Why Is Real Estate in Lagos So Expensive? (2025 Insights)

by Bright Ugochukwu

Dec 3, 2024

Lagos State is the commercial hub of Nigeria, a city that promises opportunity and progress.

But one question echoes among investors and residents…

Why is real estate in Lagos expensive? Like, why?

With soaring prices, limited supply, and ever-increasing demand, Lagos’ real estate market feels like a puzzle few can solve.

Today, we will uncover the reasons behind these soaring prices.

We’ll explore topics, involving:

- Economy

- Market Dynamics

- Building Costs

- Policy Influence

- Location

- Financial Hurdles

- Historical Trends

- Smart Solutions

…and lots more.

Key Takeaways

- Foreign exchange rate fluctuations significantly increase the cost of construction materials, making real estate prices in Lagos steep.

- High interest rates further elevate financing costs for developers, which are passed on to buyers.

- Lagos State has a 2.3 million housing deficit, which creates intense competition for limited housing stock.

- Prime locations like Ikoyi command premium prices due to proximity to business hubs, infrastructure, and exclusivity.

- The absence of robust mortgage systems and affordable housing policies makes it difficult for middle-income buyers to enter the market.

- Investors hoarding land and engaging in speculation distort the real estate market, pushing prices beyond reach for many buyers.

Economic Factors

Foreign Exchange Rate Fluctuations

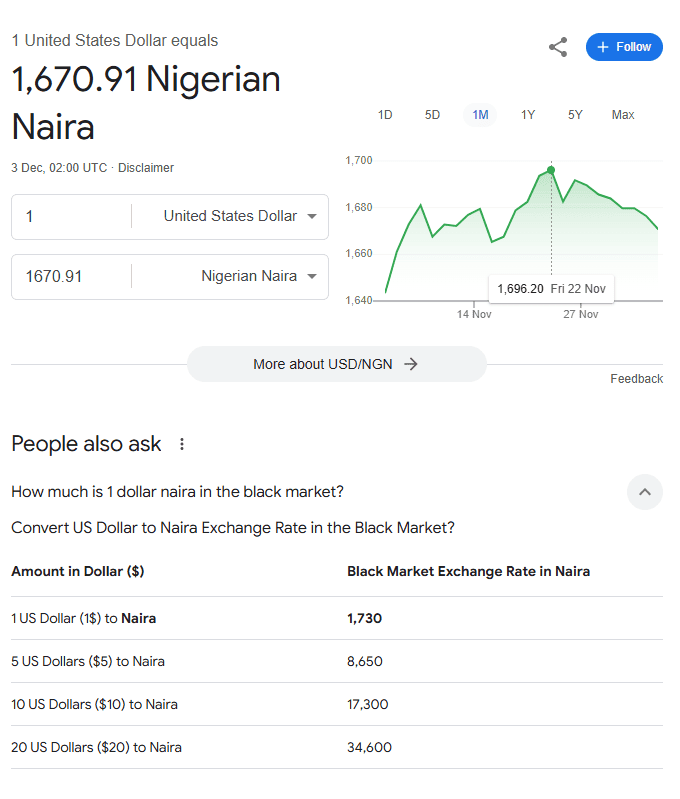

The volatility of Nigeria’s naira directly impacts real estate prices.

As of December 2nd, 2024, the official exchange rate is ₦1,670.91 to $1. However, on the black market, the exchange rate is approximately ₦1,730.00 to $1.

Developers using imported materials for finishes face higher costs when the naira falls against major currencies.

For instance, due to exchange rate fluctuations, construction costs have tripled in the past two years, significantly driving up property prices.

High Interest Rates

Financing construction in Lagos is challenging.

High interest rates, often exceeding 20%, make borrowing expensive for developers.

These costs inevitably get passed on to buyers, making properties less affordable for the average Lagosian.

Wage and Inflation Growth vs. Home-Value Growth

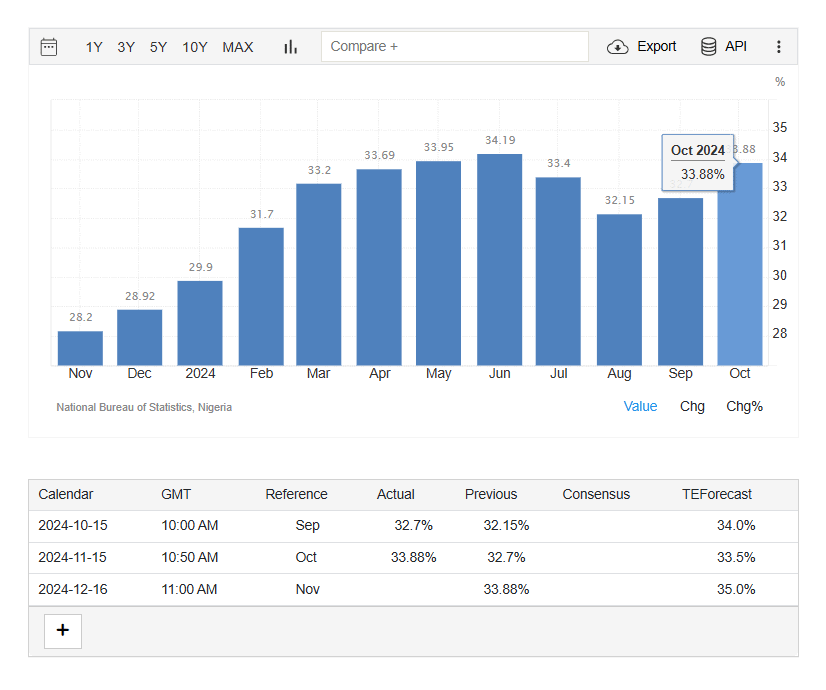

Inflation in Nigeria surpasses 20%, while wages remain stagnant.

Nigeria’s inflation rate rose for the second straight month in October 2024, climbing to a four-month high of 33.9% from 32.7% in September.

The rise was driven primarily by escalating food prices, soaring energy costs and ongoing volatility in foreign exchange markets.

In comparison, housing and utilities inflation rose to 28.8%, up from 28.6% in September amid higher electricity tariffs. On a monthly basis, consumer prices climbed by 2.6% after a 2.5% rise in the previous month.

This disparity exacerbates the affordability crisis.

Meanwhile, property values are rising faster than incomes, pricing many potential homeowners out of the market.

Lack of Affordable Housing Policies

Government interventions in the real estate sector have been minimal.

Unlike agriculture and manufacturing, real estate lacks subsidized loan schemes. This forces developers to self-finance projects, which inflates costs.

Market Dynamics

Supply and Demand

Lagos’ population of over 20 million creates an unrelenting demand for housing. With a 2.3 million housing deficit, competition for available homes pushes prices higher.

In prime areas like Lekki and Ikoyi, demand often exceeds supply. So, prices remain sky-high.

Underserved Housing Demand

Most properties cater to high-income earners, leaving middle and lower-income buyers underserved. This segmentation fuels demand in luxury markets while neglecting the broader population.

Pro Tip:Invest in areas with emerging developments to capitalize on lower prices before demand peaks.

Excessive Speculation and Hikes in Land Prices

Real estate in Lagos has become a speculative asset. Investors hoard land, betting on future value increases.

This practice not only inflates current land prices but also stifles new developments.

Speculation and Investment

Lagos’ reputation as Nigeria’s commercial hub makes it attractive to foreign and local investors.

However, speculative buying distorts market values, creating artificially high price points.

Source: The KK Show – Key to Keys

Structural and Development Costs

Construction Cost and Land Price

Construction costs in Lagos have soared, and the price of materials like cement and steel has risen significantly.

For instance, steel rod prices jumped from ₦500,000.00 per ton to over ₦1.4 million in just three months. Combine this with high land acquisition costs, and it’s easy to see why real estate prices remain unaffordable for many.

Cost of Building Materials

The reliance on imported materials subjects developers to exchange rate risks, leading to sudden cost increases.

As of now, a cement bag that costs ₦3,000.00 now retails for ₦8,000.00 because “one man says so”, further compounding the affordability issue.

Existing or Developed Estate

Properties within established estates often command higher prices due to their amenities, security, and strategic location. These estates provide value but remain out of reach for middle-income buyers.

| Material | Price (Jul 2024) | Price (Nov 2024) | % Increase |

|---|---|---|---|

| Reinforcement Iron | ₦480,000/ton | ₦1,400,000/ton | 600% |

| Cement | ₦4,800/bag | ₦8,000/bag | 66.67% |

| Building Sand (per load) | ₦15,000.00 | ₦45,000.00 | 200% |

Table Showing the Rising Costs of Construction Materials

Government and Policy Impacts

Government Presence

Lagos benefits from big government investment. But, it often prioritizes infrastructure over affordable housing.

So, while road networks improve, policies to lower construction costs still need to be made.

Lack of Mortgage Facilities

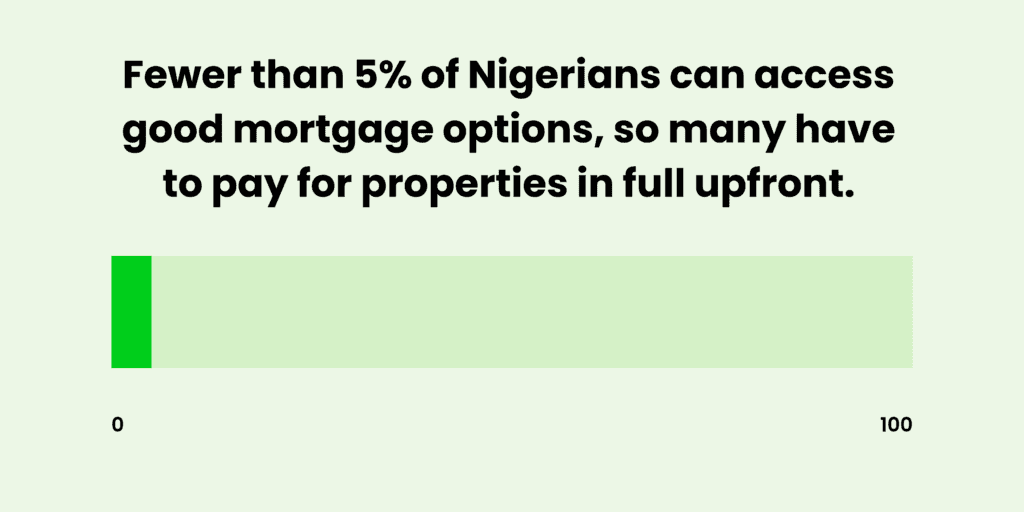

Unlike Western markets, like the US, UK and Canada, where mortgages enable homeownership, Nigeria’s mortgage industry is underdeveloped.

Fewer than 5% of Nigerians can access good mortgage options, so many have to pay for properties in full upfront.

Affordable Housing Policies

Government programs aimed at affordable housing still need to be made available. Developers can build cheap housing with subsidized land or low-interest loans.

Location and Infrastructure

Location

Proximity to business districts like Victoria Island drives up real estate values.

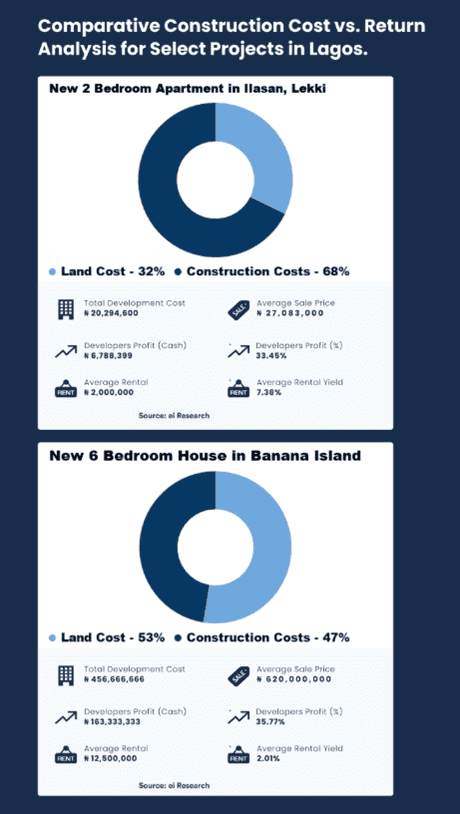

ei Research on Comparative Construction Cost vs. Return Analysis for Select Projects in Lagos

Land is a scarce commodity, and locations close to commercial and recreational activity, such as Victoria Island and Lekki, create demand and push up prices.

However, these price increases are not always rational.

Areas closer to these hubs command premium prices, reflecting their desirability and convenience.

| Area | Average Price of 3-Bedroom Apartment | Key Features |

|---|---|---|

| Ikoyi | ₦480,000,000.00 | Luxury, exclusivity, high security |

| Lekki Phase 1 | ₦220,000,000.00 | Proximity to business hubs, modern design |

| Ikorodu | ₦48,600,000.00 | Affordable, far from city center |

Table Showing Price Comparisons by Location

Good Road Network

Infrastructure improvements, such as expanded road networks, enhance property values.

Areas with poor road access, on the other hand, struggle to attract investment, perpetuating inequality in housing options.

Pro Tip: Choose locations close to planned infrastructure projects (e.g., airports or major highways) for potential appreciation. Properties near good road networks command higher rents—ideal for rental investments.

Financial and Documentation Factors

Titled Document

Secure land titles reduce disputes and increase property value.

However, obtaining these titles is often costly and slow. This further inflates real estate prices.

Non-Institutional Capital

The need for more institutional financing pushes developers to rely on personal or investor funds. This unregulated financing model leads to inconsistent pricing and delays in project delivery.

Lack of Transparency between Asking and Achievable Prices

The real estate market lacks clear pricing benchmarks, which create gaps between listed and actual sales prices. This opacity deters buyers and complicates valuation.

Pro Tip: Always verify the land title with the Lagos State Land Registry before purchasing. Get a licensed property lawyer to review agreements and contracts to avoid disputes.

Historical and Long-Term Trends

Lagos State remains the best place to invest in real estate.

Over the years, Lagos has consistently recorded high appreciation rates for properties, particularly in high-demand neighbourhoods.

This trend cements its reputation as a lucrative but costly market for real estate investment.

Why is Real Estate in Lagos Expensive?

Real estate in Lagos is expensive due to a combination of factors, including:

- High demand driven by a growing population.

- Limited housing supply.

- Rising construction costs.

- Currency fluctuations.

Prime locations like Ikoyi and Lekki command premium prices because of their proximity to business hubs and great infrastructure.

Also, speculative investments, inadequate government support for affordable housing, and high financing costs worsen the situation, making Lagos one of Nigeria’s most challenging real estate markets.

Potential Solutions and Tips

Ways to Get a Less Expensive Home

- Opt for instalment payment plans offered by reputable developers.

- Consider investing in up-and-coming areas where prices are lower but expected to rise, like Sangotedo.

- Partner with credible real estate agents to avoid scams and overpriced deals.

Next Steps

Lagos’ real estate market offers immense opportunities despite its high costs. If you want to buy, rent, or invest, know the factors driving prices. It can help you make informed decisions.

Conclusion

Real estate in Lagos is expensive for a reason—it’s a city of dreams, challenges, and opportunities.

Knowing what drives these costs will help you navigate the market. You can then find the best options to meet your goals.

For more related content, we recommend our article on investing in luxury real estate, real estate syndication and top real estate companies in Lagos.

FAQs

Which city is the most expensive in Lagos?

Ikoyi is the most expensive area in Lagos, known for its luxury properties, high-end amenities, and exclusivity.

What are the three most important things in real estate?

- Location: Proximity to business hubs, schools, and transport.

- Quality: Durability and standard of construction.

- Amenities: Features like security, recreational facilities, and infrastructure.

Where is the cheapest place to live in Lagos?

The cheapest places to live in Lagos are Agege, Ajegunle and areas on the outskirts, such as Ikorodu, Badagry, and Mowe-Ibafo are generally more affordable.

What is the richest part of Lagos?

Victoria Island and Ikoyi are the wealthiest areas of Lagos, home to some of the city’s wealthiest individuals and businesses.

Should I buy a house now or wait until 2025?

Buy now if you can afford it. Real estate prices in Lagos are likely to rise due to increasing demand and inflation, making properties more expensive in the future.

What are the 4 pillars of real estate?

- Location: Determines value and desirability.

- Financing: Accessibility of funds or mortgages.

- Demand and Supply: Market forces impacting prices.

- Legal and Regulatory Framework: Secure property ownership and smooth transactions.