- Home

- Real Estate Investing

- Real Estate Investing vs. REITs

Real Estate Investing vs. REITs: Which Wins for Your Portfolio? (2025)

by Bright Ugochukwu

Last Updated: Jun 25, 2025

Real estate is one of the most popular ways to build wealth. I mean— that’s NO news.

However, when it comes to how you invest, there’s a big decision to make: Should you buy a physical property and play landlord, or invest in REITs and let others do the work?

Quick Answer: Choose direct real estate investing if you want control, tax benefits, and hands-on involvement. Otherwise, choose REITs if you prefer passive income, diversification, and low capital entry. A hybrid approach combining BOTH is also effective.

Both can make you money—but one might be far better for your wallet, time, and sanity.

Here’s a table summarising the key differences between Direct Real Estate Investing and REITs:

| Criteria | Direct Real Estate Investing | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Ownership | You own physical property | You own shares in a real estate company |

| Control | Full control over property, tenants, and decisions | No control over properties or management |

| Capital Requirement | High (₦10M–₦150M+ depending on location) | Low (₦50k–₦100k to start) |

| Risk Exposure | High concentration risk (one property/location) | Lower risk via diversification across sectors/properties |

| Management | Active involvement (repairs, tenants, legal) | Passive; professionally managed |

| Liquidity | Illiquid (selling takes time) | Highly liquid (can sell shares instantly) |

| Income Potential | Rental income (may fluctuate) | Consistent dividends (90% of profits mandated) |

| Appreciation | Property value and equity buildup over time | Share price growth + dividend reinvestment |

| Tax Benefits | Depreciation, mortgage interest deductions (in some countries) | Dividends taxed as regular income |

| Best For | Hands-on investors with capital and long-term goals | Passive investors seeking diversification and steady income |

This table provides a concise comparison for anyone deciding between Real Estate Investing vs. REITs.

This guide will help you understand both sides—Direct Real Estate Investing vs. REITs—so you can confidently decide what’s best for your goals.

Here, we’ll cover topics, including:

Understanding the Basics: What’s the Difference?

Before diving into numbers and strategies, let’s define the two options:

Direct Real Estate Investing Explained

Direct investing means buying and owning physical properties yourself. You handle the strategy, management, and profit.

Examples:

- Single-family homes

- Duplexes and flats

- Commercial buildings

- Shortlet or vacation rentals

- Bare land (for flipping or future development)

Pro Tip: If you’re investing in Lagos, look for properties near major roads, schools, and upcoming infrastructure—these locations tend to appreciate faster than other areas due to high demand.

REITs (Real Estate Investment Trusts) Explained

REITs are companies that own or finance income-producing properties. You invest by buying shares, just like a stock.

Examples:

- Publicly traded REITs: e.g., Vanguard Real Estate ETF (VNQ), accessible via stock exchanges.

- Private REITs: Offered through firms or funds with specific entry requirements.

Vanguard Real Estate Index Fund ETF – 25 June 2025

Key Comparison: Direct Investing vs. REITs

Here’s where things get interesting. Let’s break down the head-to-head comparisons.

| Criteria | Direct Real Estate Investing | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Control & Flexibility | Full control over assets, tenants, and strategy | Passive; NO control over properties |

| Capital Requirements | High upfront cost (₦50M+ for Lagos properties) | Low entry (₦50k–₦100k for shares) |

| Risk & Diversification | High risk (single location/property) | Broad diversification across assets and sectors |

| Liquidity | Low (property sales take months/years) | High (buy/sell like stocks instantly) |

Table 1: A Comparison Table Showing the Key Differences between Real Estate Investing vs. REITs

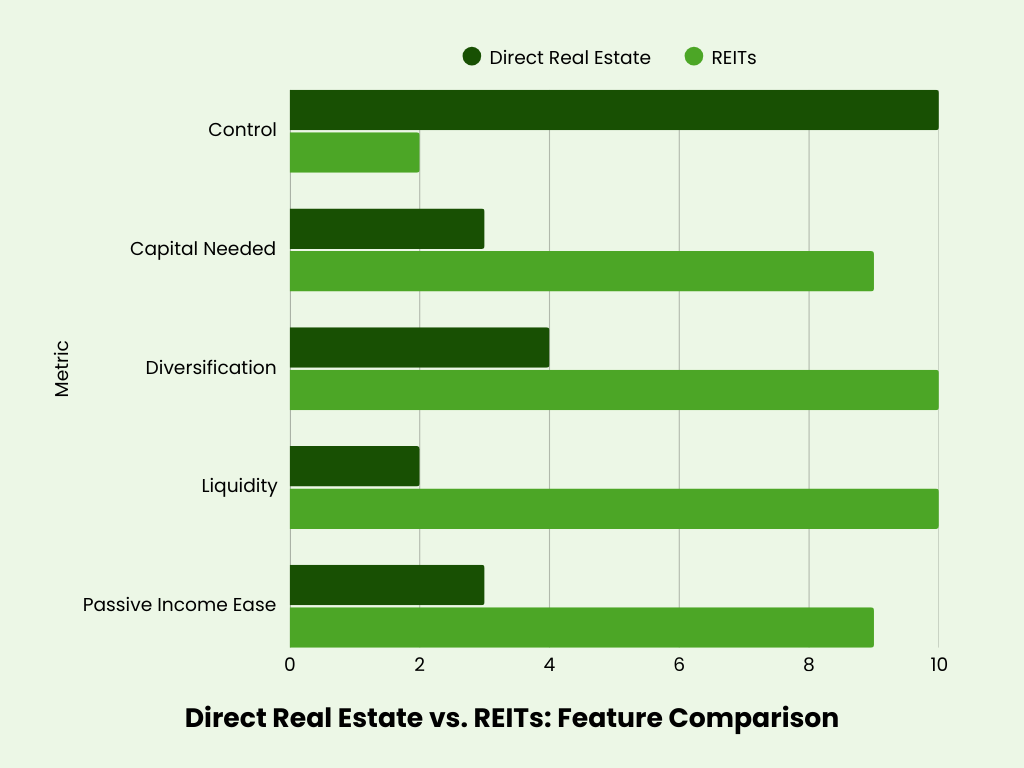

Control & Flexibility

Direct:

- You choose what to buy, where to buy, and how to manage.

- Want to renovate or flip? That’s your call.

REITs:

- 100% passive. You have no control over specific properties.

- Great for hands-off investors.

Capital Requirements & Accessibility

Direct:

- You’ll need BIG upfront capital.

- In Lagos, a decent 3-bedroom flat in Lekki might cost ₦110M to ₦210M.

- Ongoing costs: repairs, legal fees, taxes.

REITs:

- You can start with as little as ₦50,000 to ₦100,000, depending on the platform.

- No closing costs, agents, or tenants.

Pro Tip: Can’t afford a full property? Consider joint ventures or real estate cooperatives in Nigeria to pool funds and start investing directly.

Risk & Diversification

Direct:

- High concentration risk. One bad tenant or market crash = major losses.

- Your investment is tied to one location or asset.

REITs:

- REITs own hundreds of properties across different cities or sectors.

- This spreads your risk effortlessly.

Liquidity & Ease of Exit

Direct:

- Selling a property can take months or more in Nigeria.

- Finding serious buyers, legal processing, and closing delays.

REITs:

- You can sell your shares in minutes on the stock market.

- It’s as liquid as selling your stocks.

Financial Performance: Which Offers Better Returns?

Now let’s talk about money—how much you can expect to earn.

| Factor | Direct Investing | REITs |

|---|---|---|

| Income Type | Rental income (varies by tenant & location) | Dividend income (90% of profits paid out) |

| Consistency | Can be irregular (vacancies, repairs) | More predictable (quarterly/semi-annual payouts) |

| Appreciation | Property value increases + equity build-up | Share price increases over time |

| Tax Benefits | Mortgage interest, depreciation, expense write-offs | Dividends taxed as regular income (no deductions) |

Table 2: A Table Summarising the Income Potential & Tax Advantages

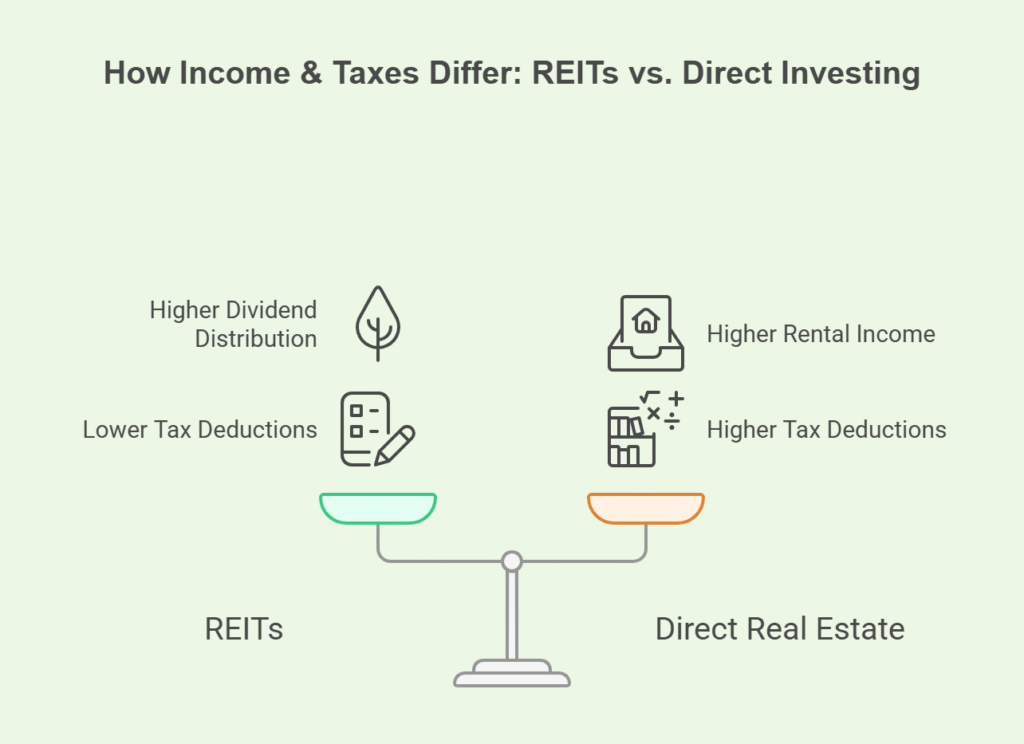

Income Potential (Cash Flow & Dividends)

Direct:

- Rental income is often higher per unit, especially in high-demand areas like Lekki or Victoria Island.

- But income can be inconsistent due to vacancies, maintenance, or late payments.

REITs:

- Most REITs pay out 90% of their taxable income as dividends.

- Though smaller per share, it’s consistent and predictable.

Pro Tip: In Nigeria, short-let rentals (like Airbnb in Lekki, Victoria Island or Ikoyi) can offer higher cash flow than long-term tenants, but they also require active management.

Appreciation & Tax Benefits

Direct:

- Properties appreciate over time, especially in urban Lagos zones.

- Plus, there are tax deductions: depreciation, mortgage interest, repairs.

REITs:

- You get growth via share price increases.

- But dividends are taxed as regular income, and there are no Nigerian tax shields.

Who Should Choose Direct Investing?

Ideal For:

- Hands-on Investors

You like making decisions, inspecting properties, and being involved. You’re a natural negotiator (love haggling prices or lease terms). You want creative freedom (e.g., convert a Lagos warehouse to co-living spaces).

- Investors with Capital

You have funds for down payments, renovations, and tenant onboarding. You aim for generational wealth (physical assets > paper shares). You see hidden potential (e.g., buying distressed Lekki properties to flip).

- Tax-Savvy Individuals

You want to reduce taxable income via property-related deductions. You own a business (e.g., rent office space to your own company).

Who Should Choose REITs?

Ideal For:

- Passive Investors

You have a busy schedule or simply prefer not to deal with tenants. You live abroad but want Nigerian real estate exposure. You hate hands-on management but love steady dividends.

- Low-Capital Investors

You want exposure to real estate with just ₦50k or ₦100k. You’re a young professional building capital. You prefer liquidity (sell shares anytime vs. waiting months to offload a house).

- Stock Market Enthusiasts

You’re comfortable with trading shares, following REIT performance, and monitoring portfolios. You want exposure to prime properties (like Ikoyi offices) without buying them outright.

Pro Tip: You can buy REITs through Nigerian investment apps like Risevest, Chaka, Afrinvest or Bamboo—they make it easy to get started with global real estate exposure.

Hybrid Strategy: Can You Combine Both?

Absolutely.

Many smart investors blend direct real estate and REITs to balance the pros and cons.

Use REITs to Hedge Risk

While managing a property in Lekki, you can invest in REITs for instant diversification.

Case Study:

An investor allocates:

- 50% into a duplex in Ajah (for long-term rental income)

- 50% into REITs (for liquidity and dividends)

This gives you monthly cash flow, property appreciation, and stock market liquidity.

Pro Tip: A good starting strategy: invest in REITs to build cash flow while saving up for your first property. Let your REIT dividends grow your capital.

Bottom Line: Which Is Right for You?

Still unsure? That’s not a problem.

Ask yourself:

- Do I want full control or a hands-off approach?

- Can I tie up large capital for years?

- Do I prefer predictable income or scalable returns?

Whichever you choose, investing in real estate is a powerful wealth-building tool. Start where you are and grow smartly.

Final Thoughts

Both Direct Real Estate Investing and REITs offer great benefits. The key is to align your choice with your goals, capital, and risk appetite.

Need expert advice on investing in Lagos properties or finding high-performing REITs? Contact Oparah Realty for personalised real estate investment guidance.

You do NOT have to pick just one. Start small. Learn. Then scale. That’s how wealth is built.

FAQs on Real Estate Investing vs. REITs

Why are REITs not popular with some investors?

REITs may seem less attractive because they offer less control, can be affected by market volatility, and dividends are taxed as regular income, reducing after-tax returns.

Additionally, some investors prefer tangible assets they can manage directly.

What is the difference between a REIT and a real estate fund?

REITs invest in income-producing properties and pay out 90% of profits as dividends.

Real estate funds (like mutual funds or private equity) may invest in REITs or property companies and typically focus more on capital appreciation with less frequent income payouts.

Do REITs beat the market?

Historically, some REITs have outperformed the market, especially in high-interest environments, but not consistently.

Their performance depends on property sectors, management, and market cycles. They’re best seen as a diversification tool, not a guaranteed market beater.

What is a disadvantage of REITs?

A key disadvantage is limited control—you can’t choose or influence the properties within the portfolio.

Also, dividends are taxed as regular income, and prices can be volatile like stocks, even if the underlying properties are stable.