Real Estate Syndication: Everything You Need to Know

by Bright Ugochukwu

Feb 28, 2025

Real estate syndication may sound fancy, but it’s simply people joining forces to invest in properties they can’t afford alone.

Imagine wanting to buy a big apartment but not having the cash to do it solo.

That’s where syndication comes in.

Regular investors can partner to invest in real estate. This way, they avoid the stress of managing properties independently and enjoy the benefits of property investment without all the hard work.

Like any investment, it carries risks. If you’re curious about how it all works, stick around, and we’ll explain it to you.

Takeaways

- Real estate syndication allows multiple investors to pool funds for larger properties.

- It provides a way for investors to gain access to real estate markets without direct property management.

- Syndications often involve a sponsor who manages the investment and investors who provide capital.

- Investors can potentially earn high returns but face risks such as market fluctuations.

- Understanding the legal and financial aspects is crucial before committing to a syndication deal.

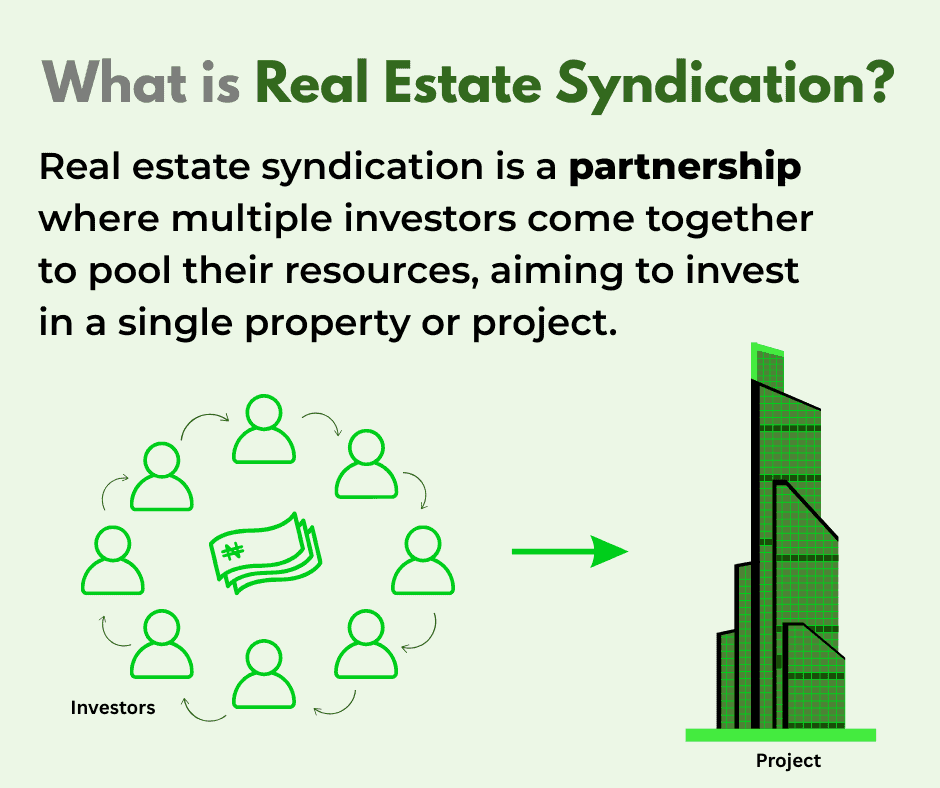

What is Real Estate Syndication?

Real estate syndication is all about collaboration. It’s a partnership where multiple investors come together to pool their resources, aiming to invest in a single property or project.

This approach allows individuals to participate in larger real estate deals, like hotels or apartment blocks, than they could manage alone.

The key idea here is shared risk and reward.

Investors can access opportunities needing large amounts of capital when they team up, which may be too big for individual investors.

Key Concepts of Real Estate Syndication

In a typical syndication, there are two main parties involved: the sponsor and the investors.

The sponsor, often referred to as the general partner, is responsible for managing the investment. They handle everything from finding the property to overseeing its management.

Meanwhile, the investors, or limited partners, provide the bulk of the capital needed. They enjoy the benefits of the investment without the hassle of day-to-day management.

Historical Evolution and Modern Practises

Real Estate Syndication has come a long way.

Historically, it was a niche investment strategy, often limited to private solicitations or those who could afford to register with the SEC.

However, things changed with the JOBS Act of 2012. This legislation opened the doors to a broader range of investors by allowing syndications to raise capital through crowdfunding, provided the investors are accredited. This means having a certain level of income or net worth.

Today, real estate syndication is a popular way to invest, especially for those looking to diversify their portfolios without directly owning property. It’s not uncommon to see syndications funding everything from residential complexes to commercial buildings, all thanks to the relaxed rules around raising capital.

Role of Sponsors and Investors

In real estate syndication, the sponsor plays a pivotal role. They identify investment opportunities, negotiate deals, and manage the property.

Essentially, they do the heavy lifting, ensuring the investment runs smoothly. Sponsors also contribute their own funds and often secure loans to cover a significant portion of the investment.

On the other hand, investors are usually more passive.

They provide the necessary capital and, in return, receive a share of the profits. This setup is particularly appealing to those who want to invest in real estate without the direct responsibilities of property management.

Pro Tip: Real estate syndication offers a unique blend of opportunity and convenience. It allows investors to benefit from real estate’s potential without the headaches of direct ownership.

The Investment Process in Real Estate Syndication

Steps to Invest in a Syndication

Investing in real estate syndication can be rewarding if you know the ropes.

Here’s a simple breakdown of the steps involved:

- Identify Your Investment Goals: Before diving in, determine what you want from your investment. Are you looking for long-term growth, steady income, or something else?

- Find a Sponsor: Look for a reputable sponsor with a solid track record. The sponsor manages the deal and guides the investment.

- Review the Deal: Once a deal is on the table, you will get an investment summary. This document outlines the property details, expected returns, and potential risks.

- Reserve Your Spot: If the deal interests you, submit a soft reserve indicating how much you wish to invest.

- Attend a Webinar: Sponsors often hold webinars to explain the deal further and answer any questions.

- Sign the Paperwork: If you decide to proceed, you’ll sign a Private Placement Memorandum (PPM) and a subscription agreement.

- Transfer Funds: Finally, wire your investment amount to the sponsor.

Legal and Financial Considerations

Investing in syndication involves more than just money; there are legal and financial aspects to consider:

- Legal Documents: Familiarise yourself with key documents like the PPM and operating agreements. These outline your rights and responsibilities.

- Accreditation: Often, you need to be an accredited investor, meaning you meet certain income or net worth criteria.

- Tax Implications: Understand the tax benefits and obligations. Syndications often offer pass-through tax advantages.

Common Challenges and Solutions

Every investment comes with its hurdles. Here are some common challenges in real estate syndication and how to tackle them:

- Market Fluctuations: Real estate markets can be unpredictable. Diversify your investments to spread risk.

- Sponsor Reliability: Not all sponsors are created equal. Do thorough due diligence to ensure your sponsor is trustworthy.

- Liquidity Issues: Syndications are generally illiquid. Be prepared to have your money tied up for several years.

Pro Tip: Investing in real estate syndication requires patience and a keen eye for detail. Knowing the process and its pitfalls can help you make smart decisions that align with your financial goals.

Benefits and Risks of Real Estate Syndication

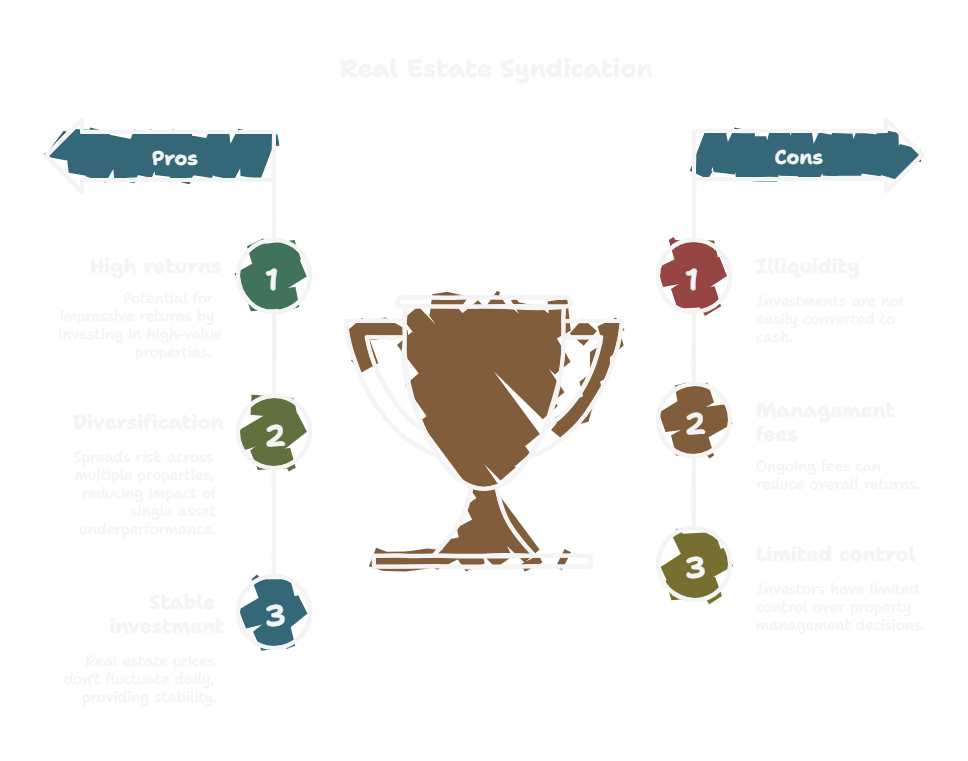

Potential Returns and Diversification

Real estate syndication offers a unique opportunity to tap into institutional-grade properties that might otherwise be out of reach for individual investors.

Investors can access high-value assets by pooling resources, potentially yielding impressive returns.

The allure of syndication lies in its ability to provide both high-return potential and portfolio diversification.

Unlike the stock market, real estate prices don’t fluctuate daily, making it a stable addition to an investment strategy. Syndication allows investors to spread their risk across multiple properties, reducing the impact of any single asset’s underperformance.

Risk Factors and Mitigation Strategies

While the potential for high returns is appealing, it’s important to acknowledge the risks involved.

Syndicated real estate investments are usually illiquid, meaning your money stays tied up for the entire investment period. This lack of liquidity can be a significant drawback if you need to access your funds quickly.

Furthermore, the performance of the investment is often tied to a single asset, increasing the risk of loss if the property underperforms.

To mitigate these risks, investors should conduct thorough due diligence, assess the experience of the syndicate sponsor, and diversify their investments across multiple syndications.

Comparing Syndication with Other Investments

Syndication offers a middle ground compared to other investment vehicles like REITs or direct property ownership.

Unlike REITs, which offer liquidity but less control, syndication allows for greater involvement in decision-making.

Direct ownership provides control but comes with the burden of management. Syndication strikes a balance, offering professional management without the day-to-day responsibilities.

Pro Tip: Real estate syndication can be a powerful tool for building wealth, but it has its challenges. Balancing the potential for high returns with the inherent risks requires careful planning and informed decision-making.

Understanding these benefits and risks is crucial for those looking to diversify their portfolio with real estate syndications.

Legal and Regulatory Aspects of Syndication

SEC Registration and Exemptions

When engaging in real estate syndication, understanding the legal landscape is crucial.

One of the main aspects is dealing with the Securities and Exchange Commission (SEC).

However, thanks to a range of exemptions, most syndicators don’t need to register with the SEC. These exemptions allow companies to offer and sell securities without the formal registration process, providing flexibility while ensuring compliance with securities laws.

Some common exemptions include Regulation D, Rule 506(b.), and Rule 506(c.), which cater to different investor types and offer scenarios.

However, it’s important to note that compliance with other securities laws, such as anti-fraud provisions, is mandatory even if registration isn’t required.

Legal Structures and Agreements

Choosing the proper legal structure is vital for any syndication.

Limited Liability Companies (LLCs) and Limited Partnerships (LPs) are popular choices because they offer flexibility and liability protection.

In an LLC, the syndicator acts as the general partner, while investors are limited partners. This setup allows investors to enjoy profits without being involved in day-to-day management.

Legal agreements should clearly outline the rights and responsibilities of each party involved, ensuring transparency and reducing potential conflicts.

Role of Accredited Investors

Accredited investors play a significant role in real estate syndication.

These individuals or entities meet specific financial criteria set by the SEC, allowing them to invest in more complex and risky offerings.

Accredited investors can simplify the regulatory process. Certain SEC exemptions, such as Rule 506(c.), are designed specifically for them.

This can make raising capital more straightforward for syndicators, as they can focus on a smaller, financially sophisticated group.

How to Start Your Own Real Estate Syndicate

Identifying and Evaluating Properties

Finding the right property is the first big step in starting your real estate syndicate.

You need to look for properties that meet your investment goals and have the potential for a good return. Start by researching the market to understand current trends and property values.

Here are a few ways to find promising properties:

- Network with real estate agents who have access to off-market deals.

- Use online platforms that list commercial properties.

- Attend real estate auctions and industry events.

After finding potential properties, check them for location, price, and growth potential. Performing due diligence is essential to ensure the property is a sound investment.

Raising Capital and Forming Partnerships

After selecting a property, the next step is to gather the necessary funds.

In a syndicate, you’ll pool money from multiple investors. This is where forming partnerships becomes crucial.

You need to connect with investors who are interested in real estate syndication and present them with a compelling investment proposal.

- Create a detailed business plan outlining the investment opportunity.

- Prepare a Private Placement Memorandum (PPM) to inform potential investors about the investment.

- Engage with potential investors through meetings and presentations.

The PPM should include all details about the property, the syndication team, expected returns, and risks involved.

Managing and Exiting the Investment

Effective management is key to ensuring a successful investment once the funds are secured and the property is acquired. You’ll need to oversee the property’s operations, maintenance, and any renovations or improvements.

- Hire a property management company if necessary.

- Regularly review financial reports to track the investment’s performance.

- Communicate with investors about the property’s status and financial health.

Eventually, you’ll need to plan for an exit strategy. This could involve selling or refinancing the property to return capital to investors. Planning your initial exit strategy is important to maximise returns and ensure a smooth transition.

Pro Tip: Starting a real estate syndicate requires careful planning, collaboration, and management. Pooling resources and expertise allows you to take on bigger projects, which can lead to better returns than investing alone.

Tax Implications and Financial Benefits

Depreciation and Tax Deductions

Regarding real estate syndication, one of the big perks is the tax benefits.

Depreciation deductions play a major role here. They let you reduce your taxable income, which means you pay less tax.

Imagine owning a property that wears out over time. The tax system lets you write off this wear and tear as an expense. It’s like saying, “Hey, my property’s getting older, so I shouldn’t have to pay as much tax on it.”

Here’s a quick snapshot of how depreciation works:

- Property Value: The initial cost of the property.

- Useful Life: The number of years the property is expected to be usable.

- Annual Depreciation: Property Value divided by Useful Life.

1031 Exchanges and Capital Gains

Another cool thing is the 1031 exchange.

This rule allows you to sell one property and buy another without immediately paying capital gains tax.

It’s like swapping one property for another and deferring the tax bill. But remember, the new property has to be similar in nature and value.

Here’s how a 1031 exchange works:

- Sell your property.

- Identify a new property within 45 days.

- Close on the new property within 180 days.

This can be a game-changer for investors looking to grow their portfolios without a hefty tax bill.

Pass-Through Tax Deductions

Real estate syndications often operate as partnerships or LLCs. This means they can benefit from pass-through taxation.

Basically, the income “passes through” the entity to the individual investors, who then pay tax on it.

The good news?

Thanks to the Qualified Business Income Deduction, you can deduct up to 20% of this income

Pro Tip: Investing in real estate syndications can be smart for those looking to maximise their returns while enjoying some tax advantages. It’s not just about the potential profits; it’s also about keeping more of what you earn by leveraging these tax benefits.

These tax perks can significantly boost your overall financial returns in real estate syndications, making it an attractive option for savvy investors.

Real Estate Syndication vs. Other Investment Vehicles

Differences Between Syndication and REITs

Real estate syndication and Real Estate Investment Trusts (REITs) are popular ways to invest in property, but they operate quite differently.

Syndication involves a group of investors pooling their money to buy or develop property. It is often managed by a sponsor who handles the day-to-day operations.

In contrast, REITs are companies that own and manage real estate assets, and their shares are traded on public stock exchanges.

Here’s a quick comparison:

| Feature | Real Estate Syndication | REITS |

|---|---|---|

| Liquidity | Low | High |

| Control | Limited influence | No influence |

| Minimum investment | Typically high | Usually low |

| Income | Variable, project-based | More stable, dividend-based |

One of the key benefits of public REITs is their liquidity; you can buy and sell shares like stocks. Syndication, however, often locks your money for several years until the property is sold or refinanced.

Crowdfunding as a Form of Syndication

With the rise of technology, real estate crowdfunding has become a popular way to participate in syndication.

Platforms like EquityMultiple allow individual investors to access deals that were once only available to large institutions. Crowdfunding acts as a bridge, connecting sponsors with a broader pool of investors.

Benefits of real estate crowdfunding include:

- Lower investment minimums

- Access to a variety of property types

- Opportunity to diversify across multiple deals

However, crowdfunding platforms offer easier access but also carry risks, such as platform reliability and deal transparency.

Liquidity and Investment Horizon

Syndication is less flexible than other investment vehicles when it comes to liquidity.

Once you invest in a syndicate, your capital is typically tied up for the entire project duration, ranging from a few years to over a decade. This illiquidity can be a significant drawback if you need quick access to your funds.

But, REITs and crowdfunding platforms generally offer more liquidity, allowing you to sell shares or interests more easily. However, this comes with trade-offs, like potentially lower returns compared to a successful syndication deal.

Pro Tip: Real estate syndication offers a unique blend of potential high returns and direct property ownership, but it’s not for everyone. Consider your financial goals and risk tolerance before diving in.

Conclusion

Real estate syndication may seem complicated at first, but it’s really a way for people to join forces and invest in property together.

It’s like pooling your money with friends to buy something big that you couldn’t afford by yourself.

Sure, there are risks, just like with any investment, but the potential rewards can be pretty sweet. You get to be part of something bigger without the hassle of managing a property day-to-day.

So, if you’re looking to dip your toes into real estate without diving in headfirst, syndication could be worth a look. Make sure you know what you’re getting into and chat with a financial advisor to see if it’s a good fit for you.

FAQs

Who can invest in real estate syndication?

Usually, only people who earn a lot of money each year or have a high net worth can invest in real estate syndication. These people are called accredited investors.

How do investors make money from real estate syndication?

Investors make money through profits from the property, like rent, or by selling the property for more than it cost to buy. They get a share of these profits based on how much they invested.

What are the risks of investing in real estate syndication?

The main risk is that the property might not earn as much money as expected or even lose money. This means investors might not receive all the money they invested.

How is real estate syndication different from REITs?

Real estate syndication usually involves buying one big property, while REITs (Real Estate Investment Trusts) own many properties. Syndication might involve more risk but can offer higher returns.

Can I sell my share in a real estate syndicate easily?

No, it’s usually hard to sell your share before the investment ends, which can take several years. You need to be okay with not having access to your money for a while.