areas: Ajah and Ibeju-Lekki

Ajah and Ibeju-Lekki are gaining attention as emerging areas.

These neighbourhoods are known for:

- Affordable housing options.

- Proximity to new developments and infrastructure.

- Growing demand from young professionals and families.

Investment Opportunities in Ikeja

Ikeja, the capital of Lagos State, offers various investment opportunities.

It is known for:

- A mix of residential and commercial properties.

- Accessibility to major roads and the airport.

- A thriving business environment.

Pro Tip: Investing in these neighbourhoods can lead to significant returns as the demand for housing continues to rise in Lagos.

Whether you want luxury living in Ikoyi or affordable options in Ajah, Lagos has something for everyone. Keep these areas on your radar for potential investment and growth!

Economic Indicators Influencing the Market

Some of the economic indicators that influences the Lagos real estate market include:

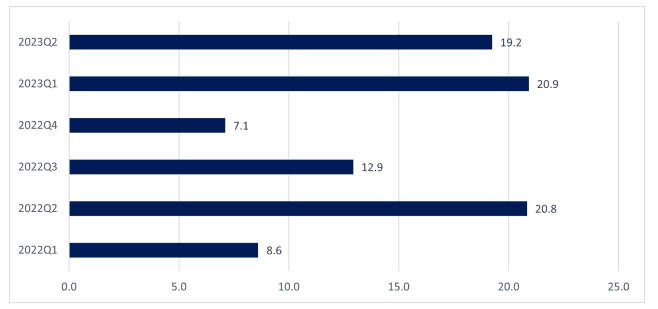

GDP Growth and Inflation Rates

Lagos’s economic health is closely tied to its GDP growth. More people can afford to invest in real estate when the economy is thriving.

Data Source: Lagos MEPB

Data from the Lagos State Bureau of Statistics (LBS) revealed that the economy grew by 20.9% (year-on-year) in Q1 2023, a big jump from 8.6% in the same period of 2022.

However, high inflation rates—officially at 33.95% in May—have led to a decline in consumer purchasing power, directly influencing the real estate market.

This means that while some areas may see growth, others may struggle due to rising costs.

Foreign Direct Investment

Foreign Direct Investment (FDI) plays a crucial role in shaping the Lagos real estate market.

Increased FDI can lead to:

- More development projects

- Job creation

- Enhanced infrastructure

These factors can raise demand for both residential and commercial properties, making Lagos an attractive spot for investors.

Impact of Oil Prices and Currency Devaluation

Oil price swings and currency devaluation can hit the real estate market hard.

When oil prices drop, it can lead to economic instability, affecting:

- Investor confidence

- Property values

- Overall market growth

Understanding these economic indicators is essential for anyone navigating the Lagos real estate market effectively.

Pro Tip: The interplay of these factors creates a complex landscape for investors, making it vital to stay informed and adaptable.

Challenges Facing the Lagos Real Estate Market

The Lagos real estate market is vibrant. But, it faces challenges that can impact investors and homebuyers.

Housing Deficit and Supply Constraints

The demand for housing in Lagos is soaring, yet the supply is struggling to keep up.

This housing deficit is primarily due to:

- Rapid population growth

- Insufficient infrastructure development

- Limited financing options for new projects

Bureaucratic Hurdles in Land Acquisition

Acquiring land in Lagos can be a complex process.

Many investors encounter:

- Lengthy approval processes.

- Confusing regulations.

- High costs associated with land transactions.

These bureaucratic challenges can deter potential investors and slow down development projects.

Financing and Investment Barriers

Access to financing remains a significant hurdle.

Many developers face:

- High-interest rates.

- Stringent lending criteria.

- Limited availability of mortgage options for buyers.

These barriers can restrict the growth of the real estate market and limit opportunities for both investors and homebuyers.

Pro Tip: The lack of enabling government laws and regulations can further complicate the landscape, making it essential for stakeholders to navigate these challenges carefully.

Investment Strategies for Success

Investing in Lagos real estate successfully requires strategic planning.

Align your investment goals with the right property types and neighbourhoods to maximise your returns.

Regardless of your focus—long-term rentals, flipping, or luxury developments—have a solid strategy. It will ensure your investments are well-positioned for growth.

Understanding Market Dynamics

Investing in the Lagos real estate market requires a clear understanding of its market dynamics. This means knowing the trends, demands, and challenges that shape the landscape.

Here are some key points to consider:

- Conduct Thorough Research: Understand the local market dynamics, property trends, and regulations before making any investment decisions.

- Build a Local Network: Connect with local real estate agents, investors, and other stakeholders to gain insights and find trustworthy partners.

- Leverage Data: Use data analytics to decide where and when to invest.

Identifying High-Growth Areas

Finding the right location is crucial for successful investments.

Here are some areas to watch in 2025:

- Ikoyi and Victoria Island: Known for luxury properties and high demand.

- Ajah and Ibeju-Lekki: Emerging areas with growth potential.

- Ikeja: Offers a mix of residential and commercial opportunities.

Leveraging Government Incentives

The Nigerian government often provides incentives for real estate investments.

Here’s how to take advantage of them:

- Stay updated on government policies that affect real estate.

- Look for grants or tax breaks available for property development.

- Engage with local authorities to understand the benefits you can access.

Pro Tip: Investing in Lagos real estate can be rewarding but requires careful planning and a strategic approach. Success comes from understanding the market and making informed choices.

Future Prospects for the Lagos Real Estate Market

Lagos’s real estate market is poised for growth.

As urbanization accelerates, investors can capitalize on residential, commercial, and luxury opportunities.

Government initiatives and technological advancements further enhance the market’s potential.

Technological Innovations in Real Estate

Technological advancements are set to transform the future of real estate in Lagos. These innovations will streamline processes and enhance the overall experience for buyers and sellers.

Key areas to watch include:

- Smart home technologies that improve energy efficiency.

- Virtual reality for property viewings, making it easier for potential buyers to explore homes remotely.

- Blockchain technology for secure and transparent transactions.

Sustainable and Green Building Practices

As the world grows more eco-conscious, Lagos is adopting green building practices.

This shift is crucial for:

- Reducing the carbon footprint of new developments.

- Attracting eco-conscious investors and buyers.

- Complying with international standards for construction.

Predictions for Market Growth

Looking ahead, the Lagos real estate market is expected to grow significantly. Factors contributing to this growth include:

- Population increase driving demand for housing.

- Continued foreign investment in the sector.

- Government initiatives aimed at improving infrastructure.

Pro Tip: The future of real estate investing in Nigeria is bright, driven by technological advancements and innovative approaches.

The Lagos real estate market is poised for exciting changes. Monitoring these trends, investors can position themselves for success in this dynamic environment.

Navigating Legal and Regulatory Frameworks

Land Ownership Laws

Knowing land ownership laws is important for anyone investing in Lagos real estate. In Nigeria, land can be owned in two main ways: statutory rights of occupancy and customary rights.

Here are some key points to consider:

- Statutory Rights: Governed by the Land Use Act, the state grants these rights and is usually more secure.

- Customary Rights: These are based on local customs and may vary significantly from one community to another.

- Documentation: Ensure the land title is properly documented to avoid future disputes.

Property Taxation Policies

Property taxes can significantly impact your investment returns.

Here are some important aspects:

- Annual Property Tax: Property owners are required to pay an annual tax based on the value of their property.

- Land Use Charge: This consolidated charge includes property tax and is assessed by the local government.

- Exemptions: Some properties may qualify for tax exemptions, so it’s wise to check with local authorities.

Regulatory Changes and Their Impact

The regulatory environment in Lagos is constantly evolving.

Here are some recent changes to be aware of:

- Streamlined Registration Process: Efforts are being made to simplify the property registration process, making it faster and more efficient.

- Increased Transparency: New regulations aim to enhance transparency in real estate transactions, reducing the risk of fraud.

- Government Incentives: Various incentives are being introduced to encourage investment in affordable housing.

Pro Tip: Understanding the legal frameworks and regulatory considerations for real estate investment in Nigeria is essential for success.

Staying informed about these laws and policies can help investors better navigate the Lagos real estate market and make informed decisions.

Conclusion

The Lagos real estate market in 2025 will offer opportunities and hurdles for those looking to invest, build, or buy homes.

Despite issues like high housing costs, Lagos attracts investors.

Its population, urban development, and economy are growing. To succeed in this market, you must understand supply and demand. Also, watch for price changes and economic signs.

As the city changes, all must adapt to new conditions and seize growth opportunities in this lively environment.

Frequently Asked Questions

What are the main factors driving the Lagos real estate market in 2025?

The Lagos real estate market in 2025 will be influenced by population growth, urban expansion, and a rising demand for luxury and affordable housing.

Which neighbourhoods are expected to see the most growth this year?

Areas like Ikoyi and Victoria Island remain popular while emerging spots such as Ajah and Ibeju-Lekki are gaining attention for investment.

How do economic conditions affect real estate prices in Lagos?

Economic factors like GDP growth, inflation, and foreign investment play a significant role in shaping property values in Lagos.

What challenges do investors face in the Lagos real estate market?

Investors often encounter issues such as a housing shortage, bureaucratic delays in land acquisition, and difficulties securing financing.

What strategies can help investors succeed in Lagos real estate?

Successful investors should understand market trends, identify areas with growth potential, and take advantage of government incentives.

What does the future hold for the Lagos real estate market?

The market is expected to continue evolving, driven by technological advancements, a focus on sustainable building practices, and opportunities for growth.